Vital Statistics:

| Last | Change | Percent | |

| S&P Futures | 1537.5 | -17.0 | -1.09% |

| Eurostoxx Index | 2590.5 | -30.9 | -1.18% |

| Oil (WTI) | 92.26 | -1.0 | -1.07% |

| LIBOR | 0.279 | -0.001 | -0.36% |

| US Dollar Index (DXY) | 82.43 | -0.245 | -0.30% |

| 10 Year Govt Bond Yield | 1.70% | -0.06% | |

| Current Coupon Ginnie Mae TBA | 105.8 | 0.5 | |

| Current Coupon Fannie Mae TBA | 104.4 | 0.4 | |

| RPX Composite Real Estate Index | 189.7 | 0.3 | |

| BankRate 30 Year Fixed Rate Mortgage | 3.59 |

They’re beating the tape with the ugly stick after a dismal jobs report. The S&P 500 futures dropped from -4 to -16 on the report. The 10-year jumped on the news and is now yielding 1.7%. It is hard to believe the 10 year was above 2% three weeks ago. MBS are rallying as well, but not as much as the 10-year.

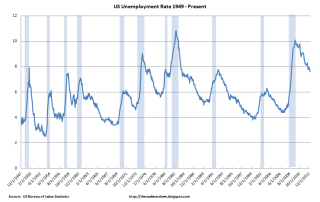

The March Employment Situation showed the economy added 88,000 jobs in March, well below the 190,000 estimate. February was revised upward to 268,000 from 236,000. The unemployment rate ticked down to 7.6% from 7.7%, but that was due to a drop in the labor force participation rate, which dropped .2% from 63.5% to 63.3%. This means that the size of the labor pool dropped as more workers simply stopped looking for a job. Long-term unemployed workers who are not actively looking for a job are not counted as part of the labor force. Wages were flat month-over-month and increased 2% year-over-year.

The recent rally in bonds pours cold water on the “great rotation” theory – the idea that 2013 would be the year when investors, particularly big institutional investors, change their target asset allocation and sell bonds to buy equities. So far, it seems like that investors are allocating money equally to both sectors – stock funds have taken in $79 billion while taxable bond funds have taken in $76 billion. Between the Bank of Japan’s QE program, which is driving funds to the US, the Fed’s QE program, and continued investor purchases of bonds, the expected 2013 bloodbath in the bond market may be held off for a while. Meanwhile, mortgage bankers are licking their chops thinking about another refi wave.

Chart: US Unemployment rate 1949-Present

Filed under: Morning Report |

Wait until the ripple effect from the sequester kicks in. Have we given up entirely on the idea that employment is demand driven?

LikeLike

Still think we may actually (finally!!!) be seeing a recovery. At least in the Houston market (which never really contracted per se but didn’t really grow either) it just “feels” different now. I spoke with a couple of different Real Estate agents who both commented that they noticed a turn around in November. I suspect the election resulted in some level of capitulation.

LikeLike

I just hear Spinal Tap’s “Tonight I’m Gonna Rock You” on Sirius/XM’s Boneyard.

Who can be the first to describe the scene in which the song was featured in the movie This is Spinal Tap?

LikeLike

It is the opening live scene for the band. And I believe the name of the song is actually “Tonight I’m Gonna Rock You Tonight”

It is also the song being played when Nigel returns to the band…

LikeLike

“Wait until the ripple effect from the sequester kicks in. Have we given up entirely on the idea that employment is demand driven?”

Government employment ex-the Postal Service was flat.

I will be curious to see if there is a rotation from full-time to part time as obamacare takes hold…

LikeLike

Brent, your right of course, I was thinking of the second scene you mentioned. Plus the transmitter interference, hilarious.

LikeLike

I heard govt hiring was plus 9k.

LikeLike

BTW, I think the song rivals Sex Farm Woman.

LikeLike

A good day:

LikeLike

jnc:

The lead sentence suggests that the ban was only for girls under 17. But later in the article it is implied that the ban was for all women. Do you know which it is?

LikeLike

jnc:

Forget it…I just read the full link which clarifies that the prescription requirement was only for girls under 17, and that it has been available without prescription for women for some time.

LikeLike

We’re such big fans of your music and your records… Not yours specifically, but the whole genre of rock and roll

LikeLike

So……………….have a nice weekend all………………….I’m taking the day off and we’re taking the grandkids away for the weekend………………museum hopping. See ‘ya on the other side.

LikeLike

“We’re very lucky in the band in that we have two visionaries, David and Nigel, they’re like poets, like Shelley and Byron. They’re two distinct types of visionaries, it’s like fire and ice, basically. I feel my role in the band is to be somewhere in the middle of that, kind of like lukewarm water.”

LikeLike

I believe it was a ban on over the counter and that those over 18 would have to request it from a pharmacist but not need a doctors prescription. Obama caught a lot of crap for it at the time as he invoked his moral authority ‘as father of two daughters’ to make this decision.

http://content.usatoday.com/communities/theoval/post/2011/12/Obama-No-involvement-in-Plan-B-decision-581152/1#.UV75hUr761w

http://www.npr.org/blogs/itsallpolitics/2011/12/09/143436013/obama-plan-b

http://www.thenation.com/blog/165065/father-two-daughters-obama-embraces-politics-over-science-emergency-contraception

LikeLike

jnc:

Yup…thanks. I should read the links before asking questions. If I can wade through Taibbi before commenting, I can certainly make my way through a wonkblog post.

LikeLike

This should be good: Krugman vs Stockman

“April 4, 2013, 6:06 pm

Thinking Straight About Debt

A heads-up: I’m doing This Week this week. Also on the panel: David Stockman. This should be, um, interesting.”

http://krugman.blogs.nytimes.com/2013/04/04/thinking-straight-about-debt/

LikeLike

I would love to see Krugman debate a conservative on his own level, someone like Charles Plosser.

LikeLike

My preference is Krugman vs Ken Rogoff.

LikeLike

You guys are such wonks sometimes! 🙂

LikeLike

We even have economist trading cards. They came in the box of Hostess products before it went bankrupt.

LikeLike

Not a lot of economic history buffs out there… I am one of the few people who can get excited about the history of banking…

LikeLike

have you guys discussed and/or seen this?

http://www.bloomberg.com/news/2013-04-05/obama-budget-calls-for-cap-on-romney-sized-iras.html

LikeLike

A better solution is probably to limit IRA investments to publicly traded stocks and other funds. My impression is that Romney did what he did by putting in stock for a closely held corporation or other non-public investment vehicle.

LikeLike

We even have economist trading cards.

I’m guessing you burned Keynes?

LikeLike

http://tinyurl.com/cyhoqdq

LikeLike

Syracuse or Michigan? Louisville or Wichita?

OK, no need to answer the second one. But the first one should be interesting.

Go ‘Cuse.

LikeLike

Although the ‘Cuse zone is better than anyone’s, I think Michigan, on a normal night, shoots so well from out that they can disrupt it. Michigan by maybe 6.

Louisville will not handle Wichita easily. This is a tough team. But Louisville is better, no doubt. Louisville by 10 or 12.

LikeLike

Mark:

If Michigan scores 65+ points, they win. Orange offense has been horrible. With the exception of their first round win vs Montana, each of their games has been an ugly affair with no offense either way. If Orange can make it ugly, they can win. But they will never be able to trade up and down baskets with Michigan

LikeLike

Sorry, Scott.

Hail To The Victors

LikeLike

Time out.

LikeLike

Ha. Ha. Ha.

LikeLike

Mich:

Believe it or not, the same thing happened to Syracuse in the tournament two years after Chris Webber called him infamous time out. The Orange were leading the defending national champions Arkansas by 1 point with 5 second to go. The Razorbacks were inbounding the ball, and Syracuse stole it, which should have preserved the upset. But someone on Syracuse called a time out, which they didn’t have. Technical foul. razorbacks tie the game on the technical foul shot, and won it in OT by 1.

LikeLike

Wichita State up by one at the half–I’m impressed.

Scott, let’s hope nobody pulls any bone-headed moves like that tonight!

LikeLike

Quite a comeback on Louisville’s part!

Now on to Syracuse’s imminent demise. . .

LikeLike

Same problem Orange have had all year…they can’t score. Lots of opportunities, great defense, but no points. Fair is the only one putting the ball in the basket. Southerland? Carter-Williams? Disappeared.

LikeLike

Uglier than I thought it would be, both games, although I wasn’t expecting free flowing at all. For that we needed Kansas and Indiana. So the final will be ugly, too. Have no idea which of these teams will win, but I think Michigan would beat Louisville 6 out of 10. Too close to call.

Michigan’s big guy cannot shoot fouls. If they lose, that might be the reason.

LikeLike

Looks like Mark did the best job of calling both games.

Good game by Syracuse–I can’t believe how many free throws UM bricked in the last 30 seconds of that game!

Next year, Scott. . .

LikeLike

They were just lucky that Syracuse couldn’t shoot from the floor, or all of those missed free throws would have done them in.

LikeLike

I thought Pitino went zone early to save energy and fouls because of the player he lost to a broken leg. L’ville is more effective in man.

Mich missed FTs – absolutely badly enough to lose. I think there was a blown call near the end that favored Mich. It was not pretty.

LikeLike

Mark:

I think there was a blown call near the end that favored Mich. It was not pretty.

I thought there were two, actually. First, the blocking foul called on Carter-Williams near half court with about 3 mins to go, as Orange were staging comeback and down by 3, was clearly an offensive push off. Resulted in CW’s 4th foul, and he fouled out on the next trip down the court on a marginal offensive foul call. Then Triche fouled out with less than a minute to go on what was definitely a Michigan block, but they called him for charging. With both CW and Triche gone, Orange had no ball handlers on crucial final possession.

Of course, if CW and Southerland had been able to score at all (a combined 8 points, I think) it wouldn’t have mattered, so Orange really can only blame themselves.

LikeLike

You guys are such wonks sometimes!

I drove my wife into work on Friday. It’s fun to do sometimes as we get an extra half hour together and it doesn’t cost me that much extra time getting into work. I tend to listen to C-SPAN in the morning, kicking over to traffic (Lisa Baden is back!) every so often. They had changed guests while I was checking traffic, but it was clearly a progressive woman. I commented that I thought it might be Kathryn van den Heuvel, who edits some magazine and writes an occasional column for the Post. I drop her off and sure enough, I’d identified her correctly (though forgot she edits the Nation).

Dropped by a favorite shop on Capitol Hill for pain chocolaut. Yum!

ßß

LikeLike

Some of you are saving too much for retirement and obama wants it stopped.

http://www.bloomberg.com/news/2013-04-05/obama-budget-calls-for-cap-on-romney-sized-iras.html

Did any thought go into this idea? We don’t save enough, Social Security is going to have trouble meeting everyone’s demands, and obama wants to discourage savings. Even if it raises a meaningless amount of revenue.

Does he filter everything through the lens of inequality or something?

By the way, given expanding longevities, limiting IRAs to $3 million is pretty low. If inflation ever returns, it will be way too low.

LikeLike

“It is a ‘plan killer,’” he said in an e-mailed statement. “As business owners reach the cap, they will lose their incentive to maintain a plan, and either shut down the plan or greatly reduce benefits. This would leave workers with a greatly diminished plan or without any plan at all.”

This strikes me as a telling criticism.

However, Brent, from a distance, we are talking about a tax break designed to encourage savings. Does it take a tax break to encourage investing by the wealthy? Should we even have tax breaks for investing for anyone? Those are bigger questions.

From close up, I agree that small business owners will be discouraged from using the plan beyond this relatively low maximum, thus killing the plan for everyone in the shop. Indeed, I have a client to whom this applies, and will be visiting with a tax specialist about this very issue next week. The two owners of the business were respectively a moderate R and a moderate D. I think they both converted to moderate R this week.

LikeLike

I thought this was sort of interesting in a lot of ways. My own sister is a bit of a hermit and we’re trying to figure out what to do about her right now. I can’t imagine living like this but I know there are people who would prefer it. After bumping up against our own hoarder last year I wondered if she wasn’t a bit of a hermit also even though she lived right in the midst of others in a middle class neighborhood. I’m fascinated by these kinds of behaviors.

As you can imagine, their existence was as bit tougher than Grizzly Adams’. In 1961, because food was so scarce, the mother starved herself to death in order to feed her kids. And three of the kids died, within weeks of each other, likely because of pneumonia brought by visiting geologists. The father died in 1988. Now, the only family member left is 70 year old Agafia, who still lives by herself. This documentary looks at her and her life. The film crew fly out by helicopter to live with her for a few days.

http://americablog.com/2013/04/family-of-siberian-hermits-lived-outside-civilization-for-40-years-didnt-know-wwii-happened.html

LikeLike

From close up, I agree that small business owners will be discouraged from using the plan beyond this relatively low maximum

Mark, how would that kill IRA savings for everyone in the shop as they are an individual retirement plan. Have they changed the rules that you can contribute to both an IRA and a 401K at the same time? It used to be you could do one or the other to gain the tax advantage, not both.

Most people we know haven’t earned $3 mil in their entire working lives, much less have that much saved for retirement.

LikeLike

You have a point, Lulu.

My client and his co-owner have a SEP-IRA set-up and they have both regularly contributed the max of $40K+ per year for several years on their own behalf and they had rolled over previous benefits when the SEP-IRA rules were invented. They had invested real well [fortuitously] in the 90s and are both over $3M now. If this goes through they will want to restructure their SEP-IRA in some way.

They have employees in several states. Whatever they do the plan will affect everyone.

But as you suggest, the employees will be able to go another route.

LikeLike

Last week I linked a piece that highlighted a number of cancer treatment centers that were turning away chemo patients. Most everyone seemed to think there was probably a better alternative in implementing the budget cuts and that they were using the patients as a ploy to reestablish their funding. I’m not convinced, primarily because I’ve seen the actual cuts hospice has taken and generally cuts that affect patients the most, come last.

This week it appears research scientists are protesting cuts to NIH, universities, labs, etc.

Thousands of prominent cancer and other medical researchers will rally in the nation’s capital Monday to protest federal funding cuts that began several years ago and were accelerated by additional forced reductions beginning to take effect under the congressionally mandated process of sequestration.

“It’s really come on top of a fairly extended period of flat funding, which has eroded the purchasing power of biomedical dollars,” said Roy A. Jensen, director of the University of Kansas Cancer Center, who will join the demonstration. “It’s almost like the final push over the edge. I know a lot of labs are having to lay people off and not pursuing promising scientific leads.”

Influential scientists say the United States has fallen to 10th place in medical research spending as a percentage of its total economy, at a time when China, Britain, Singapore, India and other countries are increasing their investments. They say the pace of breakthroughs in lifesaving treatment of cancer, HIV/AIDS and other major diseases will be slowed unless the decline is reversed.

http://www.mcclatchydc.com/2013/04/05/187880/scientists-angry-about-budget.html

LikeLike

Could be lots of medical vacations in Mumbai coming up.

LikeLike

“Brent Nyitray, on April 7, 2013 at 2:15 pm said:

Some of you are saving too much for retirement and obama wants it stopped.”

I can see a fair argument for requiring all IRA investments to be in publicly traded funds or corporations vs tightly held corporations which is what allowed Romney to realize such high returns.

LikeLike

This week it appears research scientists are protesting cuts to NIH, universities, labs, etc.

Mike, Paul and I have been telling you guys about this for weeks/months.

LikeLike

The regulations on 401ks are already very complicated to keep them from being too top heavy. My firm which is top-heavy with professionals anyways gives a 3% straight contribution to everybody on top of their own pre-tax contributions to avoid scrutiny.

For most people a $3M next egg on top of Social Security is a pretty comfortable retirement. It’s a backdoor way of means testing the plans.

LikeLike

We’re facing 14 days off for the furlough, which works out to a 5.4% annualized pay cut. My better half is a freelancer, so I’m used to managing irregular cash flow. The plan for the year was to pay off her remaining student loans and refi the house. I think we can stick with that plan, but my 2000 Solara is going to get another year or two on the road. Well, unless I get that program manager’s position at DOE, in which case, I think a shiny new Ford C-Max is on our way.

It’s a telling factor in how my interests have changed. Back when I bought the Solara, I just missed out on the 5 door Ford Focus SVT. It was introduced a year or two after I bought my car, but I would have gone for one in a heartbeat. The C-Max is a 5 door Focus, but is a hybrid. Nowadays, I’ll take the gas mileage.

ßß

LikeLike