Vital Statistics

|

Last |

Change |

| S&P Futures |

2426.3 |

-4.3 |

| Eurostoxx Index |

387.1 |

-3.3 |

| Oil (WTI) |

46.6 |

0.8 |

| US dollar index |

88.4 |

-0.1 |

| 10 Year Govt Bond Yield |

2.21% |

|

| Current Coupon Fannie Mae TBA |

103.47 |

|

| Current Coupon Ginnie Mae TBA |

104.33 |

|

| 30 Year Fixed Rate Mortgage |

3.89 |

|

Stocks are lower this morning amidst a global tech stock sell-off led by Apple. Bonds and MBS are down a tick or two.

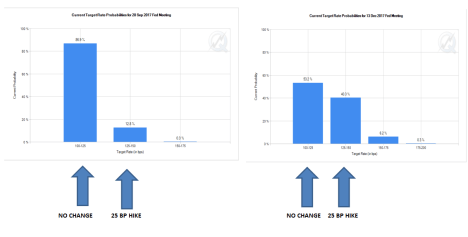

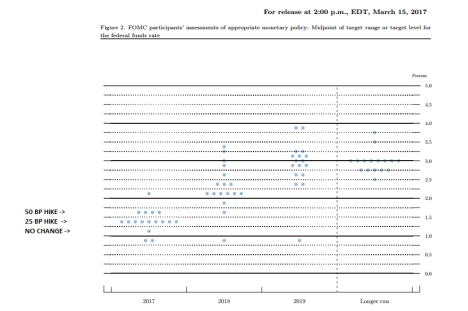

The big event this week will be the FOMC meeting which starts Tuesday. The announcement will come at 2:00 pm on Wednesday. The Fed Funds futures are pricing in a 96% chance of a 25 basis point hike in the Fed funds rate. We will also have a Bank of England and a Bank of Japan meeting this week.

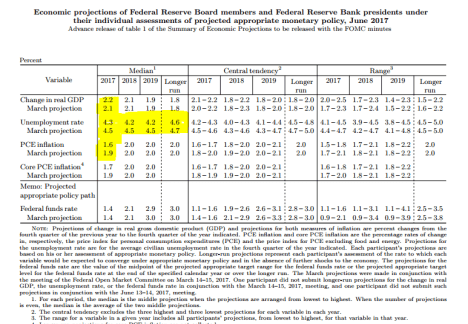

Merrill Lynch is looking for the Fed to hike 25 basis points, but they think the focus of the press conference will be on balance sheet normalization. While there is the possibility that weak economic data on Wed morning (CPI and retail sales) could prevent the Fed from hiking that is a long shot. Merrill is also looking for the Fed to cheat down their inflation projection for 2017 to 1.7%, although they expect 2018 to be unchanged at 2%. They also note that inflows into bond funds have been elevated as bond bears throw in the towel on the Trump reflation trade.

A group called “Fed Up” which includes liberal economists like Joseph Stiglitz and even includes former Fed President Narayana Kochlerakota is urging the Fed to increase its inflation target from 2% to something higher. The group notes that fiscal policy is almost impossible in this political environment, so higher inflation could act as a buffer against recessions. They are also concerned that the Fed’s tightening could send the economy into a recession. Note that Barack Obama stacked the Fed with doves already, so if the Fed is reticent to do this now, it probably isn’t going to happen as Donald Trump starts replacing members.

Market strategists have been cheating down their end of year target rate for the 10 year bond yield, and it now stands at 2.7%, about 50 basis points higher than it is currently. The lowest forecast in the data set is 1.9%. China is prepared to buy more Treasuries to stabilize the yuan market, and developed market bond fund managers are finding relative value in Treasuries, which have sold off more than other developed countries.

The NAR wrote a white paper detailing the barriers to homeownership and many of the reasons are pretty well-known. The biggest constraints are tighter mortgage lending, student loan debt, affordability issues, and a lack of supply. They take a look at the QM and ATR rules and conclude that these rules are actually hurting mortgage availability when they were intended to ease the burden on lenders:

“Though each individual provision included in the new regulations that banks must adhere to may not cause much burden for lenders in isolation, the combined impact of the numerous regulatory changes generated a multiplicative effect that is contributing to an environment of extreme caution among mortgage lenders. One such regulation that contributes a number of strenuous lender requirements is the ability-to-repay rule, detailed in the Dodd Frank Act and enforced by the Consumer Financial Protection Bureau (CFPB). The rule stipulates that lenders must ensure that borrowers are able to make timely monthly payments. While the intention behind the rule is to ensure borrower credit-worthiness and avoid the worst abuses that led to the housing bubble, the rule essentially requires lenders to document every potential element of borrower risk, no matter how small. Effectively, many lenders are forced to document issues that have little to do with lending risk, simply to remain in compliance. Additionally, the rule makes the lender liable for issues that may cause a borrower to not repay a mortgage in the future, exposing lenders to potential future litigation, the risk, scale and cost of which are largely unknown”

The paper then goes on to look at other regulatory costs, and concludes that regulatory costs and uncertainties have combined to increase average credit scores, which is shutting many creditworthy borrowers out of the market because their loan circumstances don’t “fit inside the box.” I would add that the private label MBS market is still a shadow of its pre-crisis self, which means that these loans have to be retained on a bank’s or REITs balance sheet. This limits the available credit, however the most puzzling aspect is that a lot of lenders want to get into the non-QM business, but the demand for non-QM credit has been disappointingly small. People are ramping up the non-QM product, but the loans just haven’t been there yet.

Filed under: Economy, Morning Report | 20 Comments »