Markets are flattish ahead of the Brexit vote tomorrow. Bonds and MBS are down small.

Mortgage Applications rose 2.9% last week as purchases fell 2.4% and refis rose 6.5%. Refis rose to 57.7% of all loans as rates bombed out on the FOMC decision.

The FHFA House Price index rose 0.2% in April, and is up 5.9% year-over-year. Interestingly, New England went from cellar-dweller to the leader in monthly price appreciation. The region is still lagging the most on a YOY basis however. The FHFA index is the only housing price index that has regained all of the losses from the crisis. This is because it concentrates only on houses with a conforming mortgage, so it ignores the all-cash distressed sales and the jumbo space.

Existing home sales rose 1.8% in May to 5.53 million. This is the highest pace since February 2007. The median house price was $239,700 up 4.7% YOY. Total housing inventory is at 2.15 million units, which represents a 4.7 month supply. Inventory is still tight. The first time homebuyer accounted for 30% of all sales, a decrease from last month and last year. Days on market dropped to 32 days, a record.

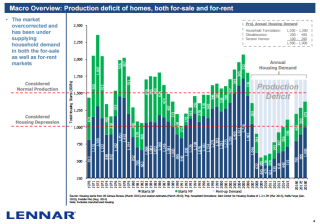

On Lennar’s earnings conference call, CEO Stuart Miller summed up Lennar’s view of the housing market. In a way, he also explained why housing starts remain so low. “As we’ve noted consistently over the past years, the overall housing market has been generally defined by a rather large production deficit that has continued to grow over the past years. While questions have been raised as to the real normalized levels of production that are required to serve the U.S. current population, we believe that production levels in the 1 million to 1.2 million starts per year range are still too low for the needs of American household growth that is now normalizing.While measuring current production levels against historical norms of 1.5 million starts per year might be flawed logic as there may be a new normal, we believe that the very low inventory levels in existing and new homes and the low vacancy rates and high and growing rental rates for apartments indicate that we are in short supply nationally.

The idea of a “new normal” being somewhere above current production levels (1.2 million units) and the historical average (1.5 million units) is as good an explanation as any. Lennar mentioned on their call that they have been transitioning from the early growth phase of the cycle to the mature phase of the cycle. In other words, they aren’t looking for the typical 2 million level of starts you usually see in the recovery from a recession. They do give a good graphic analysis of the supply / demand state of the housing market in this slide from a recent JP Morgan housing conference.

Notice that the current level of production (sub 1.2 million units is closer to the the “housing depression” line than the “normal production” line. That would make 2009-2012 “nuclear winter.” Lennar is making the same bet a lot of other builders are making that multi-fam is the way to go as they see the Millennials happy to rent. Actually, the meta-bet they (and everyone else in the financial markets) are making is that inflation is gone, dead, buried, and never, ever, ever coming back. The only reason why you would lend money to the government for no return is that you think inflation is gone. It truly is a “this time is different” argument, which is the most dangerous argument in all of investing. Especially when every central bank on the planet is on a mission to create inflation. Inflation is a debtor’s best friend, and if the Millennials can get out from under their student loan debt, we should see a bull rush for new SFR housing. The cautious homebuilders will probably be caught with too little inventory, and will suddenly start bidding against each other for workers, land and materials. And that is how recessions end.

KB Home also reported earnings last night. Earnings were better than expected, and they see a return of the first time homebuyer. Note that the current number of first time homebuyers (30%) is well below the historical average of 40%. Average selling prices were up 2%, which is much lower than the other builders.

Filed under: Economy, Morning Report |

Frist. In an interminable meeting, but this Frist gives me joy.

LikeLiked by 1 person

Amazing how much the home building industry affects the entire economy.

I believe the boom in the Austin metro – the growth – is determined by job growth, but the 2.9% unemployment rate is probably dependent on the home building industry more than any other. I mean, tech and biotech can’t produce jobs for every segment of the population.

LikeLiked by 1 person

Republicans should just adjourn the House until after the July 4th holiday or even until after the August recess and let the House Democrats have their sit in as long as they want to.

It’s not like their base has a problem with gridlock or shutting down the government. Just look at it as Christmas came early this year.

LikeLiked by 1 person

That would be funny..

LikeLike

And you got your wish!

LikeLike

Sure, why not.

McKelvey told the court she was sorry she issued the threat, and that she still believes her actions helped expose racism on campus. Her judge, obviously, did not agree with that her intent was as altruistic.

http://heatst.com/culture-wars/kean-university-student-sentenced-for-racist-twitter-threat-that-was-a-hoax/?mod=sm_tw_post

LikeLiked by 1 person

It helped expose her racism, so there’s that

LikeLike

My prediction for Brexit vote: Remain by 4 points.

LikeLike

Remain by 2%.

See also:

http://www.theguardian.com/politics/2016/jun/23/eu-referendum-legally-binding-brexit-lisbon-cameron-sovereign-parliament

LikeLike

I made an over/under bet on remain at 6%. I have the under. I think 4% is right.

LikeLike

I say it’s too close to call! And so they have to do it all over again in a few years. Meantime, UK remains.

LikeLike

Guess we were wrong.

Bradley effect?

LikeLike

Apparently the fix wasn’t in! Some very disappointed people right now, mostly those disappointed that the commoners didn’t do what their betters thought they should. Still, looks like it could be messy, and Britain might end up being out of the European Union In Name Only . . .

http://www.bbc.com/news/uk-politics-32810887

Given so many politicians wanted Britain to remain in the EU, I would expect a lot of negotiations to be made to simulate the effect of EU membership. I’m betting the folks in Brussels are regretting their decision to constrict British fishing quotas!

LikeLike

Kev, many of the EU members are both distressed that this is the first sign of the breakup and also agree that UK’s legit bitching at the power of the Commission is is shared by all of them.

First French reaction is that in the negotiations with UK the EU must make it clear that UK will not get MFN treatment from the EU, lest it send a pro-breakup message to the rest of the members. OTOH, Germany wants the reforms to the EU that UK was pushing for before Brexit.

Also, NATO still exists, weapon purchases are still common, UK is a huge trading partner with Germany, and what is likely to change is labor movement and migrant policy, not so much trade. Thus 3M Brits working on the continent may have to go home when a couple million Europeans leave the UK.

This will be a multi-year unwinding.

LikeLike

A mess, in other words! On a much tinier scale, just watching what happened in the school system where I work—involuntary merger, quasi-voluntary de-mergin a year later—illustrated for me the mess and waste of merging then breaking up. The problem tends to be that there’s a new problem (and cost) created for ever problem solved and cost eliminated. And then some extra problems and costs after that . . . And mine was just a school district. On the national level, I’m guessing it will be worse. But might the EU commission more responsive?

LikeLike

I will bet that the Commission’s wings get clipped in this process.

And I know what you mean about every problem like this at every level has big ol’ costs every time a change is made.

LikeLike