Vital Statistics:

| Last | Change | |

| S&P Futures | 2643.5 | -11.8 |

| Eurostoxx Index | 372.7 | -0.2 |

| Oil (WTI) | 58.8 | -0.5 |

| US dollar index | 83.8 | -0.3 |

| 10 Year Govt Bond Yield | 2.54% | |

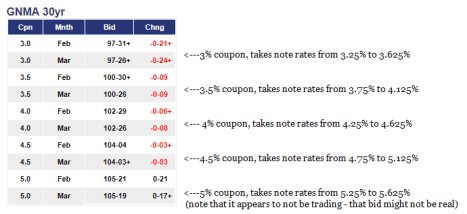

| Current Coupon Fannie Mae TBA | 103.591 | |

| Current Coupon Ginnie Mae TBA | 103.688 | |

| 30 Year Fixed Rate Mortgage | 4.37 |

Stocks are lower this morning on no real news. Bonds and MBS are up small.

Small Business Optimism rebounded in January as expansion plans hit a record high. The net percentage of businesses saying “now is a good time to expand” was the highest since 1973, when the survey began. A more benign regulatory and tax environment is helping drive sentiment. In fact, “finding quality workers” is a bigger concern now than “taxes and regulations.” Small businesses added .23 workers last month on average.

The CFPB released its strategic plan for the next 5 years, and it marks a departure from the Cordray CFPB. CFPB Acting Director lays out his strategic vision in the opening statement: “This Strategic Plan presents an opportunity to explain to the public how the Bureau intends to fulfill its statutory duties consistent with the strategic vision of its new leadership. In reviewing the draft Strategic Plan released by the Bureau in October 2017, it became clear to me that the Bureau needed a more coherent strategic direction. If there is one way to summarize the strategic changes occurring at the Bureau, it is this: we have committed to fulfill the Bureau’s statutory responsibilities, but go no further. Indeed, this should be an ironclad promise for any federal agency; pushing the envelope in pursuit of other objectives ignores the will of the American people, as established in law by their representatives in Congress and the White House. Pushing the envelope also risks trampling upon the liberties of our citizens, or interfering with the sovereignty or autonomy of the states or Indian tribes. I have resolved that this will not happen at the Bureau. The rest of the document reiterates the role of the CFPB and Mulvaney’s commitment to those duties.

Donald Trump laid out his priorities in a budget document yesterday. These sorts of things are never intended to become law (Obama had one that garnered exactly zero votes), but are more to lay out philosophies and priorities. The document did contemplate an increase in the guaranty fee that Fannie Mae charges borrowers by 10 basis points. At the margin, this would make Fannie loans somewhat less attractive relative to FHA / VA however it probably won’t matter all that much. The amount of money involved ($26 billion over 10 years) is not major. Separately, shareholders of Fannie Mae and Freddie Mac stock had hoped the document would discuss the GSEs retaining their profits. That didn’t happen.

Hurricane-related delinquencies rose in November, but fell everywhere else, according to CoreLogic. 30 year DQs fell overall from 5.2% a year ago to 5.1%. The foreclosure rate fell from 0.8% to 0.6%.

Filed under: Economy, Morning Report | 28 Comments »