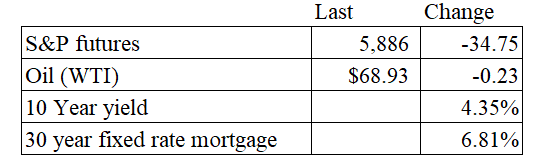

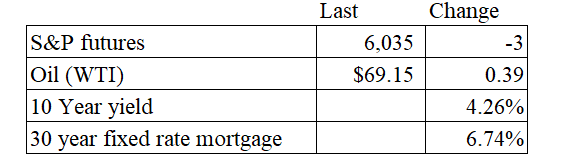

Vital Statistics:

Stocks are flattish this morning on no real news. Bonds and MBS are up.

Third quarter GDP rose 2.8% in the second revision to the estimate. This was in line with Street expectations.

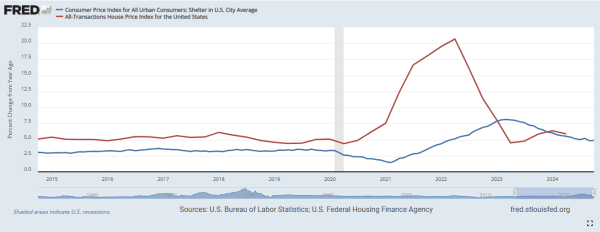

New Home Sales disappointed again, coming in at 610,000, which was well below the Street expectation of 725k. This was down 17.3% compared to September and down 9% compared to a year ago.

The median home price was $437,300, and the average price was $585,800. There was 9.5 months’ worth of supply.

The FOMC minutes were released yesterday. On the subject of inflation, the members sounded pretty confident:

With regard to the outlook for inflation, participants indicated that they remained confident that inflation was moving sustainably toward 2 percent, although a couple noted the possibility that the process could take longer than previously expected. A few participants remarked that insofar as recent robust increases in real GDP reflected favorable supply developments, the strength of economic activity was unlikely to be a source of upward inflation pressures. Participants cited various factors likely to put continuing downward pressure on inflation, including waning business pricing

power, the Committee’s still-restrictive monetary policy stance, and well-anchored longer-term inflation expectations. Several participants noted that nominal wage growth had continued to move down and that the wage premium available to job switchers had diminished. In addition, some participants observed that, with supply and demand in the labor market being roughly in balance and in light of recent productivity gains, wage increases were unlikely to be a source of inflationary pressure in the near future.

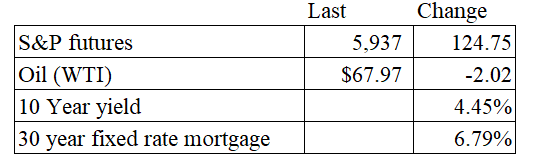

Further into the minutes, they discussed that the economy has been stronger than expected, and that downside risks to the economy had become less prominent. The Fed Funds futures see a 66% chance of a 25 basis point cut at the next meeting in mid-December.

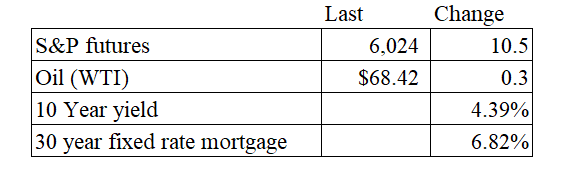

Mortgage applications rose 6.3% last week, as purchases rose 12% and refis fell 3%. “Purchase activity drove overall applications higher last week, as conventional purchase applications picked up pace and mortgage rates declined for the first time in over two months, with the 30-year fixed rate dropping slightly to 6.86 percent,” said Joel Kan, MBA’s Vice President and Deputy Chief Economist. With the growth in for-sale inventory and signs that the economy remains strong, buyers have remained in the market even though rates have increased recently. The increase in conventional purchase applications helped push the average purchase loan size to $439,200, its highest level in almost a month. The decline in refinance activity was driven by pullbacks in FHA and VA refinances. Applications were significantly higher than a year ago by most measures, but this was compared to the week of Thanksgiving 2023, which was a week earlier than this year’s holiday.”

The new FHFA limits are out, rising 5.2% to $806,500. The high balance limit (for expensive MSAs) is 150% of that or $1,209,750.

Consumer confidence improved in November, according to the Conference Board. “Consumer confidence continued to improve in November and reached the top of the range that has prevailed over the past two years,” said Dana M. Peterson, Chief Economist at The Conference Board. “November’s increase was mainly driven by more positive consumer assessments of the present situation, particularly regarding the labor market. Compared to October, consumers were also substantially more optimistic about future job availability, which reached its highest level in almost three years. Meanwhile, consumers’ expectations about future business conditions were unchanged and they were slightly less positive about future income.”

I am accepting ads for this blog if you would like to make an announcement, highlight something your company is offering or want more visibility. I am running a special for new clients as well. I offer white-label services which give you the ability to use this content for your own daily emails. The blog has thousands of subscribers / followers and an open rate around 50%. Please feel free to reach out to brent@thedailytearsheet.com if you would like to discuss this further

Filed under: Economy | 31 Comments »