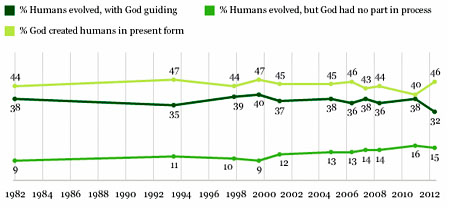

It’s not often I see an ATiM discussion echoed nearly word for word in the bigger blogosphere, but an item in Andrew Sullivan’s Dish gave me an odd sense of deja vu. He had reacted in horror to a Gallup poll which showed that 46% of Americans believe God created man as-is. Another 32% believe in what I call ‘guided evolution’ where there is divine influence. Only 15% believe that God had nothing to do with us looking as we do.

Sullivan’s alarm is stated thusly:

I’m not sure how many of the 46 percent actually believe the story of 10,000 years ago. Surely some of them know it’s less empirically supported than Bigfoot. {snip} I simply do not know how you construct a civil discourse indispensable to a functioning democracy with this vast a gulf between citizens in their basic understanding of the world.

Kevin Drum of Mother Jones rolled his eyes by noting that the 46% number is essentially unchanged since the question has been tracked and it is hardly a concern.

The fact is that belief in evolution has virtually no real-life impact on anything. That’s why 46% of the country can safely choose not to believe it: their lack of belief has precisely zero effect on their lives. Sure, it’s a handy way of saying that they’re God-fearing Christians — a “cultural signifier,” as Andrew puts it — but our lives are jam-packed with cultural signifiers.

Basically, Drum is saying that denying evolution is the price of admission to a not very exclusive club and most people are able to compartmentalize the cognitive dissonance it creates when relying on medicine or agriculture or anything that requires the actual mechanisms of evolution to work.

And lots of smart people don’t ‘believe’ in evolution (and I put ‘believe’ in air quotes because I personally ‘believe’ that is as silly as not believing in gravity) and still do quite well in their professional lives. I heard from colleagues of a prominent engineering professor who was a Young Earther, that is, he thought the Grand Canyon was created from backwash from Noah’s flood. I went to a public lecture of his and his thoughts on thermodynamics and the like were very mainstream and enlightening. Only at the end did he make a slightly veiled cryptic comment about having to conserve energy because we were stewards of the Earth.

Saying that God made Man in an afternoon and then used some spare parts to make Woman is a harmless fairy tale demonstrating a reliance on faith over a trust in reason. Evolution makes intellectual sense because it explains observable phenomena such as there being so many different types of plants and animals, far more than would fit on a raft 300 cubits long.

Not believing in evolution has very little effect on tax policy or road funding or the vast majority of governmental issues. It’s only when the theology drips into policy that I grow concerned. Jame Watt famously saw harvesting trees on a non-sustainable basis as no problem since he was imminently expecting The Rapture and then it wouldn’t matter any more. And we don’t want to even begin opening the can of worms of how religious dogma has affected the debate over reproductive rights.

So if someone wants to believe in folk tales on the origin of the world, I can only shake my head and shrug. To me these are people that in their devotion to their beliefs refuse to separate the moral and ethical authority that have been the traditional realm of religion from the mythmaking mumbo jumbo which science has supplanted. For some “God said it. I believe it. That settles it.” is all they need. For me, I expect a higher standard of intellectual rigor when deciding whose opinions I trust, I but don’t require it when selecting a plumber.

Filed under: Polling, religion | 95 Comments »