Vital Statistics:

Stocks are flattish as we head into earnings season. Bonds and MBS are up small.

The week ahead will have some important events, with Jerome Powell heading to the Hill on Tuesday and Wednesday for his semi-annual Humphrey-Hawkins testimony. We will get the consumer price index on Thursday, and earnings season kicks off with the big banks reporting on Friday.

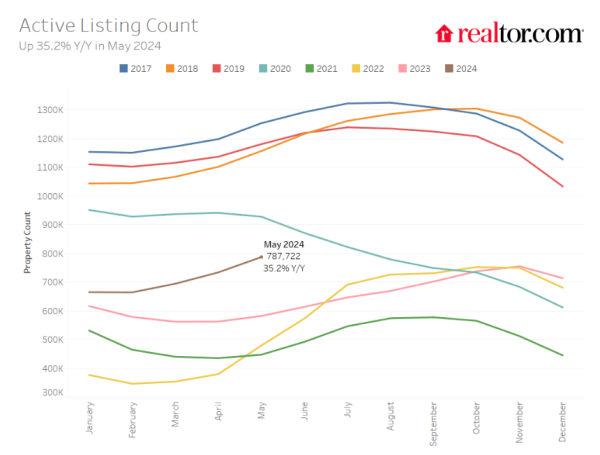

We are seeing for-sale inventory build, however we are still below pre-pandemic levels, according to research from Realtor.com. For-sale inventory rose 35% on a year-over-year basis, however median prices were flat. This might represent a mix shift, as prices rose on price per square foot basis.

While inventory is up 35% YOY, it is still about 35% below 2019 levels. Inventory is getting closer to balance in the South and West, where we saw a building boom over the past few years. Regions which saw muted growth post-2008 (lots of the Northeast and Midwest) are now catching up to the rest of the country.

Mark Zandi has come out in favor of rate cuts.

While the Fed Funds futures are seeing no move at the July 31 meeting, they are handicapping a 74% chance of a rate cut

Filed under: Economy | 13 Comments »