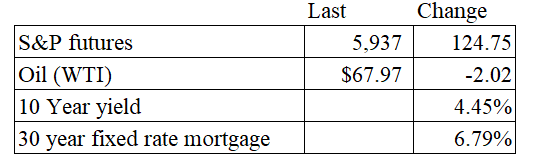

Vital Statistics:

Stocks are higher this morning as markets digest the Trump victory. Bonds, on the other hand, are getting slammed.

The Trump trade is full swing, with stocks rising in anticipation of a more business-friendly environment. The action in bonds is probably to be expected, as investors adopt a risk-on position. Overall, Trump will probably be negative for long-term bonds for a few reasons. First, the risk-on aspect means that investors will prefer riskier assets like stocks to safe assets like bonds. Second, stronger economic activity will give the Fed less leeway to cut rates. And finally, hawkish trade policy is bad for Treasuries. The reason for this is that our trading partners run trade surpluses, which means they send us goods and services and we send them Treasuries in return. If trade declines, that means less demand for Treasuries and therefore higher rates at the margin.

All attention now turns to the Fed, which starts its meeting today. Longer-term, it will be interesting to see what happens to the GSEs.

The services economy expanded for the fourth consecutive month, according to the ISM Services Index. “The increase in the Services PMI® in October was driven by boosts of more than 4 percentage points for both the Employment and Supplier Deliveries indexes. The Business Activity and New Orders indexes both dropped by at least 2 percentage points. Each of the four subindexes are now above their averages for 2024. The Supplier Deliveries Index remained in expansion in October, indicating slower delivery performance. Concerns over political uncertainty were again more prevalent than the previous month. Impacts from hurricanes and ports labor turbulence were mentioned frequently, although several panelists mentioned that the longshoremen’s strike had less of an impact than feared due to its short duration.”

Mortgage applications fell 10.8% last week as purchases 5.1% and refis fell 18.5%. “Applications decreased for the sixth consecutive week, with purchase activity falling to its lowest level since mid-August and refinance activity declining to the lowest level since May. The average loan size on a refinance application dropped below $300,000, as borrowers with larger loans tend to be more sensitive to any given changes in mortgage rates”

Filed under: Economy | 70 Comments »