Vital Statistics:

| Last | Change | |

| S&P Futures | 2264.8 | -3.0 |

| Eurostoxx Index | 345.1 | -1.4 |

| Oil (WTI) | 52.2 | -0.8 |

| US dollar index | 91.3 | -0.1 |

| 10 Year Govt Bond Yield | 2.44% | |

| Current Coupon Fannie Mae TBA | 103 | |

| Current Coupon Ginnie Mae TBA | 104 | |

| 30 Year Fixed Rate Mortgage | 4.13 |

Markets are flat this morning as we await the FOMC decision at 2:00 pm EST. Bonds and MBS are up.

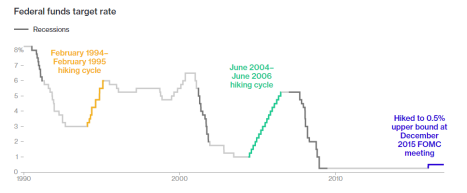

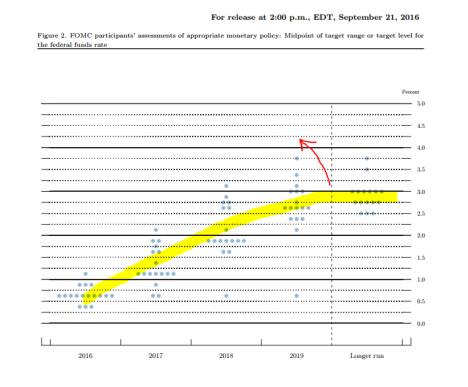

What to look for in the Fed statement: The biggest thing to watch will be the dot plot, which shows the forecasts that various members have for the Federal Funds rate. This is different than the 10 year, which determines mortgage rates. Market participants will compare the September 2016 dot plot with the December 2016 one and look for a shift in the general trend, either up or steepening.

Generally speaking the dot plots have been heading downward over the past several years as the Fed has been consistently high in its estimate for GDP growth. If the new dot plot is more aggressive (say it predicts 3 hikes for 2017, when before it was 2 hikes, then you could see a bond sell-off, which would send rates higher.

Janet Yellen will have a press conference at 2:30, and will probably do her best to dodge questions about Trump and his influence on the economy.

Retail Sales for November disappointed this morning, with the headline number up 0.1% and the core number (ex autos and gas) up 0.2%. November retail sales can be noisy, as more and more shoppers procrastinate. Still, this goes along with the weak Redbook same store sales number yesterday.

Inflation at the wholesale level is on the upswing, according to the Producer Price index. The PPI rose 0.4% MOM and is up 1.3% YOY. The core index is up 0.2% MOM and 1.8% YOY. Inflation remains below the Fed’s target which gives them the room to go slowly with rate hikes.

Mortgage Applications fell 4% last week as purchases fell 3% and refis fell 4%.

First time homebuyers face a shortage of real estate going into 2017, according to Redfin. For starter homes, the problem is acute. Over the past year, prices have risen 7.5% as inventory fell 12%. This increased the percent of income needed to buy a median home in that segment to 38.5%, an increase of about 2 percentage points. They are hopeful that the bottom is in with respect to tight inventory, however some of that will depend on regulatory policies of the new administration. On the plus side, credit will probably ease a bit as the financial system gets more clarity on regulation. On the negative side, immigration limits will exacerbate the construction labor shortage we currently are experiencing.

Filed under: Economy | 88 Comments »