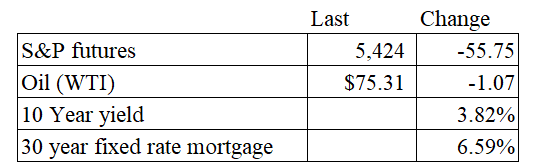

Vital Statistics:

Stocks are lower this morning as tech continues to sell off. Bonds and MBS are up big on the disappointing jobs report.

The Bank of England cut rates this morning, which is also helping put global sovereign yields lower.

The economy added 114,000 jobs in July, which was below the Street estimate of 180,000. June was revised downward from 206,000 jobs to 179,000. The unemployment rate ticked up from 4.1% to 4.3%. The number of unemployed people ticked up to 352,000.

Average hourly earnings rose 3.6% YOY, and June’s 3.9% number was revised downward to 3.8%.

Overall, this was a disappointing jobs report, and strengthens the case for a September rate cut. The 10 year bond yield moved decisively lower, falling 14 basis points in the immediate aftermath of the report.

The manufacturing economy continues to deteriorate, according to the ISM Manufacturing Index. The index contracted for the fourth month in a row, and 20 out of the last 21 months. Employment contracted by quite a bit, however prices are still rising. “Demand remains subdued, as companies show an unwillingness to invest in capital and inventory due to current federal monetary policy and other conditions. Production execution was down compared to June, likely adding to revenue declines, putting additional pressure on profitability. Suppliers continue to have capacity, with lead times improving and shortages not as severe. Eighty-six percent of manufacturing gross domestic product (GDP) contracted in July, up from 62 percent in June. More concerning: The share of sector GDP registering a composite PMI® calculation at or below 45 percent (a good barometer of overall manufacturing weakness) was 53 percent in July, 39 percentage points higher than the 14 percent reported in June. Notably, all six of the largest manufacturing industries — Machinery; Transportation Equipment; Fabricated Metal Products; Food, Beverage & Tobacco Products; Chemical Products; and Computer & Electronic Products — contracted in July,” says Fiore.

Private residential construction spending fell for the second straight month in June, largely driven by a decline in single family building. We had been seeing a shift in building from multi-family to single family for the past 18 months or so, but now both are declining.

Filed under: Economy | 39 Comments »