Vital Statistics:

| Last | Change | |

| S&P futures | 3017.5 | 5.25 |

| Oil (WTI) | 55.37 | 0.44 |

| 10 year government bond yield | 1.83% | |

| 30 year fixed rate mortgage | 3.90% |

Stocks are higher this morning after further progress on trade talks with China. Bonds and MBS are down.

China walked back some proposed tariffs on US agricultural products after Trump agreed to delay some additional tariffs. Commodities in general are up on the news.

Retail Sales rose 0.4% MOM in August, according to Census. July was revised upward to an increase of 0.8% from an increase of 0.7%. This was the back-to-school shopping season, so it gives a good indication that this year’s holiday shopping season will be strong as well. Given that consumption accounts for 70% of GDP, we might see some upward revisions in Q3 and Q4 estimates.

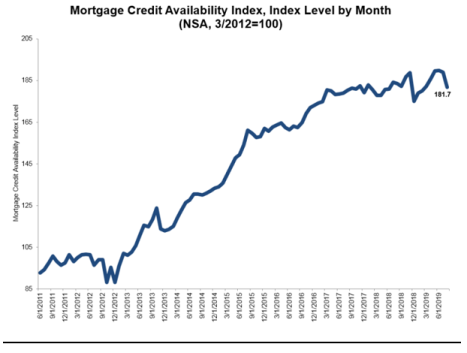

Mortgage credit availability declined in August, according to the MBA. “Credit supply declined across the board in August, even as mortgage rates fell and application activity picked up, particularly for refinances,” said Joel Kan, MBA’s associate vice president of economic and industry forecasting. “Last month’s decrease was the largest since December 2018, and also the first tightening we have seen for conventional loans all year. We anticipate some weakening of the job market in the year ahead as economic growth cools. It’s possible some lenders may be tightening credit in expectation of a slowdown.” Some contraction was expected for VA due to the new rules, but it is surprising to see it in the other buckets.

The Trump Admin is working to end Fannie and Freddie’s net profits sweep in September. “We expect a deal prior to Sept. 30 in which Fannie and Freddie will stop paying a quarterly dividend to Treasury,” Cowen Managing Director Jaret Seiberg wrote in the note. “Instead, they will pay a commitment fee for the outstanding preferred capital line. This means they can retain the rest of their profits in order to rebuild capital.”

Filed under: Economy, Morning Report | 15 Comments »