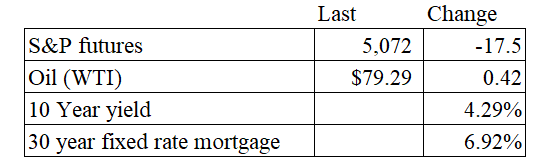

Vital Statistics:

Stocks are lower this morning on no real news. Bonds and MBS are flat.

Fourth quarter GDP was revised downward to 3.2%. Consumption was revised upward to 3%.

Mortgage applications fell 5.6% last week as purchases fell 1% and refis fell 7%. “Mortgage rates were little changed last week, with the 30-year conforming rate declining slightly to 7.04 percent but remaining about a quarter percentage point higher than the start of the year,” said Mike Fratantoni, MBA’s SVP and Chief Economist. “Higher rates in recent weeks have stalled activity, and last week it dropped more for those seeking FHA and VA refinances. Purchase activity is running 12 percent behind last year’s pace, but our January Builder Application Survey results showed that applications to buy new homes were up 19 percent compared to last year. This disparity continues to highlight how the lack of existing inventory is the primary constraint to increases in purchase volume. However, mortgage rates above 7 percent sure don’t help.”

Mortgage Capital Trading announced today announced the release of pricing indications for the to-be-announced mortgage-backed securities (TBAs) used by mortgage lenders to hedge their open mortgage pipelines. TBA indications improve transparency in illiquid market segments and act as a key reference point on lenders’ unique executions – critical data for generating accurate front-end borrower pricing. “TBA indications can now be electronically requested ad hoc by mortgage lenders from multiple approved broker-dealers,” said Phil Rasori, COO at MCT. “For the first time, lenders have a custom reference point to their own TBA execution rather than working solely from market-wide pricing that may not be applicable to them.”

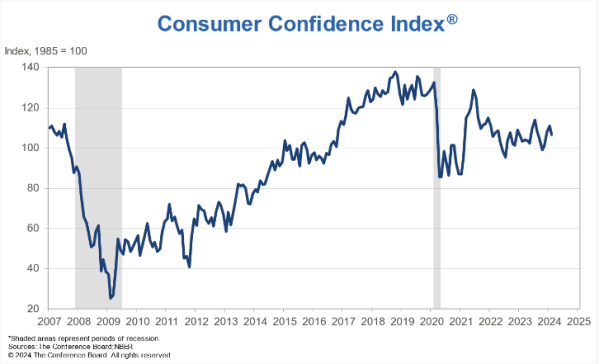

Consumer confidence fell in February, according to the Conference Board. January was revised downward. “The decline in consumer confidence in February interrupted a three-month rise, reflecting persistent uncertainty about the US economy,” said Dana Peterson, Chief Economist at The Conference Board. “The drop in confidence was broad-based, affecting all income groups except households earning less than $15,000 and those earning more than $125,000. Confidence deteriorated for consumers under the age of 35 and those 55 and over, whereas it improved slightly for those aged 35 to 54…February’s write-in responses revealed that while overall inflation remained the main preoccupation of consumers, they are now a bit less concerned about food and gas prices, which have eased in recent months. But they are more concerned about the labor market situation and the US political environment.”

More problems for real estate agents: A lawsuit filed in California targets buyer agent commissions, arguing that they should be zero. “For years buyer broker commission rates have remained stable despite a) the increase in home values, making those commissions much more valuable, and b) the diminishment to near nothing of what buyer brokers actually do to earn their commission,” the complaint says…”A truly competitive rate for buyers’ agents would in fact be 0% or $0 as, in the vast majority of cases, buyers’ agents do minimal if any work to secure a sale, with buyers doing much of their own searching via popular websites like zillow.com, and redfin.com itself,” the suit alleges.

Filed under: Economy | 37 Comments »