Vital Statistics:

| Last | Change | |

| S&P Futures | 2250.5 | 15.0 |

| Eurostoxx Index | 366.1 | 3.0 |

| Oil (WTI) | 54.9 | 1.2 |

| US dollar index | 93.7 | 0.4 |

| 10 Year Govt Bond Yield | 2.51% | |

| Current Coupon Fannie Mae TBA | 103 | |

| Current Coupon Ginnie Mae TBA | 104 | |

| 30 Year Fixed Rate Mortgage | 4.28 |

Stocks are starting the year on an up note on overseas optimism. Bonds and MBS are down.

The highlight of the week will be the jobs report on Friday and the FOMC minutes from the December meeting on Wednesday. We have no Fed-speak until Friday.

Home prices rose 7.1% YOY, according to CoreLogic. They are forecasting an increase of 4.7% for 2017, as higher rates and prices affect buyers. Home prices in 27 states are now above their pre-crisis peaks. Remember, these are nominal prices, not inflation-adjusted prices.

Delinquency rates ticked up slightly in November, from 1.21% to 1.23%. On a year-over-year basis they were down from 1.58%. The peak DQ number was in early 2010 when it hit 5.59%.

Manufacturing improved in December, according the Markit PMI Index and the ISM Manufacturing Index. New orders and pricing drove the increase. Pricing had been an issue for years. This may simply be a blip, however it does hint at inflation beginning to stir. The current level for the PMI Manufacturing Index (54.7) historically corresponds with GDP growth of 3.6%.

Construction spending rose 0.9% in November and is up 4.1% YOY. Residential Construction rose 1% and is up 3% YOY.

Barry Ritholz has his advice for 2017. His take: the secular bond bull market is over, however inflation is the real risk to bond investors, not mark-to-market losses. He also believes that secular bull markets in stocks aren’t measured from where they bottom, but from where they break out of their bear market range. This would put the beginning of the secular bull (assuming we are in one) around early 2013, not 2009. We had a secular bear market from 1966 to 1982, a secular bull market from 1982 to 2000 and a secular bear from 2000 to 2013 (if this is in fact a change of trend).

Note that corporate tax reform is a priority for the new administration. If you cut corporate taxes, then that means earnings are increasing, and the current forward P/E ratios of the S&P 500 are overstated. Of course higher interest rates, a higher dollar, and increasing wages will offset that somewhat.

Doug Kass has his surprises for 2017. This is usually a fun read and these should be looked as improbables that the markets are assigning a too-low probability to. The punch line is that the year starts off strong, however Trump’s inexperience begins to take its toll on politics and the markets, and the Administration devolves into chaos. Stocks peak in January and end the year down 15%. The 10 year shoots through 3% before falling back to 1.5% as the Fed begins QE unlimited to hold the 10 year at a specific level. Overall, it is a pessimistic take, but remember these are all “go out on a limb” sort of predictions – they aren’t base case scenarios.

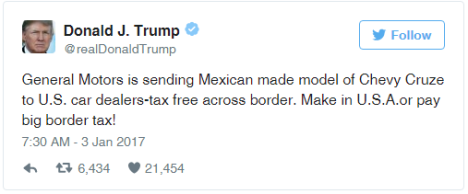

Another one of Kass’s predictions is that Trump’s security advisors finally convince him to stop Tweeting and close down his Twitter account, which causes the stock to drop 20%. Meanwhile this morning, Trump fired a shot across the bow of GM:

GM’s stock is down slightly pre-open, however tweets like this could give investors fits.

Larry Summers is skeptical that any sort of repatriation tax break for companies will find its way into re-investment. His view is that repatriated cash will be used for dividends, buybacks and M&A. Of course if companies don’t think there are opportunities for investment, they will return the money to stockholders, however that isn’t necessarily a given that there are no investment opportunities. Capital Expenditures have been moribund for a decade. You can only put that off so long. Secondly, if the psychology of CEOs changes from being worried about costs to being worried about missing out on business, then you will see more investment.

Filed under: Economy, Morning Report |

Whatever else you can say about Rolling Stone, at least they fully retracted their story when it became clear that it was total BS.

Unlike the Washington Post.

“Russian government hackers do not appear to have targeted Vermont utility, say people close to investigation

By Ellen Nakashima and Juliet Eilperin

January 2 at 10:02 PM”

https://www.washingtonpost.com/world/national-security/russian-government-hackers-do-not-appear-to-have-targeted-vermont-utility-say-people-close-to-investigation/2017/01/02/70c25956-d12c-11e6-945a-76f69a399dd5_story.html

LikeLiked by 1 person

Interesting article on the inner workings of the CFPB

http://www.nationalreview.com/article/443227/consumer-financial-protection-bureau-tragic-failures

LikeLike

Good news for home ownership Brent, the millennials are starting to sell out their values:

“A millennial Democratic Socialist buys a house, reluctantly

At first, the idea of owning property seemed creepy, against our political values and staggeringly out of reach

Alex Gallo-Brown

Monday, Jan 2, 2017 07:30 PM EST”

http://www.salon.com/2017/01/03/a-millennial-democratic-socialist-buys-a-house-reluctantly/

They really can’t be caricatured.

LikeLiked by 1 person

Prolly following Bernie Sanders example, he owns three homes.

LikeLiked by 1 person

“My girlfriend had worked her own litany of odd and more conventional jobs before completing her master’s degree in racial and social difference.”

I’d love to know what that cost. So we’ve got an advanced degree and home now. yet still the oppressed, i’d imagine.

LikeLiked by 1 person

oh, the comments are too much fun:

“I look forward to future chapters of the author’s odyssey into the unknown, including “Millennial grudgingly buys a lawn mower” and “Age of Fear: Millennial leaves his parents’ shared mobile plan.”

LikeLiked by 1 person

“Am I really a collectivist if I object to other guys sleeping with my girlfriend?”

LikeLike

Does my privelage give me the right to deny a non-privelaged rapist?

LikeLike

http://money.cnn.com/2017/01/03/news/economy/ford-700-jobs-trump/index.html

LikeLiked by 1 person

He can’t ask for better PR if he made it up himself.

“”This is a vote of confidence” in Trump and the economy, said Fields. We are “encouraged by pro growth policies, particularly reform around tax and regulatory policies.” ”

Watch him continue to run campaign ads with things like this and watch the left melt down (again).

LikeLiked by 1 person

Democrats to immediately mount their horses and rush to tilt with this particular windmill.

LikeLike

For what it’s worth, I know of no instance where Assange has lied:

Of course, the Russians could have always used an intermediary. It would in fact benefit them if Assange didn’t know where the material came from or even better actively believed it came from some other source.

LikeLike

Well, it hardly requires the Russians. I think that’s ultimately the point. There are tens-of-thousands of individuals who could have executed it.

LikeLike

The man is a marketing genius:

“BREAKING NEWS

House Republicans back off gutting ethics watchdog after backlash from Trump”

https://www.washingtonpost.com/powerpost/gop-to-start-on-ambitious-conservative-agenda-as-congress-convenes-today/2017/01/03/6117cbe2-d1a1-11e6-945a-76f69a399dd5_story.html

LikeLiked by 1 person

I say jump, and they ask how high? i say higher.

edit — no. that’s not right. you know what he’s doing:

LikeLiked by 1 person

https://twitter.com/BecketAdams/status/816325532103098369

LikeLiked by 1 person

Celebrity self-regard is reaching critical levels. Any more, and they’ll self-destruct!

LikeLike

I wasn’t worried before, but now that Springsteen has gone on record about Trump I’m really concerned:

“A majority of Americans, including Bruce Springsteen doubt Donald Trump can perform essential presidential duties”

http://www.salon.com/2017/01/03/a-majority-of-americans-including-bruce-springsteen-doubt-donald-trump-can-perform-essential-presidential-duties/

LikeLike

i guess we’re sort of in the depression / bargaining phase…

LikeLike

Happy New Year, gentlemen!

LikeLiked by 1 person

And Happy New Year to you! May 2017 be better than 2016!

LikeLike

hey, who are you calling … oh.

happy new year!

LikeLiked by 2 people

You too.

LikeLiked by 1 person

Happy New Year to you too.. Hope you enjoyed the OSU beatdown…

LikeLiked by 1 person

But of course!

The Rose Bowl, though. . . damn. Congrats on your Badgers!!

LikeLike

Mich:

Happy new year.

LikeLiked by 2 people

Someone is a marketing genius.

http://nymag.com/daily/intelligencer/2017/01/guilty-white-liberals-are-purchasing-racial-indulgences.html

LikeLike

that has to be satire

LikeLike

It’s not.

http://www.nbcnews.com/news/nbcblk/safety-pin-box-gift-white-allies-n695246

“When organizers Marissa Johnson and Leslie Mac saw white people pinning safety pins to their lapels after the election, they thought it was stupid — but they smelled a business opportunity.”

https://news.vice.com/tag/safety-pin-box

LikeLike

“it feels like there’s little chance of substantive progress anytime soon”

Well, something like 47% of the country presumably thinks we just made substantive progress. It’s all a matter of perspective, I guess.

LikeLike

These announcements by Ford and GM make me think that the big US corporations also sense a shift in the winds and want to get ahead of it.

Trump is doing what Obama would have been crucified for. Only Nixon could go to China..

LikeLiked by 1 person

How much of that is intentional and just Trump’s good luck, I don’t know. What I do know is that the folks that are jumping on these stories, essentially decrying them or attempting to “debunk” them are as politically naive as I can imagine it is possible to be. Some days the PlumLine could be retitled “Why Americans Having Jobs is Bad: No, Really”.

Shaming was all the rage when they were trying to get people to stop smoking. Seems to be working even better here. What’s the problem?

LikeLike

IMO without the Trump tweets, this wouldn’t have happened, however Trump was in the right place at the right time.

And yes, the left’s “debunking” makes them look petty and small.

LikeLiked by 1 person

“makes them look petty and small.”

this is who they are. they are wannabe authoritarian thugs who can’t bench 50 pounds.

LikeLike

The more that they attack Trump for pressuring American companies to keep jobs in the US, no matter the quantity, the better it is for Trump.

He keeps this up, he easily wins the “Cares about people like me” & “Whose side is he on” questions in 2020.

LikeLike

Steve Pearlstein spotted it with Carrier.

https://www.washingtonpost.com/news/wonk/wp/2016/12/02/give-him-credit-trump-carrier-deal-puts-shareholder-obsessed-ceos-on-notice/

I suspect that some CEO’s would also like to be less accountable to Wall Street and if Trump gives them cover, that’s fine with them.

LikeLike