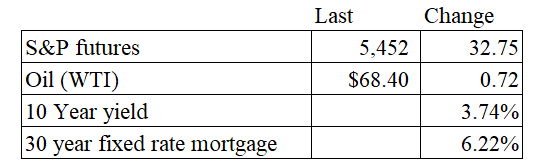

Vital Statistics:

Stocks are flat this morning on no real news. Bonds and MBS are flat as well.

Home prices hit a new record, according to the Case-Shiller Home Price Index. Prices rose 5.0% year-over-year in July, a deceleration from the 5.5% recorded in June. New York City led the charge, followed by Las Vegas and Los Angeles. “We continue to observe outperformance in most low-price tiers in the market on a three- and five-year horizon,” Luke continued. “The low-price tier of Tampa was the best performing market nationally with five-year performance of 88%. The New York market was the best market annually, posting a gain of 8.9%. New York’s low-tier index, which include home values up to $533,000, helped drive that growth with 10.8% annual gains. Over five years, markets such as New York and Atlanta saw low-price-tiered indices outperforming their market by as much as 20% and 18%, respectively. The relative outperformance of low-price-tiered indices has both benefited first-time homebuyers as well as made it more difficult for those looking for a starter home. The opposite is happening in California, which has the most expensive high-price tiers in the nation, all well over $1 million. The rich are getting richer in San Diego, Los Angeles, and San Francisco where their high-price-tiered indices outperformed on a one- and three-year basis.”

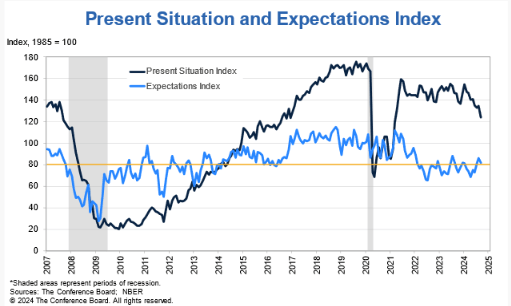

Consumer confidence declined in September, according to the Conference Board. “Consumer confidence dropped in September to near the bottom of the narrow range that has prevailed over the past two years,” said Dana M. Peterson, Chief Economist at The Conference Board. “September’s decline was the largest since August 2021 and all five components of the Index deteriorated. Consumers’ assessments of current business conditions turned negative while views of the current labor market situation softened further. Consumers were also more pessimistic about future labor market conditions and less positive about future business conditions and future income.

The Present Situation Index has moved down markedly over the summer and continues to fall. Inflationary expectations remained elevated at 5.2%.

Mortgage applications rose 11% last week as purchases rose 1.4% and refis rose 20%. “Mortgage applications increased to their highest level since July 2022, boosted by a 20 percent increase in refinance applications after a large increase the prior week. The 30-year fixed rate decreased for the eighth straight week to 6.13 percent, while the FHA rate decreased to 5.99 percent, breaking the psychologically important 6 percent level,” Joel Kan, MBA’s Vice President and Deputy Chief Economist. “As a result of lower rates, week-over-week gains for both conventional and government refinance applications increased sharply. The refinance share of applications is now at 55.7 percent, and while the level of refinance activity is still modest compared to prior refi waves, they now account for the majority of applications, given the seasonal slowdown in purchase activity.”

Filed under: Economy | Tagged: Business, Economy, finance, inflation, investing | 75 Comments »