Vital Statistics:

| Last | Change | |

| S&P Futures | 2135.3 | -3.0 |

| Eurostoxx Index | 341.6 | -2.0 |

| Oil (WTI) | 50.7 | -0.9 |

| US dollar index | 88.0 | 0.0 |

| 10 Year Govt Bond Yield | 1.75% | |

| Current Coupon Fannie Mae TBA | 103.3 | |

| Current Coupon Ginnie Mae TBA | 104.2 | |

| 30 Year Fixed Rate Mortgage | 3.57 |

Stocks are lower this morning after ECB President Mario Draghi said the ECB is not looking at doing more QE after the program ends in March. Bonds and MBS are up.

In economic data this morning, initial jobless claims rose 13k to 260k. Separately, the Bloomberg Consumer Comfort Index fell. The Philly Fed manufacturing index improved in September, but manufacturing has generally been weak across the board as the stronger dollar hurts competitiveness overseas.

Existing Home Sales rebounded in September to an annualized pace of 5.47% from a downward-revised pace of 5.3 million in August. The median home price was up 5.6% to $234,200. The first time homebuyer represented 34% of all sales, which is a big improvement from the 30% – 32% range it had been stuck in for the past year. Inventory remains tight, however with about 2.05 million homes on the market, which represents a 4.5 month supply. A balanced market is closer to 6.5 months. Distressed sales (foreclosures and short sales) represented 4% of all sales, which is a post-crisis low. Days on market ticked up to 39 days from 36 in August. The increase in the first time homebuyer is definitely good news, and we may finally be seeing the pent-up demand that has been building over the past 10 years finally come to market.

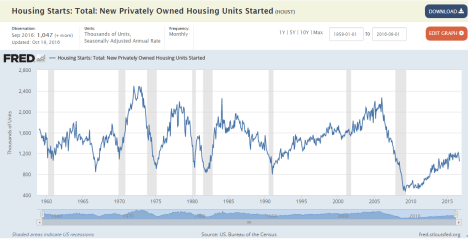

In spite of all that pent-up demand, housing starts remain anemic given where we are in the economic cycle. Housing construction has been the missing link this whole recession. Note the shaded grey areas on the chart. Those are recessions. See how housing construction historically experienced a sharp rebound after the economy bottomed? We haven’t seen that this time around. Some of that was due to an overhang of inventory from the bubble years that needed to be sold, however that adjustment was made by 2011 or so. Since then, tight inventory and rising prices have been the story. The reason why this recovery has been so tepid has been the absence of a robust housing construction market.

Note that Fannie Mae thinks that housing construction will remain muted. In their latest Economic Commentary, they forecast housing starts will grow to about 1.3 million in 2017, which is about 12% higher than their forecast for 2016. The bright spot? SFR will increase to 15% to an annualized pace of 883k. SFR will cannibalize multi-fam going forward as the economy improves and more Millennials go from being renters to being buyers. Speaking of which…

Trulia has a good piece out on the advantages of buying versus renting. Buying a home is 37% cheaper than renting nationally. Naturally, the advantage differs from market to market, but even the worst markets for buying are still 17% cheaper. This assumes the buyer puts down 20% and stays in the house for 7 years. The advantage was as high as 41% in 2012, and got as low as 34% in 2014. Of course this is a moving target as mortgage rates and house prices change. Where are the tipping points to flip the relationship? For home prices, it is a median house price of $468k. For mortgage rates, it is 9.1%.

Filed under: Economy, Morning Report | 24 Comments »