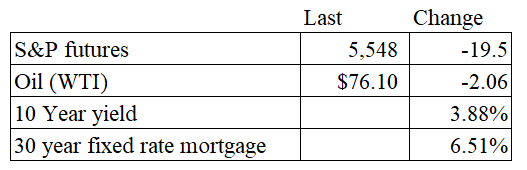

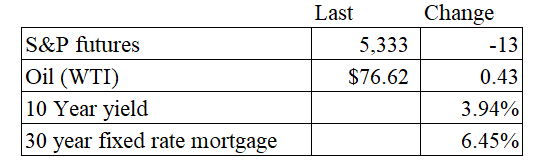

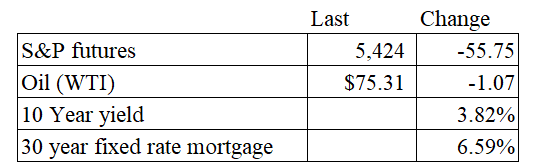

Vital Statistics:

Stocks are higher this morning after another benign inflation report. Bonds and MBS are down small.

Personal incomes rose 0.3% MOM in July, according to the Bureau of Economic Analysis. This was 0.1% above expectations. Consumption rose 0.5% MOM, which was in line with expectations.

The PCE Price Index rose 0.2%, in line with expectations, but was above May and June. The core rate, which excludes food and energy rose 0.2%, which was flat with June and in line with expectations. On an annual basis, the headline number rose 2.5% and the core rate rose 2.6%.

Bonds sold off slightly, and the Fed Funds futures now handicapping a 70% chance of a 25 basis point cut and a 30% chance of a 50 basis point cut. The strong spending number probably means the Fed will choose the less aggressive option.

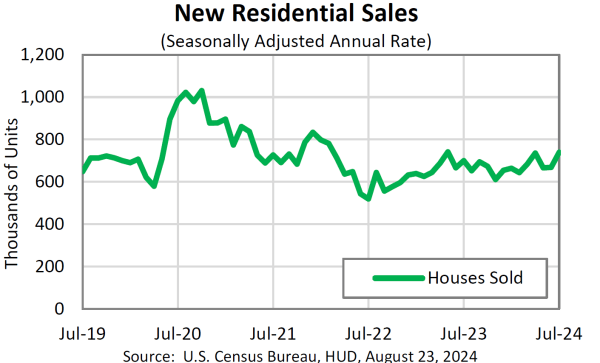

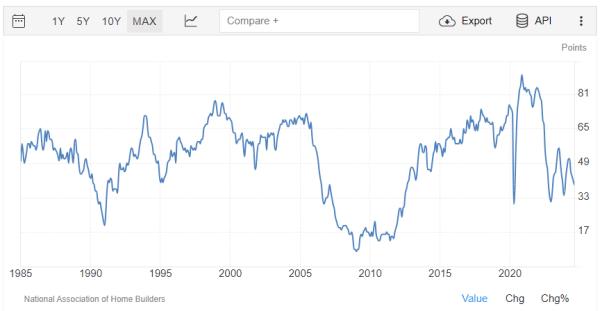

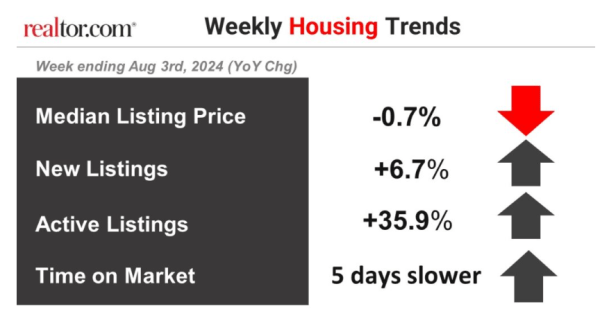

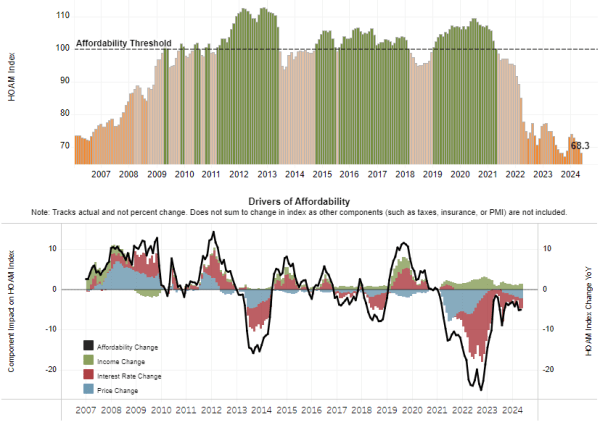

Pending Home Sales fell 5.5% in July, according to NAR. The index fell to the lowest level on record, which goes back to 2001 when the index first started. “A sales recovery did not occur in midsummer,” said NAR Chief Economist Lawrence Yun. “The positive impact of job growth and higher inventory could not overcome affordability challenges and some degree of wait-and-see related to the upcoming U.S. presidential election. In terms of home sales and prices, the New England region has performed relatively better than other regions in recent months,” added Yun. “Current lower, falling mortgage rates will no doubt bring buyers into market.”

Affordability did improve somewhat in July, according to the MBA. The national median payment for purchase applicants fell from $2,167 to $2,140. “Homebuyer affordability conditions improved for the third consecutive month as rates below 7 percent and rising housing inventory continue to bode well for prospective homebuyers,”,” said Edward Seiler, MBA’s Associate Vice President, Housing Economics, and Executive Director, Research Institute for Housing America. “MBA is expecting that slower home-price appreciation, coupled with lower rates, will ease affordability constraints and lead to increased activity in the housing market.”

Filed under: Economy | 30 Comments »