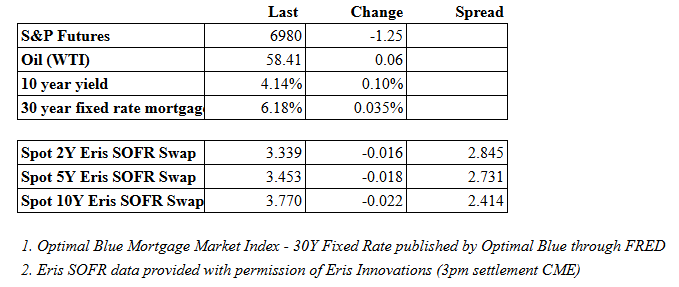

Vital Statistics:

Stocks are flattish this morning on no real news. Bonds and MBS are up.

Today should be a quiet day in the markets as most people usually take today the day after Christmas off.

There is no economic data today, and little remaining from Wednesday. Initial Jobless claims fell to 214k.

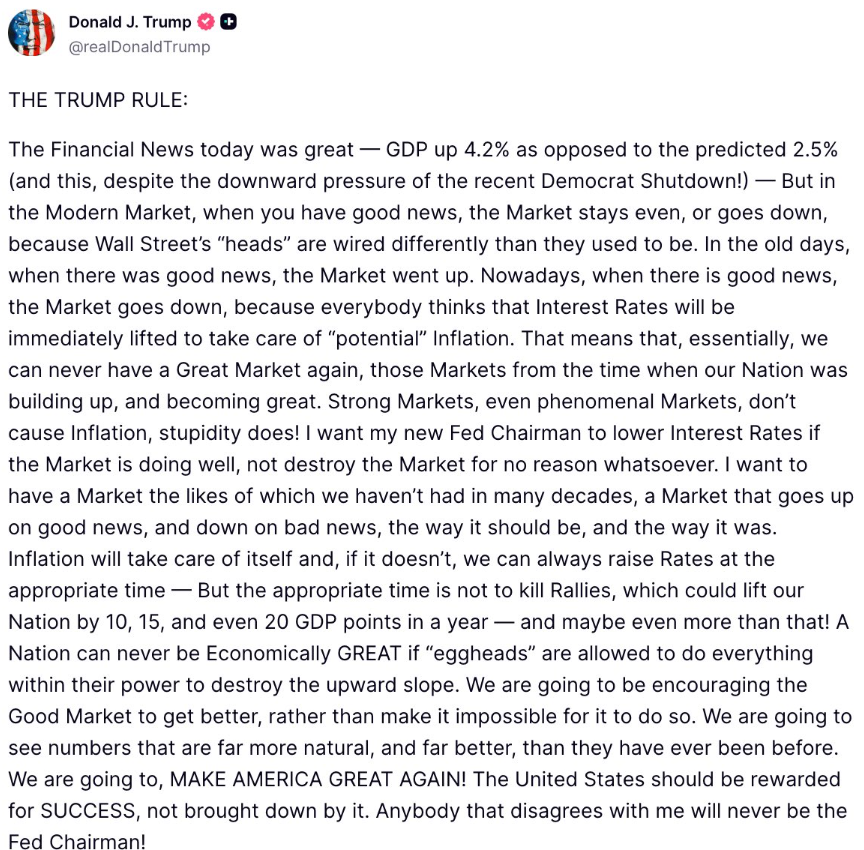

Donald Trump took to social media to talk about what he is looking for in a new Fed Chairman:

In typical Trumpian fashion, he uses a lot of hyperbole and invective which causes people to dismiss what he is saying as unhinged. It is easy to do. However on the main point here, he isn’t wrong.

If you strip out the invective and the hyperbole, he described the issues with the Powell Fed pretty well. The Fed is supposed to fight actual inflation, not potential inflation.

The Fed made this mistake in 2022 – keeping rates low despite actual inflation being in the high single digits. The Fed was betting that this inflation was “transitory” and therefore kept rates low. Powell wasn’t looking at actual inflation, he was making an inflation bet. And he bet wrong, big time. He was so wrong that “transitory” became a laugh line.

Similarly, in 2025, Powell was betting that inflation would return to the high single digits (or thereabouts) and kept the Fed Funds rate higher than it ordinarily would be because he was worried about the effect of tariffs. Again, Powell bet on future inflation and bet wrong.

So Trump’s statement that “When there is good news, the market goes down because everybody thinks interest rates will be immediately lifted to take care of “potential” inflation” is hyperbolic – nobody thinks the Fed is going to hike rates – but is more or less directionally correct. The market is interpreting strong economic data to mean the Fed is going to keep monetary policy needlessly tight.

It is easy to say that inflation IS over the Fed’s target – 2.7% versus 2.0% – however the Fed is wringing its hands over missing the target by 70 basis points, while it whistled past the graveyard in 2022 and missed by 700 basis points. It is hard to miss the double standard here.

His statement: “Strong markets, even phenomenal markets, don’t cause inflation – stupidity does” is needlessly inflammatory, however he isn’t wrong. Inflation is too much money chasing too few goods. Strong markets don’t create inflation by themselves. And that is his main point – don’t hike rates if we get good data or the market is strong simply because you worry that could ignite inflation.

Who Trump picks as a Fed Chairman will still have to deal with a bunch of voting members who (a) don’t like Trump to begin with (b) don’t want to help him politically, and (c) want to remain independent. Still it appears that monetary policy is still tight by 50 – 75 basis points which means the Fed should continue to cut in 2026.

Filed under: Economy | 22 Comments »