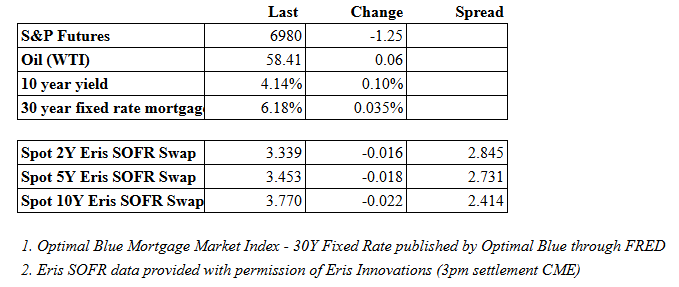

Vital Statistics:

Stocks are flattish this morning on no real news. Bonds and MBS are up.

Today should be a quiet day in the markets as most people usually take today the day after Christmas off.

There is no economic data today, and little remaining from Wednesday. Initial Jobless claims fell to 214k.

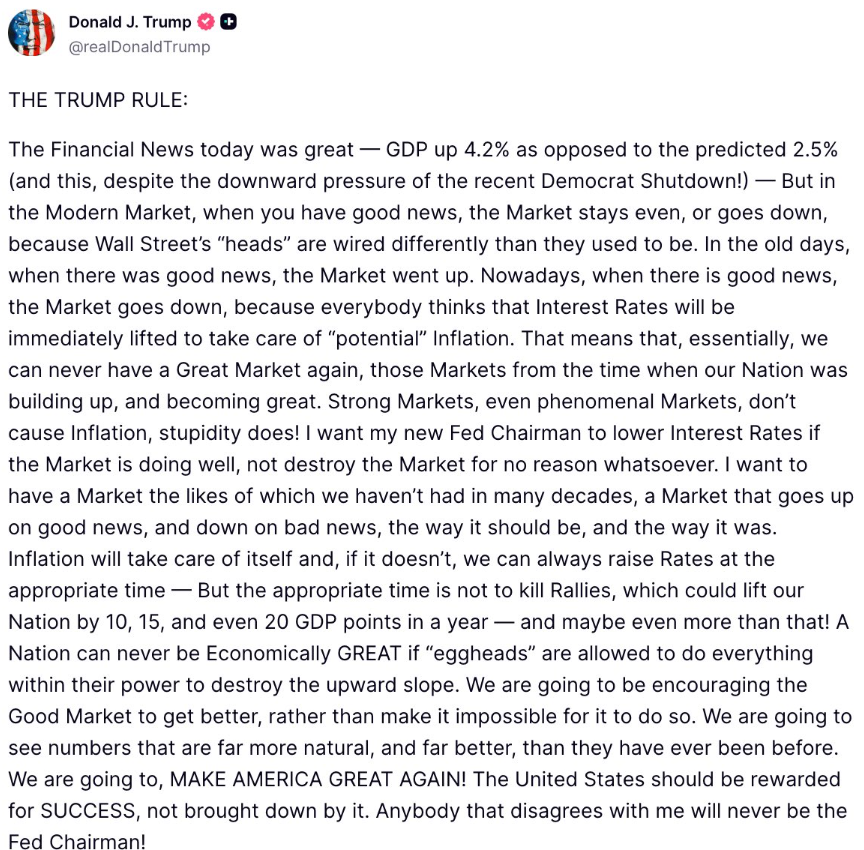

Donald Trump took to social media to talk about what he is looking for in a new Fed Chairman:

In typical Trumpian fashion, he uses a lot of hyperbole and invective which causes people to dismiss what he is saying as unhinged. It is easy to do. However on the main point here, he isn’t wrong.

If you strip out the invective and the hyperbole, he described the issues with the Powell Fed pretty well. The Fed is supposed to fight actual inflation, not potential inflation.

The Fed made this mistake in 2022 – keeping rates low despite actual inflation being in the high single digits. The Fed was betting that this inflation was “transitory” and therefore kept rates low. Powell wasn’t looking at actual inflation, he was making an inflation bet. And he bet wrong, big time. He was so wrong that “transitory” became a laugh line.

Similarly, in 2025, Powell was betting that inflation would return to the high single digits (or thereabouts) and kept the Fed Funds rate higher than it ordinarily would be because he was worried about the effect of tariffs. Again, Powell bet on future inflation and bet wrong.

So Trump’s statement that “When there is good news, the market goes down because everybody thinks interest rates will be immediately lifted to take care of “potential” inflation” is hyperbolic – nobody thinks the Fed is going to hike rates – but is more or less directionally correct. The market is interpreting strong economic data to mean the Fed is going to keep monetary policy needlessly tight.

It is easy to say that inflation IS over the Fed’s target – 2.7% versus 2.0% – however the Fed is wringing its hands over missing the target by 70 basis points, while it whistled past the graveyard in 2022 and missed by 700 basis points. It is hard to miss the double standard here.

His statement: “Strong markets, even phenomenal markets, don’t cause inflation – stupidity does” is needlessly inflammatory, however he isn’t wrong. Inflation is too much money chasing too few goods. Strong markets don’t create inflation by themselves. And that is his main point – don’t hike rates if we get good data or the market is strong simply because you worry that could ignite inflation.

Who Trump picks as a Fed Chairman will still have to deal with a bunch of voting members who (a) don’t like Trump to begin with (b) don’t want to help him politically, and (c) want to remain independent. Still it appears that monetary policy is still tight by 50 – 75 basis points which means the Fed should continue to cut in 2026.

Filed under: Economy |

This should be the subject of a 60 Minutes segment:

https://chrisbray.substack.com/p/the-trajectory-of-blue-zone-fraud

LikeLike

The mainstream media will ignore it as long as possible and then frame it as “republicans pounce”

LikeLike

Dude, sorry this happened to you.

https://x.com/washingtonpost/status/2005330445764825599?s=46&t=vSGsUlnc4rLxcUf7zfUiHg

LikeLike

Oh, the humanity!

https://x.com/jrumolo/status/2005825988240822584?s=46&t=vSGsUlnc4rLxcUf7zfUiHg

Orange Man Bad will no longer subsidize landscaping for rich people!

LikeLike

lol!

https://x.com/ismailiahmedr/status/2006491062106570813?s=46&t=vSGsUlnc4rLxcUf7zfUiHg

LikeLike

Happy New Year everyone. Interesting that this little group is still going after Plum Line has long since left the Washington Post.

LikeLike

Happy New Year, J! 6 left, I include Lulu, though she mostly lurks.

To my knowledge, no one was ever banned/blocked.

LikeLike

Happy new year to you too. Yes, it is pretty amazing. Shame we lost so many people, but this core has lasted a long time.

LikeLike

this smells fishy and hoaxy

LikeLike

lol

https://x.com/pelositracker/status/2008212618662810085?s=46&t=vSGsUlnc4rLxcUf7zfUiHg

LikeLike

Brent – this may be of interest:

https://www.joshbarro.com/p/capitalism-for-developers-communism

LikeLike

Dumb question, wouldn’t a higher productivity rate naturally result in lowered labor costs?

Brent, do you trust these numbers?

https://www.latimes.com/business/story/2026-01-08/productivity-accelerates-to-fastest-pace-in-two-years

LikeLike

productivity is a function of output and hours worked. So output increased 5.4% and hours worked increased 0.5%, so productivity came in at 4.9% (5.4% – 0.5%).

unit labor costs fell 1.9% because compensation rose 2.9% and productivity rose 4.9% (2.9% – 1.9%)

I guess the question comes down to whether you believe output increased by 5.4% in Q3. GDP growth came in at 4.3%, so it isn’t unreasonable. (Output as measured by BEA in GDP includes a bunch of stuff that BLS ignores so the numbers aren’t comparable).

LikeLike

lol!

https://x.com/robertkennedyjr/status/2009281182161068521?s=46&t=vSGsUlnc4rLxcUf7zfUiHg

LikeLike

Good read:

https://www.konstantinkisin.com/p/congratulations-the-multipolar-world

LikeLike

JFC, these people are so wrapped around self loathing it’s impossible to comprehend.

LikeLike

I do appreciate the honest Marxists disavowing “Defund the Police” as not being a part of actual leftist political theory.

https://freddiedeboer.substack.com/p/defund-the-police-failed-because

LikeLike

Good read:

https://www.eugyppius.com/p/courting-death-to-own-the-nazis

LikeLike

I’ve is becoming self-aware.

https://x.com/mysterygrove/status/2010356209442848826?s=46&t=vSGsUlnc4rLxcUf7zfUiHg

LikeLike

Surest sign yet that JP is crooked.

https://x.com/jimcramer/status/2010767625056632877?s=46&t=vSGsUlnc4rLxcUf7zfUiHg

LikeLike

Scott Adams, dead at 68.

LikeLike

That’s sad. Watching him over the last year during his illness was weird, he was very public about it and at times I felt intrusive. Rest In Peace, you always made me smile with Dilbert.

LikeLike