Vital Statistics:

| Last | Change | |

| S&P futures | 3962 | 6.4 |

| Oil (WTI) | 63.88 | -1.56 |

| 10 year government bond yield | 1.60% | |

| 30 year fixed rate mortgage | 3.26% |

Stocks are flattish this morning as we begin the March FOMC meeting. Bonds and MBS are up small.

Retail Sales fell 3% in February after a strong January. The retail sales control group, which excludes volatile items like autos, gas and building products fell 3.5%. While these numbers were a disappointment, January’s numbers were revised upward, which takes out some of the sting.

Another disappointing economic report. Industrial Production fell 2.2% in February, while the Street was looking for a 0.5% gain. Manufacturing Production fell 2.2% and capacity utilization slipped from 75.5% to 73.8%.

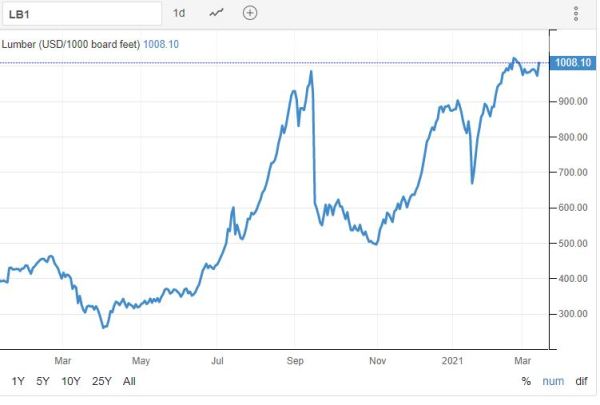

New home applications fell 9% in January, however they were up 9.2% from a year ago. “The economy and job market continue to improve, but new home sales activity slowed in February. Builders continue to be confronted with rising input costs and a lack of available lots, causing them to slow production,” said Joel Kan, MBA Associate Vice President of Economic and Industry Forecasting. “Applications for new home purchase mortgages decreased last month but remained over 9 percent higher than a year ago, and MBA’s estimate of new home sales, at 748,000 units, was at its slowest annual pace since May 2020. After seven consecutive months of a strong 800,000-unit sales pace, supply and demand imbalances are likely creating bottlenecks.”

5.8% of all mortgages were at least 30 days delinquent in December, according to data from CoreLogic. This is up 2.2 percentage points from a year ago. The worst states for delinquencies are the Deep South and the Mid-Atlantic. Louisiana, Mississippi, NY, NJ, and Maryland were the top 5 states. Below is a chart of delinquencies. Foreclosures are being held down due to government actions, so those numbers will definitely be going up once the restrictions are lifted.

The number of loans in forbearance fell to 5.14% from 5.2% a week ago. “One year after the onset of the pandemic, many homeowners are approaching 12 months in their forbearance plan,” said MBA Chief Economist Mike Fratantoni. “That is likely why call volume to servicers picked up in the prior week to the highest level since last April, and forbearance exits increased to their highest level since January. With new forbearance requests unchanged, the share of loans in forbearance decreased again. Homeowners with federally backed loans have access to up to 18 months of forbearance, but they need to contact their servicer to receive this additional relief.”

Filed under: Economy, Morning Report | 22 Comments »