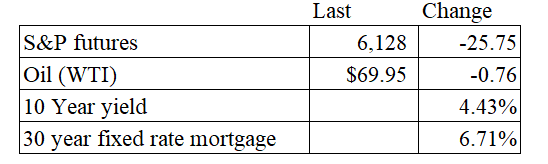

ital Statistics:

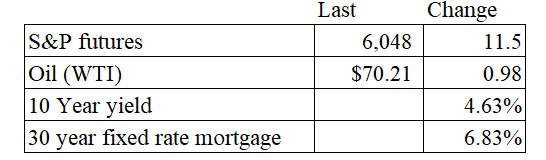

Stocks are up this morning on no real news. Bonds and MBS are down.

The markets close early today in observance of Christmas Eve. Should be a quiet day.

New home sales rose 5.9% to a seasonally adjusted annual rate of 664,000 in November. This was up 8.7% compared to a year ago. The median sales price of new houses sold in November 2024 was $402,600. The average sales price was $484,800. The median price fell 6.3%, while the average price was down about 80 basis points.

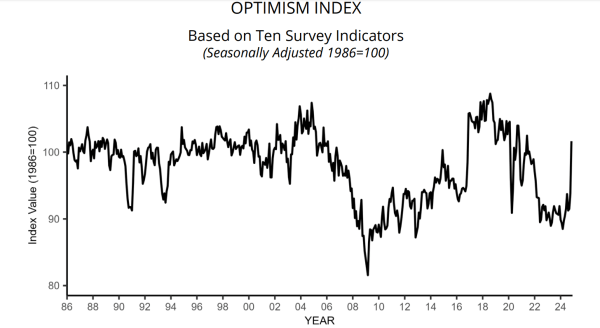

Consumer confidence pulled back in December, according to the Conference Board. “The recent rebound in consumer confidence was not sustained in December as the Index dropped back to the middle of the range that has prevailed over the past two years,” said Dana M. Peterson, Chief Economist at The Conference Board. “While weaker consumer assessments of the present situation and expectations contributed to the decline, the expectations component saw the sharpest drop. Consumer views of current labor market conditions continued to improve, consistent with recent jobs and unemployment data, but their assessment of business conditions weakened. Compared to last month, consumers in December were substantially less optimistic about future business conditions and incomes. Moreover, pessimism about future employment prospects returned after cautious optimism prevailed in October and November.”

The CPFB is accusing Rocket Mortgage of illegal kickbacks. “Rocket engaged in a kickback scheme that discouraged home-buyers from comparison shopping and getting the best deal,” CFPB Director Rohit Chopra said in a statement. “At a time when homeownership feels out of reach for so many, companies should not illegally block competition in ways that drive up the cost of housing.”

Rocket responded by saying that one-third of the borrowers with an application in progress chose to go to a different lender: “The facts are clear – data shows one-third of consumers with a loan application already in progress with Rocket Mortgage, before contacting Rocket Homes, chose to close with a different lender,” the company said in a statement. “This proves Rocket Homes is committed to empowering home-buyers to make the best decisions for their unique needs.”

Filed under: Economy | 42 Comments »