Vital Statistics:

| |

Last |

Change |

Percent |

| S&P Futures |

1646.2 |

-8.4 |

-0.51% |

| Eurostoxx Index |

2794.0 |

-41.9 |

-1.48% |

| Oil (WTI) |

94.43 |

-0.6 |

-0.61% |

| LIBOR |

0.276 |

0.003 |

1.10% |

| US Dollar Index (DXY) |

83.58 |

-0.516 |

-0.61% |

| 10 Year Govt Bond Yield |

2.14% |

-0.03% |

|

| Current Coupon Ginnie Mae TBA |

101.7 |

0.3 |

|

| Current Coupon Fannie Mae TBA |

100.6 |

0.3 |

|

| RPX Composite Real Estate Index |

200.2 |

0.0 |

|

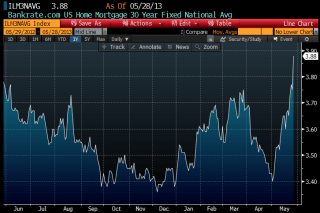

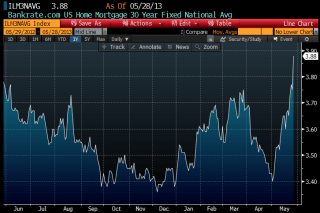

| BankRate 30 Year Fixed Rate Mortgage |

3.88 |

|

|

Bond market volatility is the theme of the day (yet again). The 10-year bond yield jumped to 2.23% this morning in late Asian hours. No real news drove the decline, just the general fear that the Fed will start paring back QE sometime this fall.

Lender Processing Services

reported that home prices are up 1.4% month-over-month and 7.6% year over year. It does appear that the rally is becoming more broad, as states other than the usual suspects are showing the biggest gains. This time around, Georgia leads the way as Atlanta prices increased 2.6% MOM. Arizona was actually in the bottom 10, indicating that perhaps the big professional-driven rally off the bottom has been played out.

CoreLogic

reported that foreclosures are down 16% YOY and 1% MOM. 52,000 foreclosures were completed in April 2013. In states like Arizona and California, the year-over-year decline is over 50%. The shadow inventory of homes in some state of foreclosure is 1.1 million, compared to 1.5 million a year ago. The judicial states of FL, IL, NJ, NY, and CT still have some work to do, but the rest of the states have largely completed their foreclosures.

The sell-off in bonds has created a massive jump in mortgage rates. Now, as the mortgage REITs hedge their books, we are approaching another wave of selling in TBAs as MBS investors hedge their convexity and REITs de-lever. This is going to push mortgage rates even higher. If rates stay here, we should be best-exing into a 3.5% coupon pretty soon.

Filed under: Morning Report | 15 Comments »