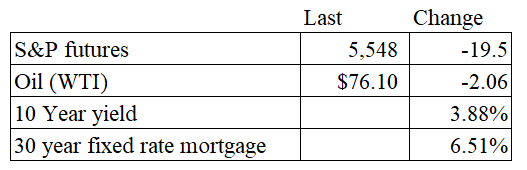

Vital Statistics:

Stocks are lower this morning on no real news. Bonds and MBS are up.

Housing starts declined to a seasonally-adjusted annual rate of 1.238 million. This is a 7% decline from a downwardly-revised June rate of 1.329 million, and down 16% compared to a year ago. Building permits fell 4% MOM and 7% YOY. Starts are at the lowest levels since May of 2020.

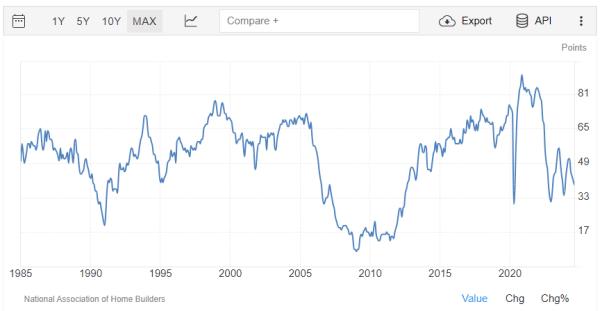

Homebuilder confidence declined in August as we await interest rate cuts. This is a decline from July and the lowest level since December last year. “Challenging housing affordability conditions remain the top concern for prospective home buyers in the current reading of the HMI, as both present sales and traffic readings showed weakness,” said NAHB Chairman Carl Harris, a custom home builder from Wichita, Kan. “The only sustainable way to effectively tame high housing costs is to implement policies that allow builders to construct more attainable, affordable housing.”

Homebuilder confidence is still stuck at the levels we saw during the post-bubble housing bust.

Mortgage delinquencies ticked up in the second quarter, according to the MBA. The delinquency rate rose 3 basis points QOQ to 3.97%. This is up 60 basis points compared to a year ago. “Mortgage delinquencies increased across all product types compared to this time last year,” said Marina Walsh, CMB, MBA’s Vice President of Industry Analysis. “While delinquencies are still low by historical standards, the recent increase corresponds with a rising unemployment rate, which has historically been closely correlated with mortgage performance.”

Industrial production fell 0.6% in July, according to the Federal Reserve. This was well below Street expectations. Manufacturing production fell 0.3%, which was in line with expectations. Capacity utilization fell to 77.8%. We have known the manufacturing economy is struggling, and this report shows no indication of a turnaround.

Filed under: Economy |

Brent,

Do you think this is true?

I have zero faith in government data gathering and statistics, but I don’t know about investors. Where does Wall Street look for accurate information?

LikeLike

Number of people employed in the US July 2023: 161,209,000

Number of people employed in the US July 2024: 161,266,000

So the US has added 57,000 jobs in the past year. The rest of the “jobs created” is just birth / death modeling noise

I think for the markets, these economic data are not big drivers of earnings estimates.

LikeLike

Thanks Brent! That’s interesting. How does the market perceive government data? As legitimate? Politicized?

LikeLike

It is only relevant to Fed watchers and government bond / currency traders.

LikeLike

Ok, that makes sense. Where do I go when I want good data, say, a crop report, too corner the market on Frozen Concentrated Orange Juice?

LikeLike

I remember visiting Chicago and going to see the Chicago Board of Trade and the Chicago Mercantile Exchange.

On the huge TV screen above the trading pits, they were playing the Weather Channel.

LikeLike

Don’t need a weatherman to know which way the wind blows.

LikeLike

I too think attending Ivy League schools is a betrayal of American values.

https://x.com/greg_price11/status/1825686764130021579?s=46&t=vSGsUlnc4rLxcUf7zfUiHg

LikeLike

The left detests the idea of someone succeeding by their own efforts.

LikeLike

I’m thoroughly enjoying the continuous humiliation of Biden, though I don’t understand why it keeps happening.

https://redstate.com/nick-arama/2024/08/20/new-nancy-pelosis-cutthroat-remarks-about-biden-during-interview-on-cnn-at-dnc-n2178307

Is it because they need him to resign as well? So that Kamala is running as an incumbent?

LikeLike

Does anybody disagree with this assessment?

LikeLike

Interesting piece on Sam Bankman-Fried.

https://www.washingtonpost.com/opinions/interactive/2024/sam-bankman-fried-michael-lewis-ftx/?itid=hp_opinions_p002_f001

One would think there might be a way to appeal his sentence since all the customers who presumably were the victims got 100% of their deposits back.

LikeLike

Part of the Democrats goal is to tax unrealized capital gains. Is there any country that does that? If so, what structure do they use?

LikeLike

I would assume the structure used would be one of inevitable economic collapse.

LikeLike

Absolutely awesome!

https://x.com/greg_price11/status/1826378177754935482?s=46&t=vSGsUlnc4rLxcUf7zfUiHg

LikeLike

Well capital gains go both ways… what does the government do on underwater trades?

LikeLike

What did Henry Hill keep repeating in Goodfellas, “ Fuck you, pay me”

LikeLike

It is a backdoor wealth tax

LikeLike