Vital Statistics:

| Last | Change | |

| S&P futures | 4,115 | -5.4 |

| Oil (WTI) | 60.47 | 1.15 |

| 10 year government bond yield | 1.67% | |

| 30 year fixed rate mortgage | 3.27% |

Stocks are flattish this morning on no major news. Bonds and MBS are flat.

We kick off earnings season this week, with the big banks starting the show. We will get some important economic data with the Consumer Price Index on Tuesday, Industrial Production on Thursday and Housing starts on Friday.

Fannie Mae and Freddie Mac will stop purchasing loans under the GSE patch starting on July 1. This means they will no longer accept loans with debt-to-income ratios above 43%. This is interesting given that the CFPB has proposed extending the patch to October 2022.

Fed Chairman Jerome Powell went on 60 Minutes yesterday and talked about the state of the economy. Here is the transcript. Nothing was said that could be considered market-moving, although he did discuss the Fed’s thinking regarding inflation as the economy improves:

SCOTT PELLEY: What the Fed has done traditionally is use economic models to predict inflation and then raise interest rates, tap the brake if you will, before inflation happens. Is that what you’re planning on doing?

JEROME POWELL: No, it’s not. And really, what we’ve done is we’ve updated our understanding of the economy and therefore, our policy framework to the way the economy has evolved. The economy has changed. And what we saw in the last couple of cycles is that inflation never really moved up as unemployment went down.

We had 3.5% unemployment, which is a 50-year low for much of the last two years before the pandemic. And inflation didn’t really react much. That’s not the economy we had 30 years ago. That’s the economy we have now. That means that we can afford to wait to see actual inflation appear before we raise interest rates. Now, we don’t want inflation to go up materially above 2% and go back to, you know, the bad, old inflation days that we had when you and I were in college back a long time ago. But at the same time, we do have the ability to wait to see real inflation. And that’s what we plan on doing.

Overall, the Fed is sticking with its base case scenario that the second half of 2021 will be exceptionally strong, perhaps the strongest in 30 years. That said, there are still about 9 million fewer people working than there were pre-pandemic and a lot of small businesses have closed. It will take time for those people to find jobs and new businesses to emerge to replace the closed ones.

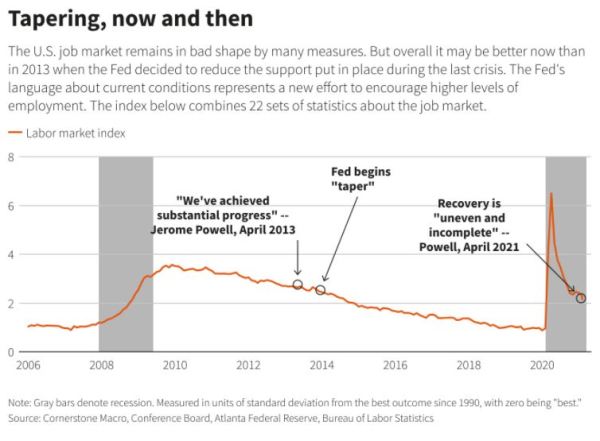

Powell has changed his thinking even over the course of his term regarding tapering and getting off the zero bound. The labor market index is roughly at the same place today as it was in 2013 when Powell began urging the Fed to reduce purchases of Treasuries and MBS. As the article notes, we are going to see a spike in inflation simply because prices during the lockdown days of 2020 were artificially low. Of course that doesn’t tell the whole story; supply chain bottlenecks are driving prices higher as well, although those should be temporary. Ultimately people’s perception of inflation is largely driven by prices at the gas pump, and the summer driving season begins soon.

Filed under: Economy, Morning Report |

An interesting article and, surprisingly, not a hit-job.

NYT on Substack:

Why We’re Freaking Out About Substack

That being said, doesn’t really explain the freaking out about Substack. But being too explicit about the dinosaur media’s entitlement and desire to be all-powerful gatekeepers of information might not be an approach any writer can take in The Times.

LikeLike

This section early in the article explains the freaking out about Substack.

“This new direct-to-consumer media also means that battles over the boundaries of acceptable views and the ensuing arguments about “cancel culture” — for instance, in New York Magazine’s firing of Andrew Sullivan — are no longer the kind of devastating career blows they once were. (Only Twitter retains that power.)”

Media members power to police of other media members has been lost. I see this as status anxiety, it’s always the newest members of a class that view their membership as most tenuous and need to police it to maintain it’s distinction from another class.

LikeLiked by 1 person

I think you’re right. Ultimately, I think they are selling buggy whips in the automotive age. No matter how successful deplatforming and censorship campaigns are, you’re going to get alternatives cropping up that are almost impossible to police or shut down.

They were always going to lose their unique status. They write words. Something any literate person can do. In an era of a million pathways for information, they were always going to lose their status. And nothing they are doing is helping them preserve it (the opposite, I suspect).

Takes longer than I would think in human time but by a geological clock it’s going to take about a nanosecond.

LikeLike

@brentnyitray:

Do you know how housing prices are doing in cities where there is (likely) the most flight to less oppressive and riot-filled standards of living?

I was wondering if perhaps the lack of housing inventory is keeping prices of houses up even in NYC and San Francisco and maybe even Portland and Minneapolis so that people who want to flee can still expect to sell their property and get sufficient cash to buy a nice house in the suburb of some Texas or Alabama or Tennessee town?

My completely subjective theory is that the lack of housing inventory over the past 15 years (and more for a lot of the urban areas) is making it a lot easier for people who want to exit those cities to do so, even after the COVID (and even though those aren’t the most attractive places to move to, in many cases). Because housing prices are still relatively high, because of the scarcity of inventory, when it comes to moving well away from such urban centers.

LikeLiked by 1 person

I tell ya, the housing market in Houston and the suburbs is still white hot.

LikeLike

Yup. I’m just wondering if the housing markets in blue, police-defunding cities is still hotter than you would think it would be, given the circumstances, simply because of market scarcity.

LikeLike

And I think that also might impact blue-state suburb to red-state suburb moving. People in the city want to move out to a suburb, people in the suburbs have decided their blue state suburb is not far enough–I feel like that’s a form of multi-step migration made possible by property values all across the chain being propped up by scarcity.

But have no facts really to prove it. 😉

LikeLike

I think the big trend will be a return to the exurbs as work-from-home acceptance reduces the importance of commute times.

LikeLiked by 1 person

The most oppressive and riot-filled cities were already the most inflated going into the pandemic: places like SF, Seattle, Portland, etc. FWIW, New York metro area is probably the weakest housing market in the country.

LikeLike

So if I’m in Seattle or Portland or SF and I want to sell my house there for enough to buy a nice house in some Wyoming or Alabama suburb, can I sell the house? Is the scarcity enough that someone will still buy that house–for less than they might have in 2019, maybe, but still plenty to move to Tyler, Texas?

LikeLike

Yes, there is still plenty of demand.

LikeLike

I love this!

https://nypost.com/2021/04/09/fake-covid-vaccination-cards-running-rampant-online/

LikeLike

Inevitable, but also kind of vindicates the narrative that vaccination passports are normal and expected so nobody should object to them openly, but rather forge a vaccine passport so they can fake compliance.

LikeLike

Thanks! I’m going to feel vindicated in my conjectures!

LikeLike

Can we expect an impeachment?

https://ace.mu.nu/riots_#more

LikeLike

Of course not. He *meant* peacefully while Trump was using it as a dog whistle and knew what was going to happen.

Also rioting is not as bad if it isn’t at the Capitol or in the neighborhoods Congress critters live. 😀

LikeLike

https://babylonbee.com/news/nation-braces-for-most-peaceful-protests-yet

LikeLike