Vital Statistics:

Stocks are higher as markets digest the Fed decision. Bonds and MBS are down small.

As expected, the Fed maintained the Fed Funds rate at current levels. “Recent indicators suggest that economic activity has continued to expand at a solid pace. Job gains have remained strong, and the unemployment rate has remained low. Inflation has eased over the past year but remains elevated. In recent months, there has been modest further progress toward the Committee’s 2 percent inflation objective.” In the May statement, the Fed said that “In recent months, there has been a lack of further progress toward the Committee’s 2 percent inflation objective.” So there is a bit of an improvement in the language.

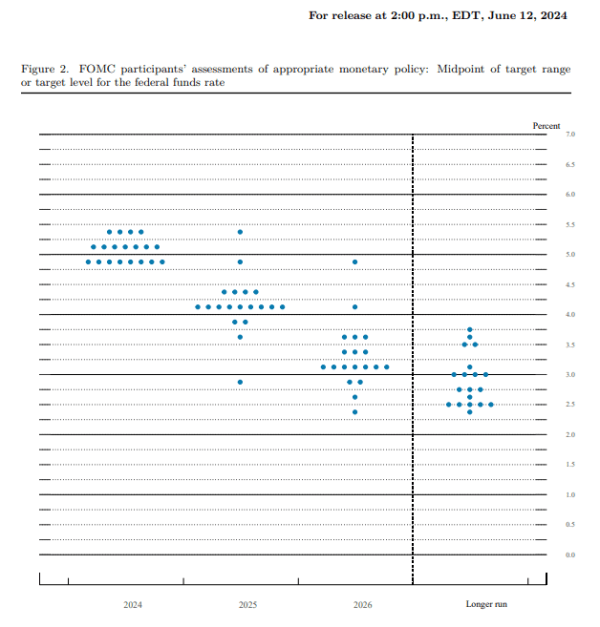

The dot plot showed the Committee expects to cut rates once this year. The economic forecasts didn’t move much, however they did bump up their inflation forecasts a tad, with the headline PCE forecast increasing from 2.4% to 2.6% and the core rate increasing from 2.6% to 2.8%.

We have another benign inflation report, with the producer price index actually falling 0.2% on a month-over-month basis and 2.2% on a year-over-year basis. About 60% of the decline was due to falling gas prices. Ex-food and energy, the index was flat and rose 2.3% on a YOY basis. Both numbers were below expectations.

More evidence of a weakening job market: Initial Jobless Claims rose to 242k last week. This is the highest level since August of last year.

The median home sale price in the US hit a record last week, according to Redfin. The median sale price hit $394,000 which is up 4.4% on a year-over-year basis. Asking prices appear to be leveling off however. The median mortgage payment fell to $2,829 due to falling mortgage rates. “The latest inflation report is good for homebuyers because it has already sent mortgage rates down, though this week’s Fed meeting will temper mortgage-rate declines,” said Chen Zhao, Redfin’s economic research lead. “But on the other side of the coin, if lower mortgage rates bring back more demand than supply, that could erase the possibility that home-price growth softens, and push prices up even further. Lower rates and higher prices may ultimately cancel each other out when it comes to homebuyers’ monthly paym

Filed under: Economy | 44 Comments »