Vital Statistics:

| Last | Change | |

| S&P Futures | 2295.3 | 2.3 |

| Eurostoxx Index | 363.7 | 0.9 |

| Oil (WTI) | 52.8 | 0.6 |

| US dollar index | 90.7 | -0.1 |

| 10 Year Govt Bond Yield | 2.36% | |

| Current Coupon Fannie Mae TBA | 102.1 | |

| Current Coupon Ginnie Mae TBA | 103.2 | |

| 30 Year Fixed Rate Mortgage | 4.13 |

Stocks are up marginally on no real news. Bonds and MBS are down small.

Initial Jobless Claims came in at 234k last week, which is the lowest number since November. Note that the last time initial jobless claims were this low, the Vietnam War was being fought. When you adjust for population growth, we are at record levels. Note that Census has been revising downward its previous estimates for population, as the net immigration numbers have turned out to be lower than initially thought.

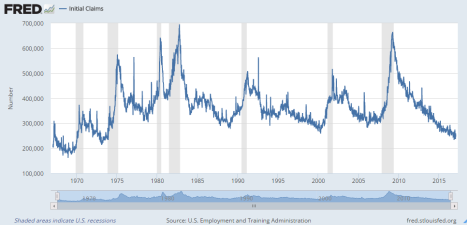

Here is the chart for initial jobless claims:

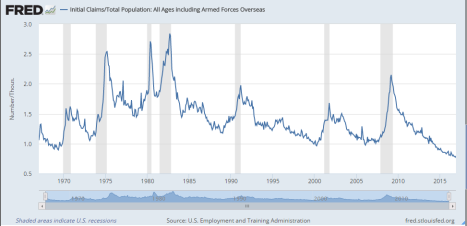

And now initial jobless claims divided by population (in .000s). Record low.

We have some Fed-speak today with James Bullard this morning and Charles Evans in the afternoon. Probably won’t be market moving, but be aware.

The latest trend in banking? People-less branches. You walk in and deal with someone via videoconference. “This is the beginning of the end of the American bank branch,” said Peter Fitzgerald, a former U.S. senator from Illinois, lifelong banker and founder of Chain Bridge Bank in McLean, Va. “Bank branches are dead. They were killed by the iPhone. It’s like the horseshoe when the automobile came along.” Indeed, the iPhone is changing mortgage banking as well, as the Millennial Generation prefers to not interact with humans.

Once of the changes Donald Trump is making to financial regulation is subtle, but important. Typically regulators have to conduct a cost-benefit analysis of new regulations, in order to determine whether the proposed regulations do more harm than good. That requirement was largely ignored by the Obama administration. He is bringing that requirement back, which would require the government to take into account things like restrictions in credit, lost GDP from less lending, and the impact on consumers and financial choice. In fact, a study from Goldman found that low income borrowers and small businesses bore the greatest cost of financial regulation.

While regulation is couched in terms (and intention) to be about public protection, in practice it often acts as a barrier to entry which restricts competition rather than it is something that benefits the public. In fact, restricted credit is only of the big things that is an issue in housing construction. Big publicly-traded homebuilders can borrow all the money they want in the bond market at exceptionally low rates, while smaller builders (who are banked by the smaller guys) cannot borrow because the smaller banks are hamstrung by the regulators. Remember, we haven’t had a 1.5 million year in housing starts (which was normalcy from the sixties until the crisis) since 2006.

Filed under: Economy, Morning Report | 56 Comments »