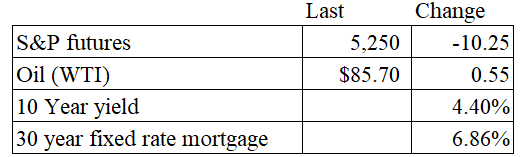

Vital Statistics;

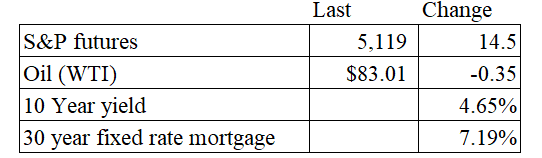

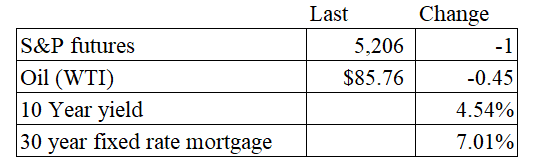

Stocks are lower this morning as the May FOMC meeting begins. Bonds and MBS are up.

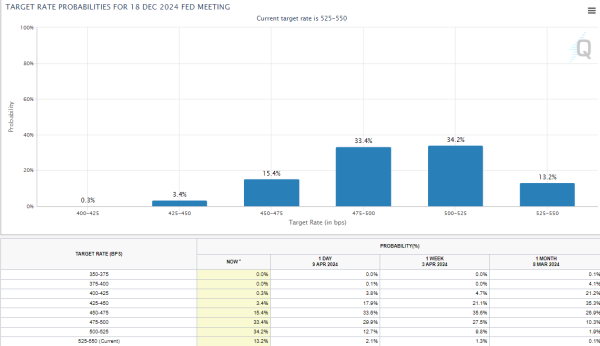

Fed-whisperer Nick Timaros of the Wall Street Journal says the Fed is planning to signal to the markets that it is comfortable keeping rates higher for longer, while stopping short of introducing the possibility of raising rates further.

“Firmer-than-anticipated inflation in the first three months of the year has likely postponed rate cuts for the foreseeable future. As a result, officials are likely to emphasize that they are prepared to hold rates steady, at a level most of them expect will provide meaningful restraint to economic activity, for longer than they previously anticipated.”

“But a hawkish pivot, suggesting an increase in rates is more likely than a cut, appears unlikely, for now. Any such shift is likely to unfold over a longer period. It would require some combination of a new, nasty supply shock such as a significant increase in commodity prices; signs that wage growth was reaccelerating; and evidence the public was anticipating higher inflation to continue well into the future.”

The article suggests the Fed is close to tapering its balance sheet reduction (quantitative tightening) by reducing the runoff of its Treasury securities. In other words, this won’t affect mortgage backed securities. The runoff for mortgage backed securities continues, albeit at an organic pace driven by relocation and a few cash-out refis.

Compensation costs for civilian workers increased 1.2% in the first quarter, according to the Employment Cost Index. Wages increased 1.1%, as did benefit costs. For the past 12 months, compensation costs rose 4.8%. On a quarter-over-quarter basis, compensation costs rose from 0.9% to 1.2%, driven largely by an increase in benefit costs. Note this kind of contradicts the CPI data which claims that health insurance costs fell 15% in March.

Filed under: Economy | 53 Comments »