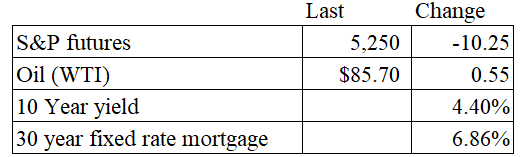

Vital Statistics:

Stocks are lower this morning as we await comments from Jerome Powell. Bonds and MBS are flat.

Employers added 184,000 jobs in March, according to the ADP Employment Survey. This was 150k higher than the estimate, and a touch lower than Friday’s 200k forecast. Pay increases were flat at 5.1% for job stayers, but rose 10% for job changers.

“March was surprising not just for the pay gains, but the sectors that recorded them. The three biggest increases for job-changers were in construction, financial services, and manufacturing,” said Nela Richardson, chief economist, ADP. “Inflation has been cooling, but our data shows pay is heating up in both goods and services.”

Mortgage Applications fell 0.6% last week, according to the MBA. Purchases rose 1% while refis fell 2%. “Mortgage rates moved lower last week, but that did little to ignite overall mortgage application activity. The 30-year fixed mortgage rate declined slightly to 6.91 percent, while the 15-year fixed rate decreased to its lowest level in two months at 6.35 percent,” said Joel Kan, MBA’s Vice President and Deputy Chief Economist. “Elevated mortgage rates continued to weigh down on home buying. Purchase applications were unchanged overall, although FHA purchases did pick up slightly over the week. Refinance applications decreased to fall 5 percent below last year’s pace.”

Job openings were more or less unchanged in February, according to the JOLTS jobs report. Job openings were down about 11% on a year-over-year basis. The quits rate, which tends to lead wage increases, was flat month-over-month at 2.2% and down significantly from a year ago.

Home prices rose 5.5% in February, according to CoreLogic. The Northeast saw the biggest increases.

“Home price growth pivoted in February, as the impact of the January 2023 Home Price Index bottom finally faded,” said Dr. Selma Hepp, chief economist for CoreLogic. “As a result, the U.S. should begin to see slowing annual home price gains moving forward.”

“Nevertheless,” Hepp continued, “with a 0.7% increase from January to February 2024, which is almost double the monthly increase recorded before the pandemic, spring home price gains are already off to a strong start despite continued mortgage rate volatility. That said, more inventory finally coming to market will likely translate to more options for buyers and fewer bidding wars, which typically keeps outsized price growth in check. Still, despite affordability challenges, homebuyer demand appears to favor already expensive, coastal markets with a limited availability of properties for sale.”

Filed under: Economy | 33 Comments »