Stocks are higher this morning after a decent jobs report. Bonds and MBS are down.

The economy added 130,000 jobs in January, according to the BLS. November and December payrolls were revised downward by 17,000. The unemployment rate fell to 4.3%. Average hourly earnings rose 0.4% month-over-month and 3.7% YOY. Health care, social assistance and construction accounted for the majority of the job gains, while financial activities and government declined.

The number of employed people increased by 528k, while the number of unemployed people fell by 141k. Those not in the labor force fell by 221k. This pushed up the labor force participation rate and the employment-population ratio.

The initial reaction in the bond market was a 7 basis point spike in yields. A March rate cut is looking highly unlikely. The Employment Cost Index rose 0.7% on a quarterly basis and 3.4% YOY.

Dallas Fed President Laurie Logan said she is cautiously optimistic that if the labor market remains stable no further rate cuts are needed. “If so, this would tell me that our current policy stance is appropriate and no further rate cuts are needed to achieve our dual mandate goals,” Logan said in remarks prepared for delivery in Austin, Texas. If instead inflation falls but the labor market cools materially, “cutting rates again could become appropriate. But right now, I am more worried about inflation remaining stubbornly high.”

Mortgage applications fell 0.3% last week as purchases decreased 2% and refis rose 1%. “Mortgage applications were relatively flat over the week, but it was a mixed bag for the different loan types. The 30-year fixed rate was unchanged at 6.21 percent, and conventional applications declined for both purchases and refinances as borrowers held out for another drop in rates or shifted to other loan types,” said Joel Kan, MBA’s Vice President and Deputy Chief Economist. “FHA purchase and refinance applications increased, helped partially by the FHA rate declining and remaining 20 basis points lower than the conforming 30-year fixed rate.”

Mortgage delinquencies declined 16 basis points last month, while foreclosure starts rose 54% (probably seasonality). Foreclosures are up 27% on a YOY basis, but still below pre-pandemic levels. Foreclosure activity is being driven primarily by FHA.

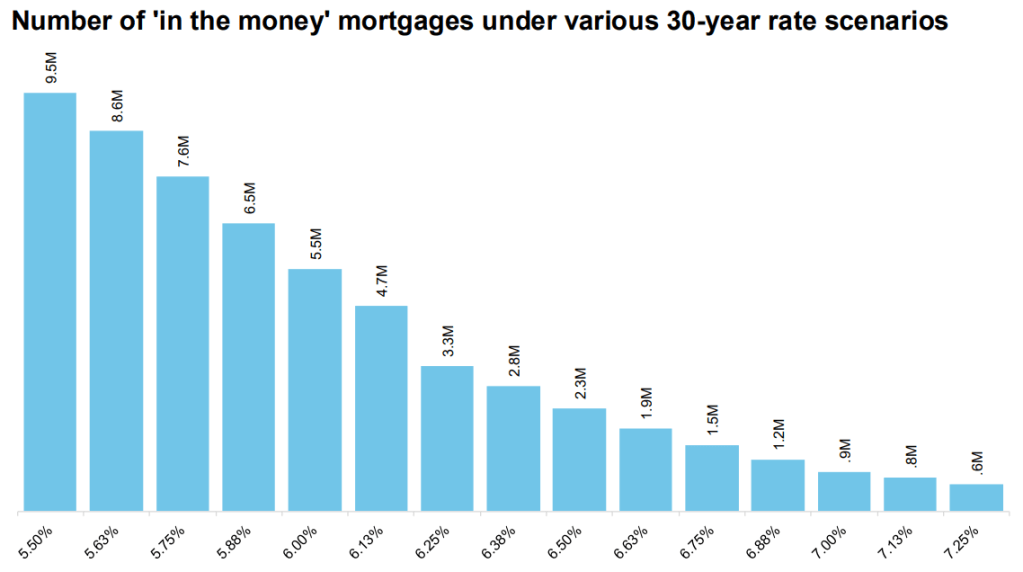

We are seeing refi activity pick up as mortgage rates move lower. If mortgage rates fall to 6.0%, 5.5 million borrowers are in the money for a refi. At 5.875% that number jumps to 6.5 million. We are on the cusp of a refi wave if rates cooperate.

Filed under: Economy |