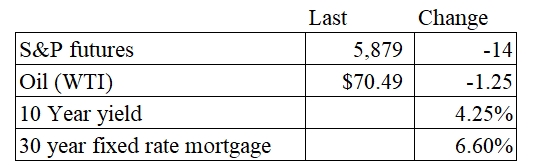

Vital Statistics:

Stocks are lower this morning as earnings continue to pour in. Bonds and MBS are down again.

Bond yields seem to be rising in lockstep with the probability of a Trump win. Although polling data indicates a close race, betting markets are increasingly predicting a Trump win. Both sides accuse the other of “painting the tape” with Democrats accusing foreign bad actors of placing big bets to influence the odds, while Republicans accuse Democrats of releasing partisan, over-D sampled polls into the overall mix.

Presumably, a Trump win would be bad for bonds as tariffs would raise prices, and a more pro-business regulatory regime would be better for the economy overall, which will keep the Fed from cutting rates as aggressively. A Trump Presidency would also bring back the debate over what to do with the GSEs.

Mortgage applications fell 6.7% last week as purchases fell 5.1% and refis fell 8.4%. “Mortgage rates saw mixed results last week, but the 30-year fixed rate remained unchanged at 6.52 percent. Application activity decreased to its lowest level since July, as both purchase and refinance applications saw declines,” said Joel Kan, MBA’s Vice President and Deputy Chief Economist. “Purchase applications continued to run stronger than last year’s pace for the fifth consecutive week. Even though rates have been on a recent upswing, they are over a full percentage point lower than a year ago, which has kept some homebuyers in the market. For-sale inventory has started to loosen, and home-price growth has eased in some markets, providing more options for buyers in combination with these lower rates.”

Home prices grew 0.5 MOM in September, according to data from Redfin. On a year-over-year basis, prices rose 6%. “There are around 20% fewer homes on the market today than there were five years ago, mainly because so many homeowners locked in a low mortgage rate during the pandemic,” said Redfin Senior Economist Sheharyar Bokhari. “With mortgage rates back above 6.5% this month—and unlikely to drop below 6% this year—home prices will likely continue their consistent climb until more inventory comes onto the market in the spring.”

Filed under: Economy | 59 Comments »