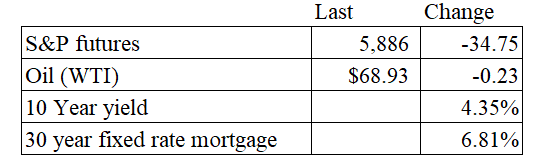

Vital Statistics:

Stocks are lower this morning on Ukraine / Russia fears. Bonds and MBS are up.

Housing starts fell to 1.311 million units in October, according to the Census Bureau. This is down 4% on a year-over-year basis. Building permits fell 7.7% on a YOY basis to 1.534 million units.

Homebuilder confidence improved in November as political uncertainty abated. “With the elections now in the rearview mirror, builders are expressing increasing confidence that Republicans gaining all the levers of power in Washington will result in significant regulatory relief for the industry that will lead to the construction of more homes and apartments,” said NAHB Chairman Carl Harris, a custom home builder from Wichita, Kan. “This is reflected in a huge jump in builder sales expectations over the next six months.”

“While builder confidence is improving, the industry still faces many headwinds such as an ongoing shortage of labor and buildable lots along with elevated building material prices,” said NAHB Chief Economist Robert Dietz. “Moreover, while the stock market cheered the election result, the bond market has concerns, as indicated by a rise for long-term interest rates. There is also policy uncertainty in front of the business sector and housing market as the executive branch changes hands.”

Nomura is out with a call saying that the Fed will not cut rates at the December FOMC meeting. Their argument is that the election of Trump will be inflationary due to tariffs, which will prevent the Fed from easing further. The bank sees the Fed skipping the December meeting and then cutting in May and June of 2025 by 25 basis points. After that, they see the Fed holding rates there.

FWIW, I doubt the Fed is letting policy speculation drive its decision-making. Inflation continues to fall towards the Fed’s 2% target, and policy remains restrictive.

Filed under: Economy | 83 Comments »