Markets are lower this morning on overseas weakness. Bonds and MBS are flat

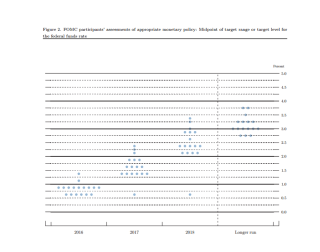

The Fed left interest rates unchanged yesterday, and the biggest data point was the dot graph which showed 6 members expect no change in interest rates this year. That sent the 10 year yield down 4 basis points and the 2 year down 5. The actual language of the statement wasn’t dramatically different from April. They released new economic forecasts, taking down their estimate for 2016 and 2017 GDP to 2%, and increasing their estimate of 2016 inflation from 1.2% to 1.4%. In the press conference afterward, Janet Yellen acknowledged the upcoming vote in the UK (Brexit) was also a factor. The big admission was that rates will remain lower for longer.

The Fed Funds futures market is now discounting a single-digit chance of a rate hike in July, and the futures are predicting less than a 50% chance of a move throughout the rest of the year.

Bond yields are falling worldwide, with the German Bund trading at -2.3 basis points, the Swiss 10 year at -51 basis points, and the Japanese government bond yield at -20 basis points. Like it or not, the US 10 year probably won’t be able to escape the low rate vortex in the rest of the world, as investors swap out negative-yielding assets and buy Treasuries. Not saying we are going to go negative, but I find it hard to see where the selling pressure is going to come from. Are we going to be positioned for another refi boom? Don’t rule it out.

The other potential beneficiary of low rates worldwide should be mortgage backed securities, especially GN securities which are guaranteed by the government. I would have to imagine overseas investors will find these appetizing at some point. GN and FN TBAs have lagged the movement in Treasuries so far this month. This should translate into better conforming and government pricing going forward, even if bonds take a breather.

The other beneficiary of negative interest rates? Gold, which has been on a tear lately. The knock on gold has always been that it has no yield. No yield is better than negative yields, and gold has upside, while there probably isn’t much upside in a government bond with a negative yield. A rule of thumb for gold has always been that an ounce of gold should buy a high quality men’s suit.

Initial Jobless Claims rose to 277k last week from 264k the week before. While it looks like payroll growth is slowing, we aren’t yet seeing evidence of layoffs. As a rule of thumb, a sub-300k initial jobless print is a sign of strength in the labor market.

The consumer price index rose 0.2% in May, and is up 1% YOY. Ex-food and energy, it is up 2.2%. Note the Fed doesn’t use the CPI, it uses the PCE.

Real average weekly earnings rose 1.1%.

Purchase loans are the majority of new originations despite the rally in bonds, according to Ellie Mae’s Origination Insight Report. Purchases accounted for 62% of all loans. Days to close increased a day to 45 days and average FICO increased a point to 724.

Filed under: Economy, Morning Report |

https://www.washingtonpost.com/opinions/valedictorians-vs-trump/2016/06/15/90b98cb8-2f4a-11e6-9b37-42985f6a265c_story.html

The Post article tells of two undoc valedictorians in TX.

Because I believe in merit immigration – as opposed to unlimited family reunification immigration – I would be for issuing green cards to these students upon HS graduation and would also include undocs in the top 10% of their classes, NM Semifinalists, Westinghouse award winners, and those who show distinguished potential citizenry through successful completion of JROTC.

Baylor might lobby for the inclusion of Div 1 capable athletes, as well.

LikeLike

I feel like the concept of awarding such things based on objectively measurable merit is not going to happen, although I 100% agree.

LikeLike

Anderson Cooper apparently thinks that one is a “hypocrite” if one objects to the random killing of homosexuals but does not support SSM.

https://www.washingtonpost.com/news/the-fix/wp/2016/06/14/anderson-cooper-jus-absolutely-grilled-floridas-gop-attorney-general-over-lgbt-rights/?postshare=2331465931286353&tid=ss_tw

And he also had the ‘nads to later claim afterwards that ““I’m not trying to push an agenda. I’m not here to be an advocate, railing at the top of my lungs at injustices; that’s the role other people have.”

LikeLike

Ha! Objecting to Same Sex Marriage is the same as supporting the wholesale murder of homosexuals. Just like objecting to 10 year olds getting married would be the same as supporting the murder of 10 year olds. And so on. I’m okay with SSM, but it’s absurd to suggest that even those who object strenuously to it are hypocritical if they object to mass murder.

LikeLike

Interesting how over the past few days the media have grasped for any excuse to change the Orlando shooter’s motives to something other than his stated allegiance to ISIS, Islam’s view of homosexuality, etc. The new one apparently is “toxic masculinity”.

The comparison to Dylan Roof where the immediate response (aside from banning guns) was to call for the removal of the symbols of his stated ideology, i.e. the Confederate flag, is telling. No dispute that Roof was all about racism, white supremacy, inspired by the Confederacy, etc.

LikeLike

The left hates conservative white males more than Islamic terrorists…

LikeLiked by 1 person

Milo really needs to be Trump’s spokesman here:

http://www.breitbart.com/milo/2016/06/16/heres-everything-wanted-say-islam-yesterday-couldnt/

LikeLiked by 1 person

So much for my Trump VP pick:

http://www.etonline.com/news/191164_oprah_winfrey_endorses_hillary_clinton_upcoming_election_it_a_seminal_moment_for_women/

LikeLiked by 1 person

Damn!

LikeLike

The Economist on BREXIT:

http://www.economist.com/news/leaders/21700637-vote-leave-european-union-would-diminish-both-britain-and-europe-divided-we-fall

LikeLike

Orlando attack was caused by American racism and Islamaphobia (audio clip). It’s an audio clip, but the best part is at the end: “There is a not insignificant overlap between queers in Muslims, although they are being set up, in this instance, as being somehow in conflict.”

But Muslims and the gay community (dear friends) are in the same boat: victims of white males and the patriarchy and Christian evangelicals! Or at least, that’s the only conclusion I can draw.

This will not end well.

LikeLike