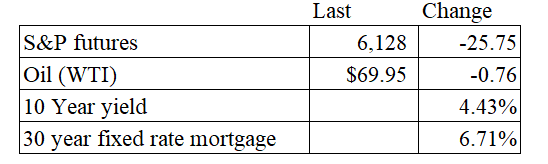

Vital Statistics:

Stocks are lower as the Fed begins its FOMC meeting. Bonds and MBS are up.

Retail sales rose 0.7% MOM in November, which was above expectations. On a year-over-year basis, they rose 3.8%. Motor Vehicles and parts were the big driver of the increase. Excluding vehicles and gas, sales rose 0.2% MOM, which was below expectations. October’s sales numbers were revised upward.

The S&P Flash PMI hit a 33 month high in December. Output rose at the steepest rate in 33 months, and much of the increase was attributed to the incoming administration. That said, the growth was concentrated in the service sector, as manufacturing conditions continued to deteriorate.

“Business is booming in the US services economy, where output is growing at the sharpest rate since the reopening of the economy from COVID lockdowns in 2021. The service sector expansion is helping drive overall growth in the economy to its fastest for nearly three years, consistent with GDP rising at an annualized rate of just over 3% in December.

“It’s a different picture in manufacturing, however, where output is falling sharply and at an increased rate, in part due to weak export demand. Encouragingly, confidence in the 12-month outlook has lifted to a two-and-a-half year high, suggesting the robust economic upturn will persist into the new year and could also become more broad-based by sector. However, some of the high spirits seen after the election in the manufacturing sector have been checked over concerns surrounding tariffs and the potential impact on inflation resulting from the higher cost of imported materials. December saw raw material prices spike sharply higher amid supplier-led price rises and higher shipping costs, in a reflection of busier supply chains in advance of threatened protectionism in the new year.”

Notably, the PMI and the CPI are diverging, and since the PMI generally leads the CPI, we should see further downward pressure on inflation, which is good for the Fed as it fights the last mile of inflation.

Industrial production fell 0.1% MOM in November, according to the Federal Reserve. Manufacturing production rose 0.2%. Capacity Utilization slipped to 76.8%. Note that October’s numbers were revised downward.

Filed under: Economy | 46 Comments »