Vital Statistics:

| Last | Change | |

| S&P Futures | 2318.0 | 5.3 |

| Eurostoxx Index | 369.8 | 2.4 |

| Oil (WTI) | 53.4 | -0.4 |

| US dollar index | 91.1 | 0.2 |

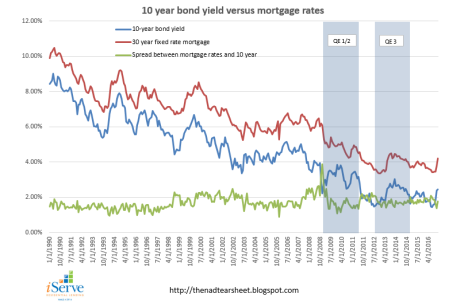

| 10 Year Govt Bond Yield | 2.44% | |

| Current Coupon Fannie Mae TBA | 102.1 | |

| Current Coupon Ginnie Mae TBA | 103.2 | |

| 30 Year Fixed Rate Mortgage | 4.06 |

Stocks are higher this morning on no real news. Bonds and MBS are down.

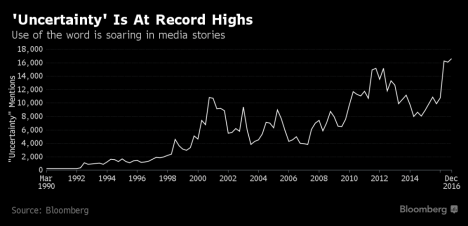

No economic data this morning, but we will get some inflation data this week with the consumer price index and the producer price index. Janet Yellen also delivers her 2 day Humphrey-Hawkins testimony on the Hill on Tuesday and Wednesday. My hunch is that monetary policy will take a backseat to banking regulation as the main subject of questioning. Note that top Fed banking regulator Daniel Tarullo has announced his resignation. Tarullo was viewed as a tough regulator (and was disliked by the industry for opacity and for changing the rules in the middle of the game. GE executive and former deputy to Hank Paulson David Nason is the front-runner to replace Tarullo.

Donald Trump will get to fill 3 Federal Reserve Board governorships (maybe 4 as Lael Brainard is rumored to be resigning as well). It is unlikely that he will go with nominees in the mold of Janet Yellen and will choose business leaders instead of academics to fill those seats. While Trump criticized the Fed on the campaign trail as keeping rates too low for too long, there isn’t a politician on the planet that likes a hawkish Fed. In fact, if Trump is successful in making big fiscal changes to the fiscal situation in DC, then he may prefer to have a more dovish Fed to keep rates low.

Foreign investors are dumping Treasuries, although this has been going on for almost a year, so it is hard to characterize it as Trump-related. Foreign selling has been absorbed by US domestic money managers, which has lowered the impact. Ultimately, the Fed is probably driving it: While the Fed sees the light at the end of the tunnel for QE and extraordinary stimulus, the ECB and the Bank of Japan are still in the middle of it. While the US has some of the highest yields in the world, it is at the biggest risk of a big bond market sell-off. The cost to foreign investors in hedging the US currency is also extremely high. For example, a Japanese money manager isn’t getting 2.44% when they buy a Treasury. It turns out to be around 90 basis points when you add in hedging costs.

Treasury Secretary nominee Steve Mnuchin looks like he will get past the Senate today.

The Washington Post has a good run-down on potential changes to Dodd-Frank. Overall, the reforms center on the Volcker Rule, the CFPB, and small banks. The paper obtained a memo from Jeb Hensarling which discussed some of the reforms. The biggest component is the financial CHOICE act, which allows banks an exemption from some of the Dodd-Frank restrictions (think prop trading) if they raise more capital. The CFPB would continue to be run by a single director who could be fired at will by the President. It will also have some restrictions on rule-making and enforcement, making it look more like the Federal Trade Commission. The CHOICE act probably has enough votes to clear the House, but getting it through the Senate will be a challenge.

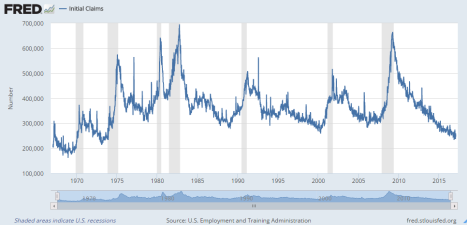

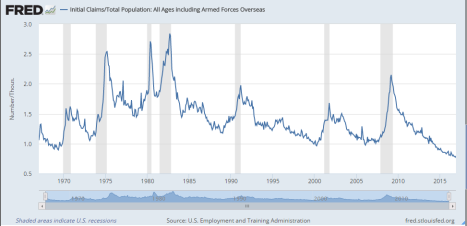

Professional economists are still scratching their heads over the lack of wage growth in the economy. If we are truly at full employment, the laws of supply and demand say that wages should be increasing. This is the biggest driver for the Fed, so getting it right is important. If the Fed tightens in expectation of wage inflation that was never going to arrive in the first place, they could choke off the recovery. The Bank of Japan made the same mistake twice since 2000. My sense is that the term “full employment”is a misnomer. Yes, we are at full employment according to the Bureau of Labor Statistics, but that is because we no longer count the unemployed once they hit 6 months without a job. They are still unemployed, however and that shadow inventory of workers colors the mindset of both workers and employers.

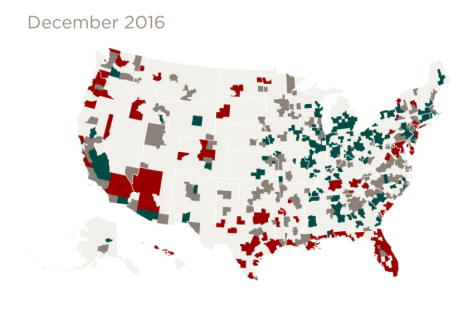

There is some concern about Ben Carson as the leader of HUD, and what he intends to do with respect to affordable housing. Carson doesn’t have a large body of work discussing housing policy, however he has made some contradictory statements, referring once to efforts by HUD to change local zoning laws as “social engineering” yet mentioning local regulatory impediments to housing affordability in his testimony to Congress. What these regulatory impediments are is anyone’s guess. They could be zoning restrictions, environmental restrictions, or even things like open space requirements. Obama’s HUD was very aggressive in suing localities to change their zoning laws, and we will have to see if that continues. Overall, the Federal government doesn’t have a lot of influence over local zoning rules. and has gotten nowhere in ultra-blue Westchester County NY, even with the the carrot of Federal housing money and the stick of lawsuits.

Filed under: Economy, Morning Report | 9 Comments »