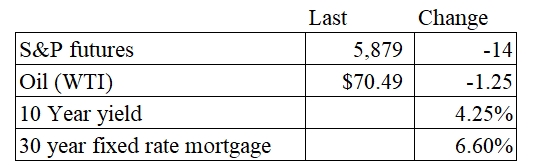

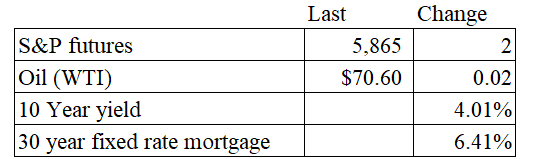

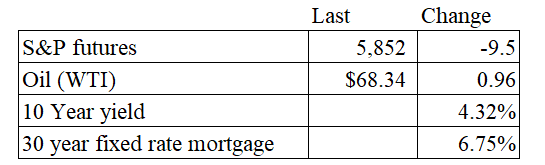

Vital Statistics:

Stocks are lower this morning on no real news. Bonds and MBS are down yet again.

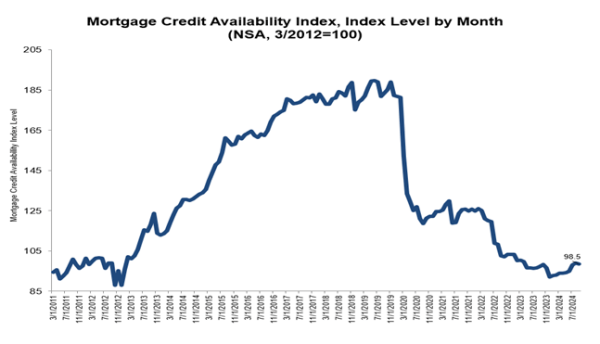

The move in mortgage rates over the past month has been astounding. This is the Optimal Blue Mortgage Market Index for the 30 year conforming mortgage.

The 10 year bond yield has risen as well, but MBS spreads are widening. The ^MOVE index, which tracks bond market volatility is up some 42% over the past month, so that is probably driving it as well.

The media is claiming that this rise in rates is due to fears that the deficit will rise after the election. I guess that is possible, but fiscal rectitude in Washington kind of left the building circa 2009, so I can’t imagine that it is all of a sudden mattering now. The trader in me thinks this will turn out to be a “buy the rumor, sell the fact situation” and rates will peak right before the election, and then come back down as people unwind their Trump trades.

Homebuilder D.R. Horton reported fourth quarter numbers that disappointed the Street, and the stock is getting slammed pre-open. Sales and guidance disappointed.

“Despite continued affordability challenges and competitive market conditions, our net sales orders in the fourth quarter increased slightly from the prior year to 19,035 homes. Our sales pace was in line with normal seasonality from the third to fourth quarter but was below our expectations. While mortgage rates have decreased from their highs earlier this year, many potential homebuyers expect rates to be lower in 2025. We believe that rate volatility and uncertainty are causing some buyers to stay on the sidelines in the near term. To help spur demand and address affordability, we are continuing to use incentives such as mortgage rate buydowns, and we have continued to start and sell more of our homes with smaller floor plans. The supply of both new and existing homes at affordable price points is still generally limited, and demographics supporting housing demand are favorable. With a focus on affordable product offerings, 37,400 homes in inventory and continued improvement in our construction cycle times, we are well positioned for fiscal 2025.”

Home prices rose 4.2% annually in August, which is below the 4.8% annual average. “Home price growth is beginning to show signs of strain, recording the slowest annual gain since mortgage rates peaked in 2023,” says Brian D. Luke, CFA, Head of Commodities, Real & Digital Assets. “As students went back to school, home price shoppers appeared less willing to push the index higher than in the summer months. Prices continue to decelerate for the past six months, pushing appreciation rates below their long-run average of 4.8%.

After smoothing for seasonality in the data, home prices continued to reach all-time highs, for the 15th month in a row. “Regionally, all markets continue to remain positive, barely,” Luke continued. “Denver posted the slowest annual gain of all markets this year, dropping below Portland for the first time since the spring. The Northeast remains the best performing region, with the strongest gains for over a year. Currently, only New York, Las Vegas, and Chicago markets are at an all-time high. Comparing average gains of traditional red and blue states highlight a slight advantage for home price markets of blue states. With stronger gains in the Northeast and West than the South, blue states have outperformed red states dating back to July 2023.”

Filed under: Economy | 95 Comments »