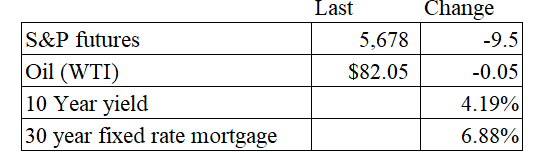

Vital Statistics:

Stocks are lower despite a good CPI print. Bonds and MBS are up.

Inflation fell 0.1% MOM and 3.0% year-over-year. The Street was expecting an increase of 0.1%, so this was a good surprise for the bond market. Energy prices fell overall, which was offset by increases in shelter. Used Car prices were down 10% on a year-over-year basis.

If you strip out food and energy, prices rose 0.1% month-over-month and 3.1% year-over-year. This was again below expectations. The bond market reacted positively to the report, with the 10 year yield falling over 10 basis points to below 4.2%.

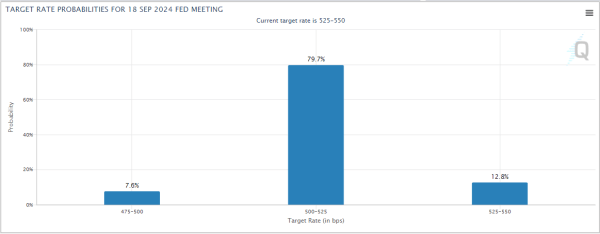

The September Fed Funds futures now see a 80% chance of a rate cut at the September meeting.

Over the past year, we have seen a lot of eye-popping payroll gains, which get revised downward in later months. The average downward revision this year has been 50,000 per month. The typical headline number has been around 275k, so this is a pretty big downward revision. What is going on?

The explanation may be that the numbers are less reliable due to lower response rates. The government estimates payroll growth by sending out questionnaires to businesses who report how many people they hired during the month. It goes out to some 600,000 businesses nationwide.

The response rate fell to a 21 year low in 2023, and has fallen even more this year. If less businesses respond to the survey, the less accurate it is. And with the big downward revisions, the labor market might be worse off than it initially appears.

One recent phenomenon has been the posting of “ghost jobs” which are job listings where the company really doesn’t intend to hire any one. They are there for HR window dressing and resume collection, but they don’t represent real hiring needs. If this behavior is affecting the JOLTs job openings number, then that is another employment statistic that is hiding a broader deterioration in the labor market.

Filed under: Economy | 72 Comments »