Vital Statistics:

|

Last |

Change |

Percent |

|

|

S&P Futures |

1649.5 |

-2.1 |

-0.21% |

|

Eurostoxx Index |

2654.8 |

-11.8 |

-0.44% |

|

Oil (WTI) |

97.95 |

+0.2 |

+0.23% |

|

LIBOR |

0.273 |

0.000 |

0.00% |

|

US Dollar Index (DXY) |

80.92 |

-0.031 |

-0.04% |

|

10 Year Govt Bond Yield |

2.198% |

+0.02% |

|

|

Current Coupon Ginnie Mae TBA |

104.5 |

-0.1 |

|

|

Current Coupon Fannie Mae TBA |

103.1 |

-0.1 |

|

|

RPX Composite Real Estate Index |

203.4 |

0.5 |

|

|

BankRate 30 Year Fixed Rate Mortgage |

4.01 |

Markets are flattish as we await the FOMC decision, which should be out around 2:00 pm EST. Bonds and MBS are flat

Mortgage applications fell 3.3% last week, which is surprising since rates fell 9 bps. The purchase index fell 3% while the refi index fell 3.4%.

The CoreLogic Market Pulse has lots of good things in it this month. One article notes that prices are adjusting more quickly in this cycle as opposed to historical cycles. They also expect gains to moderate in the red-hot West Coast markets as previously underwater homeowners put their properties on the market. They also are hearing that professional investors believe some of these market to be overheated and are looking to exit. This could be good for originators as the cash buyers become a smaller percentage of buyers.

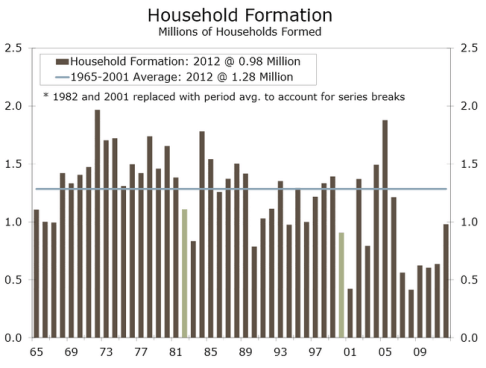

Wells Fargo recently held a conference call on the housing market. They see the Fed starting to move towards tapering QE towards the end of the year, but believe it will be gradual. They make an interesting point regarding the low household formation numbers – that they remain depressed because the jobs that are being created are not quality jobs. They are low paying / temporary jobs that will not really give a boost to housing demand.

Another interesting tidbit – although it seems like the refi boom is over, it turns out that half of the outstanding mortgages in the U.S. have interest rates of 5% or more.

And finally, Treasury Secretary Jack Lew has re-done his signature from OOoooooooOO to something a bit more legible. His new John Hancock will be gracing your dollar bills shortly.

Filed under: Morning Report |

OOoooooooOO

So backing off QE moves the stock market down. Is that because financial analysts think the economy will crater? Or is it just fear of rising interest rates? Or is it just fear of change?

LikeLike

mark:

Or is it just fear of rising interest rates? Or is it just fear of change?

Yes and yes, I think.

LikeLike

Thanx, Scott, for the reply.

LikeLike

I never read Thomas Friedman anymore.

Just ask New York Times columnists Thomas Friedman and Bill Keller. Rising to the defense of NSA snooping on a scale never before imagined in human history, they warn us that if there was a second 9/11-type attack, we would lose all of our civil liberties, so we should be grateful for this trade-off.

“I believe that if there is one more 9/11—or worse, an attack involving nuclear material—it could lead to the end of the open society as we know it,” Friedman wrote in his June 11 column.

No nation in history has ever possessed such an imbalance of military superiority and the ability to ward off foreign threats without sacrificing its core values. Never has this country been as vulnerable to foreign attacks as when the founders approved our Constitution with its Fourth Amendment and other protections of individual sovereignty against an intrusive government. They did so out of the conviction that individual freedom makes us stronger rather than weaker as a nation. In short, they trusted in the essential wisdom of the people as opposed to the pundits who deride it.

Defending Friedman’s column, Keller wrote Sunday:

“Tom’s important point was that the gravest threat to our civil liberties is not the NSA but another 9/11-scale catastrophe that could leave a panicky public willing to ratchet up the security state, even beyond the war-on-terror excesses that followed the last big attack.”

http://www.truthdig.com/report/item/the_terror_con_20130618/

LikeLike

@lmsinca: The question is, can the NSA and the CIA discover relevant information that prevents 9/11 scale attacks? I’m not remotely surprised about NSA and CIA snooping, but I’ve recently been reading Legacy of Ashes, which paints a picture of an American intelligence and covert ops system that has been consistently incompetent, most successes being the product of sheer luck.

That being said, I’d rather have a robust intelligence network gathering and sifting data than a robust covert ops agency (or agencies) trying to engineer world politics with strategic assassination, wars, and bribes . . . I’m just not sure we should trust our intelligence organizations to gather and process information competently enough to prevent future 9/11s.

LikeLike