Vital Statistics:

Stocks are flattish this morning on no real news. Bonds and MBS are down small.

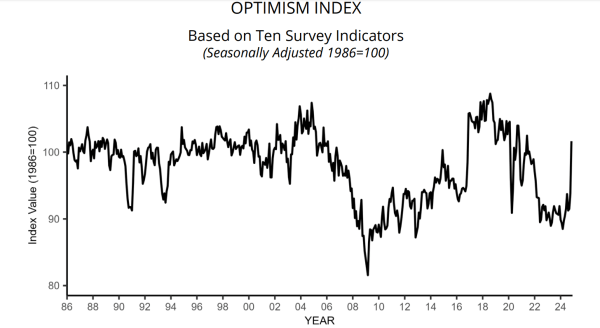

Small business optimism improved markedly in November, according to the NFIB Small Business Optimism Report. The index rose by 8 points to hit the highest level since June 2021, and breaking through the 50 year average for the first time in 34 months.

All components of the index improved as uncertainty over the election faded. The labor market remains tight, with 36% of small businesses reporting they had jobs they were unable to fill. Labor costs remain the biggest concern for small businesses.

Sales remain challenged, however optimism for the future improved. The net number of firms reporting higher sales was negative 13, however a net 18% think things are about to get better.

“After a year of readings at 94 or lower (98 is the 50-year average), the Index of Small Business Optimism rose to 101.7 in November, clearly a response to the presidential election. The election results signal a major shift in economic policy, particularly for tax and regulation policies, that favor economic growth. Economic and employment growth have been dominated by government spending, financed with massive deficits, crowding out private spending with higher prices and interest rates. Average small firm loan costs rose from 4 percent to over 9 percent over the past four years. Government (federal, state, and local) employment (direct and indirect) surged, competing with private firms for employees, mainly those businesses that did not benefit from government spending. Trump’s first term as president produced inflation rates that averaged well under the Fed’s 2 percent target and very strong economic growth. Owners hope for a repeat performance.”

The national delinquency rate improved to 3.45% in October, according to the latest ICE Mortgage Monitor. The 90 day rate continues to tick up, however. Foreclosure activity remains muted, rising 12% MOM, but still down about 12% on a YOY basis.

We saw a spike in rate / term refis in October, which is something that has been non-existent for the past few years. Rate / term refis actually exceeded cash-out refis. Much of the activity came from loans originated in 2023, when mortgage rates were closer to 8%.

Productivity increased 2.2% in the third quarter, according to BLS. Unit labor costs were revised downward from 1.9% to 0.8%. A downward revision to compensation accounted for the change.

People’s household finance outlook improved dramatically, according to the latest data from the New York Fed. The outlook has returned to February 2020 levels (i.e. pre-pandemic) levels.

Filed under: Economy | 45 Comments »