1972 – US swimmer Mark Spitz helps his team win the medley relay in a record setting time, thus winning his 7th gold medal at the Munich Olympic games, setting a record that would last for 40 years. Spitz also set new world records in each of the other 6 events in which he won the gold. His tally of 7 golds will remain a record until 2012 when Michael Phelps took home 8 at the Beijing Olympics.

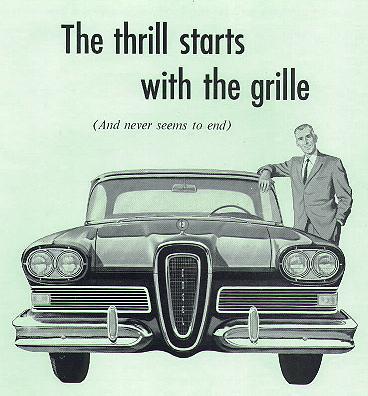

1957 – The Edsel, the first new car brand to be introduced by one of the Big 3 motor companies in 20 years, and perhaps the most infamous flop in car manufacturing history, is presented to the public by the Ford Motor Company. Veiled in secrecy, Ford had hyped the new car with a marketing campaign that showed only the hood ornament and promised simply “The Edsel is coming.” But when it was finally unveiled, the public was not impressed. Coming amidst a changing economic landscape, the car was too big and too expensive, and had a myriad of technical problems, including a hood ornament that tended to fly off on the highway. After only 3 years, and a loss of $250 million, the Edsel division folded.

1886 – The Indian wars of the American southwest effectively come to an end when Geronimo, the last remaining warrior chief to organize resistance to US forces, surrenders. Geronimo is sent to reservations first in Florida and then in Louisiana, finally ending up in Oklahoma, where he converted to Christianity, became a successful farmer, and even participated in Theodore Roosevelt’s inaugural parade.

Filed under: This Day in History | 7 Comments »