Vital Statistics:

| Last | Change | |

| S&P futures | 3017 | 5.5 |

| Oil (WTI) | 58.51 | 0.54 |

| 10 year government bond yield | 2.05% | |

| 30 year fixed rate mortgage | 4.07% |

Stocks are higher this morning after good numbers from Apple. Bonds and MBS are flat.

The FOMC announcement is scheduled for 2:00 pm EST. A Bloomberg piece from Ex NY Fed President William Dudley was making the rounds yesterday, which poured cold water on the idea that the Fed is entering a new easing cycle.

“All told, the case for lowering rates is less compelling now than it was when the Federal Open Market Committee last met in June. This doesn’t necessarily mean that an interest-rate decrease this week would be a mistake. But it does mean that market participants — who are expecting a series of cuts over the next year or so — might be in for an unpleasant surprise, because the Fed’s future moves will be more dependent on incoming economic data than they think. There’s a good chance that, after this week’s meeting, the central bank will be “one and done.”

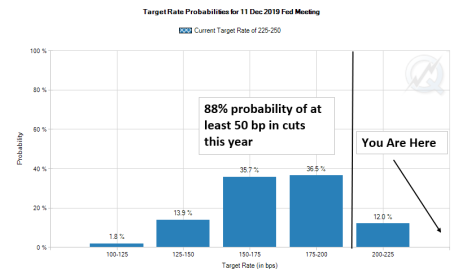

If Dudley is right, and Powell’s subsequent press conference confirms this, then the Fed Funds futures market is way over its skis with respect to further rate cuts this year. The December Fed Funds futures are handicapping a 88% chance of at least 50 basis points in rate cuts this year. If the Fed disappoints, that doesn’t necessarily mean that long-term rates would increase, since the US 10 year is highly influenced by overseas bond markets. But further rate cuts are already baked in the cake, and the market will be vulnerable to a statement and / or press conference that is insufficiently dovish. Not only that, don’t be surprised if one or two members dissent (in favor of no rate cut). Might want to think about locking before the 2:00 pm release.

Mortgage Applications fell 1.4% last week as purchases decreased 3% and refis were down 0.1%. Purchase activity is up 6% from a year ago, however it has been stalling out. Refinance applications for conventional mortgages were up 1.1%, however a 3% drop in government (primarily VA) offset the gain. Conventional 30 year mortgage rates were unchanged at 4.04%.

The economy added 156,000 jobs in July, according to the ADP Employment Report. IT and mining fell, while most other buckets increased. The Street is looking for 164,000 nonfarm payrolls this Friday.

The employment cost index rose 0.6% in the second quarter. On a YOY basis, they rose 2.7% as wages and salaries rose 2.9% and benefit costs rose 2.3%.

Filed under: Economy, Morning Report |

‘Merica

https://redneck.bank/

LikeLiked by 1 person

Big if true.

https://twitter.com/seanmdav/status/1156728269447802880

LikeLike

I’m guessing slap-on-the-wrist at most. Then the tell-all book about his persecution and how hard it is to be a lone, noble hero in this Trumpian era. He’ll be fine.

LikeLike

He already made millions from his book, paid to him by the same lefties who blamed him for HRC’s loss.

I admire his ability to grift.

LikeLike

KW:

Then the tell-all book about his persecution and how hard it is to be a lone, noble hero in this Trumpian era.

Didn’t he already do that?!?

LikeLike