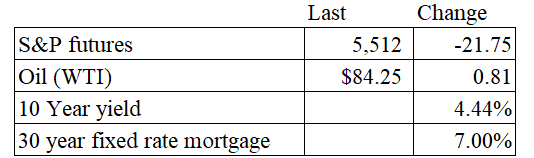

Vital Statistics:

Stocks are lower this morning on no real news. Bonds and MBS are up small.

Jerome Powell is speaking at 9:30 this morning.

The manufacturing economy contracted again in June, according to the ISM Manufacturing Report. “Demand remains subdued, as companies demonstrate an unwillingness to invest in capital and inventory due to current monetary policy and other conditions. Production execution was down compared to the previous month, likely causing revenue declines, putting pressure on profitability. Suppliers continue to have capacity, with lead times improving and shortages not as severe. Sixty-two percent of manufacturing gross domestic product (GDP) contracted in June, up from 55 percent in May. More concerning is the share of sector GDP registering a composite PMI® calculation at or below 45 percent — a good barometer of overall manufacturing weakness — was 14 percent in June, 10 percentage points higher than the 4 percent reported in May.”

Importantly, the prices index fell pretty dramatically, which helps support falling inflation.

The manufacturing economy expanded slightly in June, according to the S&P US Manufacturing PMI. New orders appear to be increasing, and input costs remain an issue. That said, business confidence hit a 19 month low. “Factories have been hit over the past two years by demand switching post-pandemic from goods to services, while at the same time household and business spending power has been diminished by higher prices and concerns over higher-for-longer interest rates. These headwinds persisted into June, accompanied by heightened uncertainty about the economic outlook as the presidential election draws closer. Business confidence has consequently fallen to the lowest for 19 months, suggesting the manufacturing sector is bracing

itself for further tough times in the coming months.”

Filed under: Economy | 28 Comments »