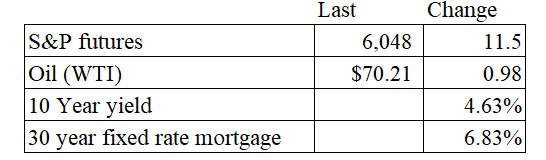

Vital Statistics:

Stocks are flattish as we await earnings from Nvidia after the close. Bonds and MBS are down small.

Consumer confidence fell sharply in February, according to the Conference Board. Both the Present Situation index and the Expectations index fell. “In February, consumer confidence registered the largest monthly decline since August 2021,” said Stephanie Guichard, Senior Economist, Global Indicators at The Conference Board. “This is the third consecutive month on month decline, bringing the Index to the bottom of the range that has prevailed since 2022. Of the five components of the Index, only consumers’ assessment of present business conditions improved, albeit slightly. Views of current labor market conditions weakened. Consumers became pessimistic about future business conditions and less optimistic about future income. Pessimism about future employment prospects worsened and reached a ten-month high.”

The Expectations Index is back at levels usually associated with an impending recession. Inflation and tariff fears are the biggest drivers, though we are also seeing consumers become less constructive on the labor market.

Richmond Fed President Thomas Barkin said the fight against inflation is facing headwinds such as changing demographics and higher government spending. “If headwinds persist, we may well need to use policy to lean against that wind,” he said. In other words, rates may have to be higher for longer. “We learned in the ’70s that if you back off inflation too soon, you can allow it to re-emerge. No one wants to pay that price.”

The price differential between new construction and existing homes has disappeared, according to the NAHB. Limited inventory of existing homes is pushing median sales prices higher, while builder decisions (a focus on lower-priced offerings) is the driver for new homes. In the fourth quarter of 2024, the differential was only around $9,000 versus a $50,000 10 year average.

Mortgage applications fell 1.2% last week as purchases rose 0.2% and refis fell 3.6%. “Treasury yields moved lower on softer consumer spending data as consumers are feeling somewhat less upbeat about the economy and job market. This pushed mortgage rates lower, with the 30-year fixed rate decreasing to 6.88 percent, the lowest rate since mid-December,” said Joel Kan, MBA’s Vice President and Deputy Chief Economist. “Applications were about one percent lower for the week, which included the President’s Day holiday, as purchase applications stayed flat from a week ago while refinance applications saw a small decline. Purchase applications were up 3 percent from the same week last year. Increasing for-sale inventory in some markets has provided prospective buyers more options as we approach the spring homebuying season.”

Filed under: Economy | 76 Comments »