Vital Statistics:

Stocks are higher this morning on no real news. Bonds and MBS are down.

The week ahead will have a lot of real estate data, with home prices and pending home sales. We will get the third revision to Q1 GDP and get personal incomes / outlays on Friday which will give us the all-important PCE Price Index.

Existing home sales fell 0.7% MOM in May, according to NAR. This is a decline of 2.8% compared to a year ago. The median home price rose 5.8% on a YOY basis to $419,300. There are about 1.28 million units for sale, which represents a 3.7 month supply at the current sales pace. A balanced market is 6 – 7 months’ worth of supply.

“Eventually, more inventory will help boost home sales and tame home price gains in the upcoming months,” said NAR Chief Economist Lawrence Yun. “Increased housing supply spells good news for consumers who want to see more properties before making purchasing decisions.” “Home prices reaching new highs are creating a wider divide between those owning properties and those who wish to be first-time buyers,” Yun added. “The mortgage payment for a typical home today is more than double that of homes purchased before 2020. Still, first-time buyers in the market understand the long-term benefits of owning.”

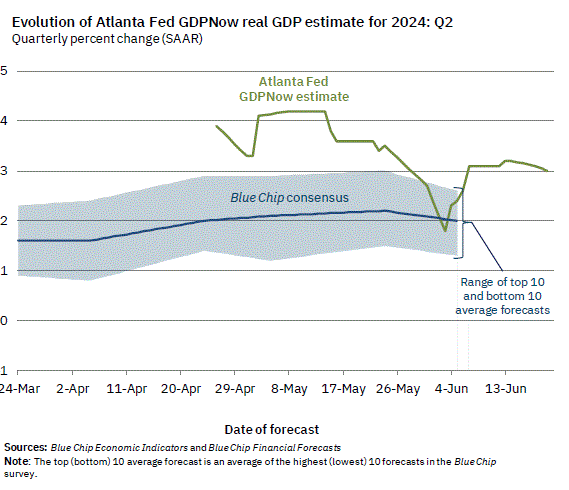

Q2 GDP is tracking around 3%, according to the Atlanta Fed GDP Now model.

Filed under: Economy | 70 Comments »