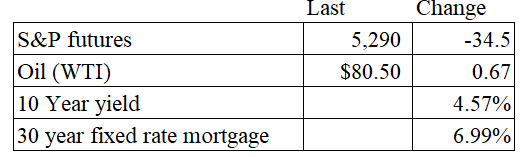

Vital Statistics:

Stocks are lower this morning on global weakness and weaker bonds. Bonds got hammered yesterday after a lousy bond auction of 5-year notes, which sent the 10 year yield back above 4.5% to end at 4.55%. Bonds and MBS are weaker again today.

Minneapolis Fed President Neel Kashkari isn’t ready to start thinking about rate cuts yet, and warned about the possibility of another rate hike in an interview with CNBC yesterday. “Many more months of positive inflation data, I think, to give me confidence that it’s appropriate to dial back….I’m not seeing the need to hurry and do rate cuts. I think we should take our time and get it right.” On the subject of rate hikes, he said: “I don’t think we should rule anything out at this point”

Home prices rose 6.6% in the first quarter of 2024 compared to the first quarter of 2023. “U.S. house prices continued to grow at a steady pace in the first quarter,” said Dr. Anju Vajja, Deputy Director for FHFA’s Division of Research and Statistics. “Over the last six consecutive quarters, the low inventory of homes for sale continued to contribute to house price appreciation despite mortgage rates that hovered around 7 percent.”

Home price appreciation is accelerating again:

Home prices hit a new all-time high, according to the Case-Shiller Home Price Index. “This month’s report boasts another all-time high,” says Brian D. Luke, Head of Commodities, Real & Digital Assets at S&P Dow Jones Indices. “We’ve witnessed records repeatedly break in both stock and housing markets over the past year. Our National Index has reached new highs in six of the last 12 months. During that time, we’ve seen record stock market performance, with the S&P 500 hitting fresh all-time highs for 35 trading days in the past year.

“Regionally, the Northeast remains the top performer with an 8.3% annual gain, showcasing robust growth compared to other metro markets. Conversely, cities like Tampa, Phoenix, and Dallas, which saw top-tier performance in 2020 and 2021, are now growing at a slower pace. COVID was a boom for Sunbelt markets, but the bigger gains the last couple of years have been the northern metro cities,” Luke reported. “On a seasonal adjusted basis, national home prices have reached their ninth all-time high within the past year, with all 20 metropolitan markets posting positive annual gains for the fourth consecutive month, indicating widespread and sustained growth in the housing sector.”

It does seem to be a tale of two markets, where the Sunbelt struggles with a lot of new construction, while the two markets that have lagged the post 2012 real estate recovery – the Midwest and the Northeast – are gathering steam. Of course San Diego continues to perform well regardless, because it is, well, San Diego.

Consumer confidence improved in May, according to the Conference Board. “Confidence improved in May after three consecutive months of decline,” said Dana M. Peterson, Chief Economist at The Conference Board. “Consumers’ assessment of current business conditions was slightly less positive than last month. However, the strong labor market continued to bolster consumers’ overall assessment of the present situation. Views of current labor market conditions improved in May, as fewer respondents said jobs were ‘hard to get,’ which outweighed a slight decline in the number who said jobs were ‘plentiful.’ Looking ahead, fewer consumers expected deterioration in future business conditions, job availability, and income, resulting in an increase in the Expectation Index. Nonetheless, the overall confidence gauge remained within the relatively narrow range it has been hovering in for more than two years.”

The present situation index remains well above the expectations index. Fewer people thought jobs were hard to get and expectations improved slightly. That said, the expectations index remains firmly mired in recessionary territory, with inflation expectations increasing from 5.3% to 5.4%.

Note that inflationary expectations are a key input to Fed decision-making since there are all sorts of ancillary behavioral effects that go along with it. Based on inflationary expectations, real interest rates are more or less zero, which could explain why the economy (and inflation) has remained resilient even in the face of 525 basis points of tightening.

Finally, home purchase plans remain the lowest since the bottom of the housing bust in 2012.

Filed under: Economy | 50 Comments »