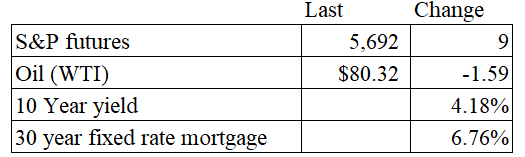

Vital Statistics:

Stocks are higher this morning as earnings continue to come in. Bonds and MBS are up.

Jerome Powell spoke yesterday, and said that the Fed isn’t going to wait until inflation hits its 2% target before easing. “The implication of that is that if you wait until inflation gets all the way down to 2%, you’ve probably waited too long, because the tightening that you’re doing, or the level of tightness that you have, is still having effects which will probably drive inflation below 2%,” Powell said.

He also acknowledged the recent good inflation reports: “What increases that confidence in that is more good inflation data, and lately here we have been getting some of that,” he said.

The September Fed Funds futures now see a rate cut as a certainty.

Retail Sales were flat month-over-month in June, according to the Census Bureau. They rose 2.3% on a year-over-year basis. Since these numbers are not adjusted for inflation, real retail sales fell.

Non-store retailers (i.e. online shopping) and restaurants saw big increases. If you strip out motor vehicles, sales rose 0.4% MOM and if you exclude vehicles and gasoline, they rose 0.8%.

May’s retail sales numbers were revised upward.

When inflation rises, politicians invariably return to one of the dumbest ideas ever put forward – price caps. The idea is that we beat inflation by simply putting a ceiling on prices. Of course this has unintended consequences – the most common is that price controls create shortages – but those effects take time to play out, so it can often give a politician the veneer of “doing something” long enough to get through the election cycle before the unintended effects are visible.

I mention this because the Biden Administration wants to impose rent control nationwide, capping annual price increases at 5%. Of course since this doesn’t affect the costs that landlords bear, it will act to lower cap rates for multi-family developments, which will discourage investment.

Needless to say, industry groups oppose this. The MBA said “There are endless examples in localities in America and around the world that prove that rent control is a counter-productive policy idea that ultimately harms renters by distorting market pricing, discouraging new construction, and degrading the quality of rental housing. While the odds are stacked against this proposal ever passing Congress, a federal rent control law would be catastrophic to renters and our nation’s rental housing market.

The measure requires Congressional approval, so has little-to-no chance of getting passed, let alone in an election year, but it does demonstrate yet again that bad ideas are like Freddy Kreuger – they keep coming back

Filed under: Economy | 59 Comments »