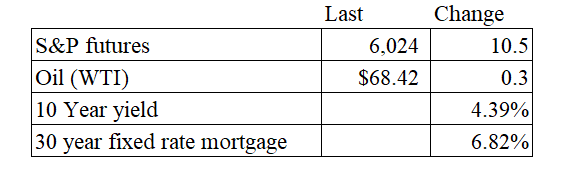

Vital Statistics:

Stocks are higher this morning despite a pick up in inflation. Bonds and MBS are down.

The headline consumer price index rose 0.2% MOM in October, according to the BLS. Shelter rose 0.4% and accounted for half the increase. Energy was flat after a big decline in September.

On a year-over-year basis, the headline CPI rose 2.6%. If you strip out food and energy, the CPI rose 0.3% month over month and 3.3% YOY.

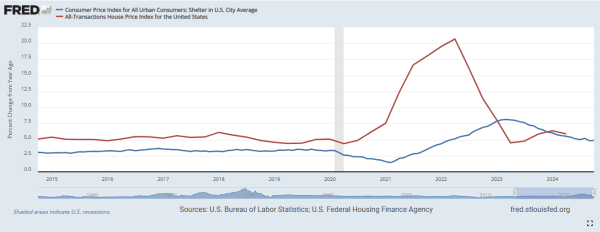

I graphed the CPI shelter index (blue line) versus the FHFA House Price Index (red line). You can see that the FHFA house price index leads the CPI shelter index, and FHFA’s house price growth is returning to pre-2020 levels. This should drag down the shelter component of CPI and return inflation back to pre-pandemic levels.

Mortgage applications increased 0.5% last week as purchases rose 2% and refis fell 2%. “Mortgage rates continued to increase last week, driven by higher Treasury yields as financial markets digested the likely impacts of a Trump presidency. The Federal Reserve’s 25-basis-point rate cut was already anticipated and did little to move the markets,” said Joel Kan, MBA’s Vice President and Deputy Chief Economist. “The 30-year fixed rate was at 6.86 percent last week, its highest since July 2024. However, despite the increase in rates, applications increased for the first time in seven weeks.”

Added Kan, “Purchase applications picked up and remained close to levels from a year ago. FHA and VA purchase applications drove the stronger overall purchase activity, increasing 3 percent and 9 percent, respectively. FHA mortgage rates bucked the overall trend and were lower over the week, which likely helped some borrowers. Conventional purchase applications were also up slightly. Meanwhile, the upward climb in rates led to refinance activity falling to its lowest level since May 2024.”

Filed under: Economy | 99 Comments »