Vital Statistics:

Stocks are higher this morning as we await inflation data. Bonds and MBS are flattish.

The Personal Incomes and Outlays numbers for September were scheduled to be released this morning at 8:30. So far there is nothing on the BEA’s website. It may have been pushed back to later today.

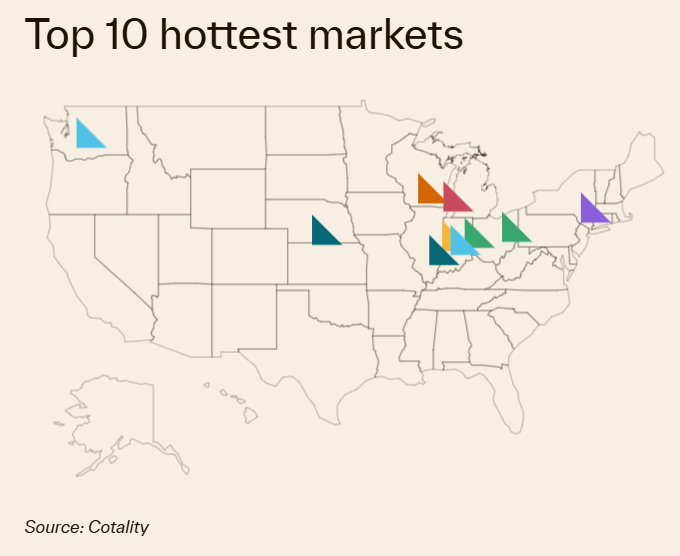

Home Price appreciation continued to decelerate, according to Cotality. Prices rose 1.1% overall on a YOY basis, with declines extending from 6% of MSAs to 32% of MSAs. On a MOM basis, prices declined 0.2%

“The housing market in 2025 demonstrated remarkable resilience despite significant headwinds. Slowing price growth reflects a much-needed rebalancing after years of unsustainable gains. While some markets are experiencing declines, these adjustments will help restore affordability over time and make housing more accessible to a wider group of buyers,” said Cotality’s Chief Economist Dr. Selma Hepp.

“Looking ahead, regional differences will remain pronounced, with demand favoring areas that offer both economic opportunity and relative affordability. In general, home price growth is projected to remain below the long-running average of 4% to 5%. However, mortgage rates will play a critical role in shaping the 2026 housing market. A notable drop in mortgage rates combined with low supply could lead to a re-acceleration of price gains.”

The hip-to-be-square trade continues, with the biggest gain (9%) coming from the tony destination of Bridgeport, CT.

Investor purchase activity was muted in the third quarter, according to research from Redfin. Investor home purchases rose only 1% compared to a year ago. With flattening rents, this shouldn’t be a surprise. “Investor activity is stuck in neutral because profits are harder to come by, more homes are selling at a loss, and the rental market has softened,” said Sheharyar Bokhari, a senior economist at Redfin. “Investors aren’t completely retreating, but they’re not driving the housing market forward.”

The share of homes bought by investors slipped to 17%, which is still on the high side compared to pre-pandemic levels. High home prices, elevated mortgage rates and a sluggish rental market are conspiring to make income properties and fix / flip deals harder to pencil out.

Filed under: Economy | 28 Comments »