Vital Statistics:

| Last | Change | Percent | |

| S&P Futures | 1341.4 | -0.8 | -0.06% |

| Eurostoxx Index | 2471.7 | -22.2 | -0.89% |

| Oil (WTI) | 101.61 | -0.2 | -0.19% |

| LIBOR | 0.4931 | -0.002 | -0.40% |

| US Dollar Index (DXY) | 79.952 | 0.225 | 0.28% |

| 10 Year Govt Bond Yield | 1.96% | 0.03% |

Global equity markets are weaker this morning as European leaders delay a vote on the Greek bailout until 2/20. The finance leaders were able to squeeze some more concessions from political leaders, but there are still differences over surveillance and control. Separately, Moody’s threatened a downgrade of the global banking sector. Bonds and mortgage backed securities are slightly lower as well.

GM posted a record profit! I am sure tomorrow’s editorial pages will be filled with columns praising the auto bailout and using this earnings announcement as justification. Well, if you repudiate your debt and get rid of all that pesky interest, you had better post record earnings. GM’s numbers were still below estimates and the stock is down a couple of percent pre-open. As an aside, Chrysler has to issue senior secured debt at 8%. That is a usurious rate for senior secured debt. See, that is what happens when you re-order the priority of creditors. Investors remember.

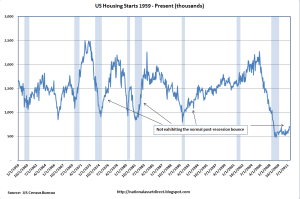

Economic data this morning: Producer Price Index more or less in line with expectations, running at 4.1% annually. Initial Jobless Claims continue to fall, coming in at 348k vs 365k expected. We are more or less back in the historical “normal” range. Housing starts came in at 699k, above expectations, but still very low. In prior recessions, housing starts bottomed at 750k – 850k. The last time we were above 1 million units was June of 2008. 1.5 million is normal. The lack of residential construction has been the achilles heel of the recovery so far.

Chart: Housing Starts:

The minutes of the FOMC meeting were released yesterday. They really don’t add anything to what was said in the press conference after the rate decision. The minutes don’t really address the question most had regarding the recent good economic data. “Many participants noted some indicators bearing on the economy’s recent performance had shown greater-than-expected improvement, but a number noted less favorable data…” The tone of the minutes was that the economy was improving, albeit slowly, and there is no reason to take our foot off the gas for the moment. Maybe the Fed believes the Greek negotiations are simply a big kabuki dance and that a default is unavoidable.

RealtyTrac has released its U.S. Foreclosure Market Report for January 2012. Key Quote: “Although overall foreclosure activity was down from a year ago for the 16th straight month in January, we continue to see signs on a local and regional level that the frozen-up foreclosure process is beginning to thaw.” They predict increasing foreclosures in the coming months especially given the settlements in early Feb between the nation’s largest lenders and 49 state attorney generals. Clearing out the shadow inventory of foreclosed homes is a necessary but not sufficient condition for a recovery in house prices.

Filed under: Economic data, Federal Reserve, Foreclosure, Greece |

I saw the GM CFO on tv this morning. He admitted the pension fund was underfunded by 22 BILLION, when the real number is more like 25. Think of it. Their market cap is only 39 billion. So they owe at least 60% of their market cap, just to the pension fund!

LikeLike

Is the labor force expanding or are more people dropping out to account for the decrease in new unemployment claims?

LikeLike

Troll, continuing claims fell by 100k, but the report doesn’t say whether it was because they found new jobs or had exhausted their 99 weeks of benefits.

LikeLike

Thanks Brent.

LikeLike

John, I would love to know the assumptions that went into that number – assumed rate of return on plan assets and assumed healthcare cost inflation.

I guess we’ll have to wait for the 10K to get that data.

LikeLike

brent:

Old info, but still owrth a look:

http://www.thetruthaboutcars.com/2011/09/with-liabilities-looming-gm-and-uaw-agree-to-pension-buyouts-but-what-about-the-workers/

LikeLike

http://www.bloomberg.com/news/2011-09-01/no-gm-buyback-or-dividend-seen-as-pension-gap-freezes-cash-cars.html

LikeLike

“There were 21 U.S. companies whose pensions were underfunded by at least $3 billion last year, according to Bloomberg data. Only AMR Corp. (AMR) and Delta Airlines Inc. have plans that were underfunded by more than current market cap, the data show. Aside from AMR and Delta, GM had the largest pension deficit as a percent of market cap, at more than 60 percent. ”

We know what happened to AMR already. LOL

LikeLike

Philly Fed came in good.

LikeLike

“I saw the GM CFO on tv this morning. He admitted the pension fund was underfunded by 22 BILLION, when the real number is more like 25. Think of it. Their market cap is only 39 billion. So they owe at least 60% of their market cap, just to the pension fund!”

What happened to the whole idea of transferring the pension fund to the UAW?

LikeLike

Karl Rove has a pretty good column this morning.

“Obama and Other People’s Money

What sets this president apart is how eager he is to fund his schemes outside the normal appropriations process.

By Karl Rove

February 16, 2012”

http://www.rove.com/articles/365

LikeLike

jnc:

They never moved the pension plan, just the health care.

LikeLike

brent:

As per yesterday:

“As Investment, Renting Beats Owning ‘100% of Time'”

http://www.cnbc.com/id/46413058

Of course that only applies if you’re not a total numb nuts about money.

LikeLike

“As Investment, Renting Beats Owning ’100% of Time’”

http://www.cnbc.com/id/46413058

Ding! DIng! DIng! We have hit the bottom of the real estate market.

LikeLike

Plus, the government is more or less paying you to take money right now. It isn’t like a renter is getting the benefit of that.

LikeLike

stops getting triggered in the SPUs

LikeLike

George Will on NYC’s rent control laws that were commented on previously.

The ability to inherit a lease is absurd. They need to amend the rent control laws to sunset all of them in X number of years.

“Supreme Court should take on New York City’s rent control laws

By George F. Will, Published: February 15”

http://www.washingtonpost.com/opinions/rent-control-laws-foolish-and-unconstitutional/2012/02/14/gIQAcZvbGR_story.html

LikeLike

jnc:

If that’s a quote, that might be the shortest sentence he’s ever written.

LikeLike

Banned- Since you like harassing me about Detroit, here’s National Geographic article lauding the city. Detroit is to American cities as soccer is to American sports. They have both been on the verge of something big for a decade or more.

LikeLike

ash

I can’t remember if I said it here or not, but when they stop filming Transformer movies there respresenting the end of civilization, then I’ll believe it’s back.

(are they same writers who keep having Greece on the verge of a bailout?)

LikeLike

I can’t remember if I said it here or not, but when they stop filming Transformer movies there respresenting the end of civilization, then I’ll believe it’s back.

You have said that before and to my knowledge, Transformers 4 is not being filmed anywhere in Detroit. So there…

(I assume they are the same writers.)

LikeLike

hey good market day, even if it all goes to hell soon.

Scott and brent :

I went long calls on T’s today, How’s THAT for confidence in the recovery?

LikeLike

Wow. How much upside do you is left in Treasuries?

LikeLike

jnc:

Karl Rove has a pretty good column this morning

You get my vote for oxymoron of the day. 🙂

LikeLike