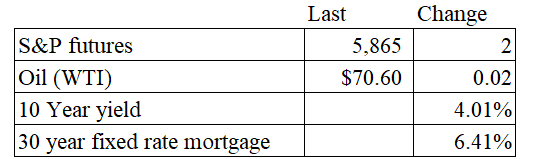

Vital Statistics:

Stocks are flattish this morning as earnings continue to come in. Bonds and MBS are up.

San Francisco Fed Chair Mary Daly is open to skipping a rate cut at one of the two remaining Fed meetings this year. “It’s clear that the direction of change is down,” but added “one or two cuts was a reasonable thing” provided that the economic data continues as expected. Atlanta Fed Head Raphael Bostic is also open to skipping a meeting.

The December Fed Funds futures still overwhelmingly see two more cuts this year:

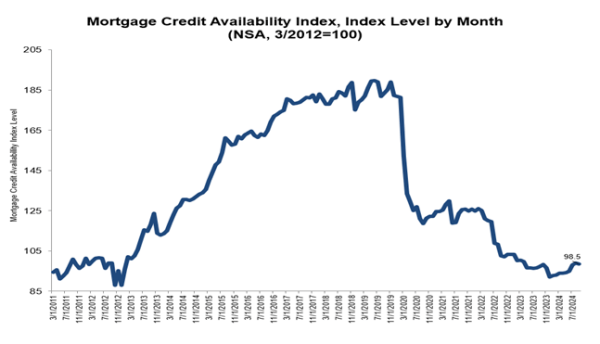

Mortgage credit availability decreased in September, according to the MBA. “Mortgage credit availability tightened slightly in September as lenders remained cautious in this uncertain economic environment,” said Joel Kan, MBA’s Vice President and Deputy Chief Economist. “There was a decline in loan programs for cash-out refinances, jumbo and non-QM loans, including loans that require less than full documentation. Most component indexes decreased over the month, but the government index increased, driven by more offerings of VA streamline refinances.”

Mortgage applications fell 17% last week as purchases fell 7.2% and refis fell 17%. “ Mortgage rates moved higher for the third consecutive week, with the 30-year fixed rate increasing to 6.52 percent, its highest level since August,” said Joel Kan, MBA’s Vice President and Deputy Chief Economist. “The recent uptick in rates has put a damper on applications. Refinance applications fell 26 percent to their lowest level since August, with comparable drops in both conventional and government refinances. This pushed the refinance share of applications back below 50 percent for the first time in over a month. Furthermore, purchase applications also decreased but notably remain 7 percent higher than a year ago.”

US Bank reported better than expected earnings, although revenues missed. Mortgage origination volume improved markedly, rising 16.7% YOY to $11 billion. They are marking their $215 billion MSR portfolio at 4.9x. Provisions for credit losses increased 8% YOY.

Filed under: Economy | Tagged: Federal Reserve, finance, inflation, interest-rates, real-estate | 45 Comments »