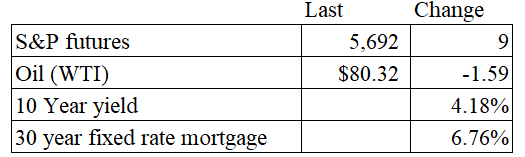

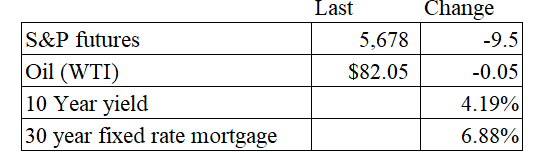

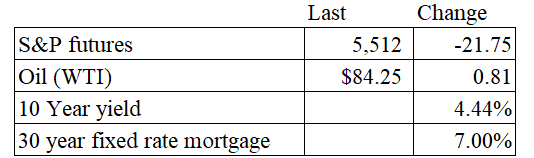

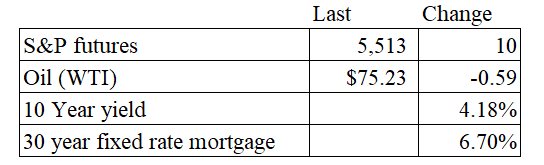

Vital Statistics:

Stocks are higher this morning as earnings continue to come in. Bonds and MBS are down small.

The US Treasury expects to borrow $740 billion in the third quarter, which is down about $106 billion from the April estimate. It expects to borrow $565 billion in Q4.

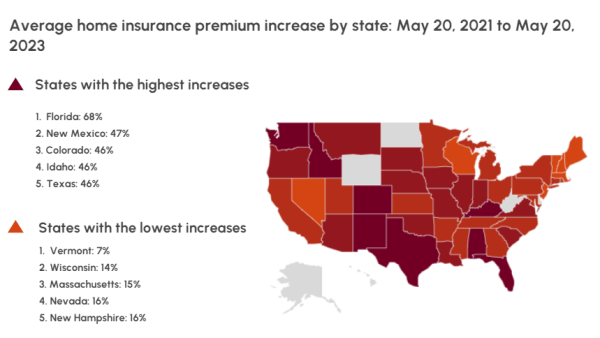

Home insurance premiums rose 21% last year. “The levels of risk and the kinds of hazards that a property can be exposed to are massively changing,” said Carlos Martín, director of the Remodeling Futures program at the Joint Center for Housing Studies of Harvard University.

“And right now there’s a lot of confusion, not just among the homeowners, but also among the insurers about how they should be pricing this actuarially,” he said.

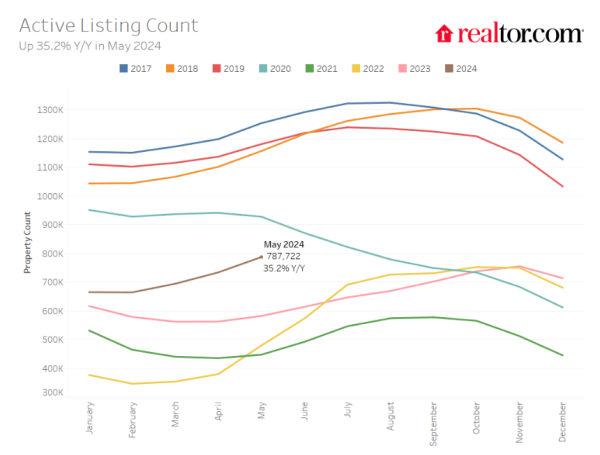

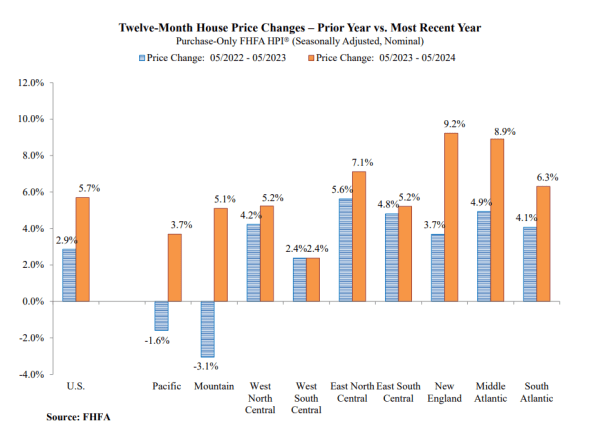

Home price appreciation was flat in May, according to the FHFA House Price Index. Over the past year, home prices rose 5.7%. “U.S. house price movement was flat in May,” said Dr. Anju Vajja, Deputy Director for FHFA’s Division of Research and Statistics. “The slowdown in U.S. house price appreciation continued in May amid a slight rise in both mortgage rates and housing inventory.”

The hot markets of the pandemic era are fading, while the post-2008 laggards are showing the most growth.

The Case-Shiller index showed a 5.9% annual gain in May. “While annual gains have decelerated recently, this may have more to do with 2023 than 2024, as recent performance remains encouraging,” says Brian D. Luke, Head of Commodities, Real & Digital Assets. “Our home price index has appreciated 4.1% year-to-date, the fastest start in two years. Covering the six-month period dating to when mortgage rates peaked, our national index has risen the past four months, erasing the stall experienced late last year. Collectively, all 20 markets covered continue to trade in a homogeneous pattern. Coming into the 2024 presidential election, traditional red states are in a dead heat with blue states, both averaging 5.9% gains annually.

“The Big Apple returned to the top of the leader boards, toppling San Diego from its six-month perch. New York’s 9.4% annual return outpaced San Diego and Las Vegas, by 0.3% and 0.7%, respectively. All 20 markets observed annual gains for the last six months. The last time we saw that long a streak was when all markets rose for three years consecutively during the COVID housing boom. This rally pales in comparison in both duration and annual gains, with above trend growth of 6.2%. The waiting game for the possibility of favorable changes in lending rates continues to be costly for potential buyers\ as home prices march forward.”

Filed under: Economy | 27 Comments »