Vital Statistics:

| Last | Change | Percent | |

| S&P Futures | 1548.6 | -1.9 | -0.12% |

| Eurostoxx Index | 2715.7 | -3.0 | -0.11% |

| Oil (WTI) | 92.49 | 0.4 | 0.47% |

| LIBOR | 0.281 | 0.001 | 0.36% |

| US Dollar Index (DXY) | 82.6 | 0.030 | 0.04% |

| 10 Year Govt Bond Yield | 2.04% | -0.02% | |

| RPX Composite Real Estate Index | 194.1 | -0.1 |

Markets are taking a breather after a string of gains over the past week and a half. The Dow Jones Industrial Average is at a record high, and the S&P 500 is within striking distance of its 2007 high. Bonds are catching a bounce after a lousy week. MBS are up as well.

The National Federation of Independent Businesses reported that small business optimism increased small in February to 90.8, and is returning to its post crisis norm. It is still well below its historical average, and even below the lows of the 91-92 recession and the 01-02 recession. The report makes an interesting study in contrasts – while the stock market indices are approaching record highs, and earnings are at or near record highs, the small business sector is still stuck in the morass that began in 2008. The reason for that international sales account for a bigger percent of the S&P 500, and that has been doing better than the US (Europe notwithstanding). On the other hand, restaurants and retailers, the backbone of small business in the US, are still having a tough go of it as consumers continue to de-leverage. Construction, energy, and manufacturing were the bright spots of the report.

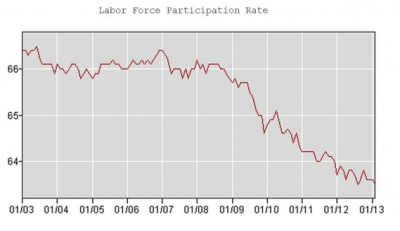

Given Friday’s positive jobs report, how long will it take us to get to full employment? Of course it depends on the labor force participation rate. The low labor force participation rate is what has been holding down the unemployment numbers, as people who have been unemployed over 6 months but are not actively looking for a job are no longer counted among the unemployed. If those people started looking for jobs again, they would start counting as unemployed and the unemployment percentage would increase. If the labor force participation rate remains stuck at the current lows, it would take 49 months. If it went back to historical norms, it would take 73 months.

With the continuing resolution approaching, Paul Ryan and Patty Murray will submit dueling budgets. Expect both budgets to be on the partisan side before real negotiating begins. The sticking point will be the sequester, which the Left wants eliminated and the Right wants to use as the baseline for future budgets. The debt ceiling still needs to be dealt with at the end of the summer.

Mary Jo White promises to get tough on Wall Street if she is confirmed as head of the SEC. Finishing rulemaking under Dodd-Frank is an “immediate imperative” as well. High Frequency Trading will also be a focus. She is expected to be confirmed.

Filed under: Morning Report |

Worth a read, even though I don’t agree with all of the conclusions:

“Regrettable

The troubling things I learned when I re-reported Bob Woodward’s book on John Belushi.

By Tanner Colby|Posted Tuesday, March 12, 2013, at 5:42 AM”

http://www.slate.com/articles/arts/culturebox/2013/03/bob_woodward_and_gene_sperling_what_woodward_s_john_belushi_book_can_tell.single.html

LikeLike

J,

What’s funny to me is that while Bob “I talk to coma people” Woodward is a complete d-bag, reporters are now, after the Juiceboxer’s reflexively defended their Christ, coming out of the woodwork whinging about (Canadian pronunciation) how the White House does bully them (and Obama must not know because as the Chief among Chiefs how could he possibly be a negative influence though he did, ya know, hire the bully’s. Just like Stalin musn’t of known).

Like I said vis a vis Puffy Face, WIN! WIN! WIN!

LikeLike

who is puffy face?

LikeLike

The next Senator from Kentucky, Ashley Judd!

http://www.usmagazine.com/celebrity-news/news/ashley-judd-calls-puffy-face-criticism-hatred-of-women-2012114

LikeLike

Ah, the voice of mainstream liberalism!

LikeLike

Reprinted for purely educational and non-commercial purposes with apologies to the copyright holder if required. The national D Party again is tone deaf to local politics, IMHO.

———————————————-

Kentucky Democrats Are Afraid Ashley Judd Really Is Running for Senate

By Michael Catalini

The actress seems to be readying a run against Mitch McConnell, and that worries Bluegrass Staters who fear she could hurt the party.

The honeymoon is over for Ashley Judd.

At a time when Democrats in Washington are having second thoughts about embracing Ashley Judd as their standard-bearer against Senate Minority Leader Mitch McConnell in 2014, Kentucky Democrats are waving red flags about the actress, arguing that her candidacy plays into the GOP’s strengths and tarnishes the party brand in the Bluegrass State.

“She’s gonna have a tough row to hoe,” said Jim Cauley, who ran Governor Steve Beshear’s 2007 campaign and also worked on President Obama’s 2004 Senate campaign. “She doesn’t fit the damn state. That’s her problem. I don’t think she fits the voters of the state of Kentucky.”

As she gets closer to an announcement of her intentions, Judd has garnered national media attention. Strategists predict that a Judd-McConnell faceoff would be one of the most expensive and closely watched Senate races in recent years. Judd’s backers say she is the only Democrat who could raise enough money to not only attack McConnell’s record, but also beat Kentucky’s longest-serving senator.

Other Democrats in the state, including a top donor in Northern Kentucky, disagree. They argue she has not been in the state enough to mount a credible attack on McConnell, who will be ready for the fight. Karl Rove’s super PAC American Crossroads attacked Judd with a web video earlier this year for living in Tennessee.

“I’m in this to win it, and I don’t believe Ashley Judd is in it to win it,” said Nathan Smith, a leading Kentucky Democratic donor, who is also the head of the Manufactured Housing Institute. Smith helped raise money for Senator Sherrod Brown of Ohio, Senator Joe Donnelly of Indiana, and Beshear. He’s hosted Hillary Rodham Clinton at his house. He said he called Judd about 10 days ago, prepared to give his advice to the actress, but hasn’t heard back.

“If she was to call me tonight, I would give her some advice and I doubt that she’d be excited to come back for round two of that conversation. I don’t care how many movies she’s made.” Smith said.

To Bluegrass State Democrats who worry about winning back the state Senate and keeping the state House, national Democrats are more concerned with forcing Republicans to spend money in Kentucky and distract McConnell from his day job as Republican Senate leader. They see Judd as a political infatuation. The actress, they say, would have trouble winning a state Mitt Romney carried by nearly 23 points in 2012.

Asked if his reaction amounted to sour grapes because Judd hadn’t called him personally, Smith told a story about a recent high school basketball event that drew some 20,000 people. He said he talked to dozens who were skeptical about Judd.

“Maybe she can become a senator without talking to anybody from Kentucky,” Smith said.

Top Democrats who are cool to Judd’s candidacy say they’d like to see Kentucky Secretary of State Alison Lundergan Grimes get into the race. The daughter of a former state party chair, Grimes defeated her GOP challenger by a wide margin. State Democratic officials stop short of calling for a primary if Judd enters the race, but they give voice to a wider concern that McConnell will get whom he wants in Judd — an opponent who can be tied to the president.

“Electing Ashley Judd gets a Republican Legislature elected. That’s what I see at stake here. Your perspective is different if you’re in New York or Los Angeles. They don’t live here. We do. Judd’s candidacy makes it seamlessly easy to Obama-ize this election,” one Kentucky Democratic strategist said.

This article available online at:

http://www.theatlantic.com/politics/archive/2013/03/kentucky-democrats-are-afraid-ashley-judd-really-is-running-for-senate/273946/

Copyright © 2013 by The Atlantic Monthly Group. All Rights Reserved.

LikeLike

Puffy face vs. The Turtle?

LikeLike

Brent, does high speed trading tend to stabilize or destabilize the market? It obviously is a broker’s dream.

If high speed trading were curbed, say by the imposition of a similar financial transaction tax by all the exchanges everywhere, would all markets fall one time to a new equilibrium because of slower trading? Or does the equilibrium of buyers and sellers at a moment in time include a similar equilibrium of high speed buyers and sellers?

Do we even know?

I would only support a financial transaction tax if it were 1] pretty much universal so that no exchange had an advantage; 2] in this country were accompanied by a similar automatic transfer payment tax on all automated transfers; and 3] the tax bite itself was very small on each transaction, perhaps 1/10th per cent on each side of the transaction.

But I wonder if anyone has actually analyzed the effect of limiting or strangling high speed trading would have on the market[s].

LikeLike

Mark, I personally do not think HFT has an effect on market stabilization. High frequency traders will stop trading once the market gets too volatile. This is because they are playing for pennies (if not fractions of a cent), and if the market moves too quickly, they can find themselves losing on these trades. So they generally turn off the machines once things get too volatile.

High frequency traders do not pay brokerage commissions – they do not want a third party getting in between them and the exchange. For that matter, they cannot afford the latency that using a 3rd party would cause. So they have their own pipes directly to the exchanges. James Simons of Renaissance supposedly has the fastest pipe of anyone. Which means he generally gets to see the order book before everyone else does. Which means he sees you enter your order to buy Exxon Mobil into ETrade at market, lifts the offer in front of you, and sells it to you a penny higher. They are not “market makers” in that they do not provide liquidity – in fact they are liquidity takers. I personally have no use for them – in fact I consider what they do front-running. So if they left the scene, I would gladly see them go. That said, I used to be a NASDAQ market maker back in the day, and I couldn’t stand the SOES bandits, which were the predecessors to high frequency traders. So I have a bit of a professional bias to these guys as they were always a pain in my ass.

As a matter of fact, since high frequency traders are liquidity takers, you could make the argument that getting rid of these guys will increase liquidity and transparency. To counter the HFTs, anyone who works an order in a stock will use an algorithmic trading system and dark pools to hide what they are doing. So whenever you look at an order book, you may have many institutions working orders, but everyone is hiding their size, showing 100 shares at a time. If you show something “large” like even 5000 shares, you can be assured that every Tom, Dick, and Harry will hit the bid or lift the offer in front of you, forcing you to pay up, or sell down. Often, I will see it happen even before I see my order being reflected in the market. Like I said, if you are working a large order, these guys are a pain in the ass.

As far as your financial transaction tax idea, we already have SEC fees and exchange fees on every ticket. And even today, commissions for institutional investors bottom out around 1/4 of a cent a share. To show my age, I remember when stocks traded in 1/8ths and commissions were 6 cents a share. So no, I don’t think a financial transactions tax of 1/10th of a cent would adversely affect liquidity.

Who loses in that tax? HFTs, obviously. Their margins get crushed, and if the tax is too large, they can’t make a profit. Which means the exchanges lose because they collect a toll every time you trade, and a lot of the volume on the exchanges is HFT. Now that they are publicly traded companies, they have a fiduciary duty to their shareholders to fight this. And the SEC gets tribute as well, so they will be conflicted on the issue.

LikeLike

Thanks, Brent!

LikeLike